Omicron triggers market mayhem

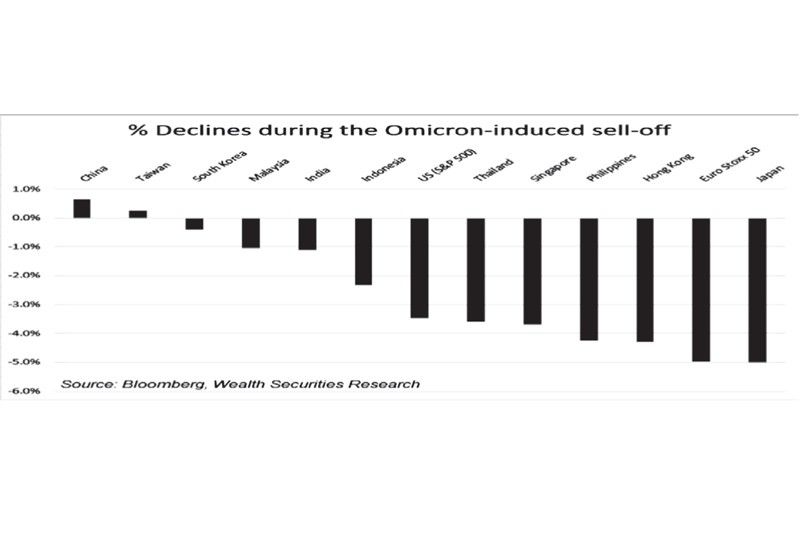

The discovery of the more transmissible Omicron variant renewed volatility in financial markets. Stock markets worldwide tumbled. Risk assets like crude oil and cryptocurrencies tanked, while yields on US Treasuries slid. At its low, the S&P 500 fell 4.4 percent, the Euro Stoxx 50 by 5.4 percent, the Japanese Nikkei by 5.9 percent, and the Philippine Stock Exchange Index by 5.7 percent. Investors are worried over the possibility of another spike in cases, the uncertainty that the variant is resistant to current vaccines, and concerns that the global recovery will slow down while the Fed is tapering. First identified in South Africa, the Omicron variant has spread to 40 countries worldwide, including the US, which reported its first case in California last Wednesday.

More contagious but milder than Delta

Early reports show that the Omicron variant is more contagious than the Delta variant. In fact, the spread of cases in South Africa has accelerated faster than the Delta wave. Some experts believe the Omicron causes mild disease, but it may be too early to tell. Nevertheless, this has raised hopes that the cases from Omicron and less severe than its predecessors.

Can Omicron end the pandemic?

Marko Kolanovic, JP Morgan’s quant guru and one of the most followed strategists in Wall Street, suggests that Omicron could actually be bullish for stocks and speed up the end of the pandemic. In his recent note to investors, Kolanovic said that “if Omicron turns out to be less severe and more transmissible, it could crowd out the more severe variants and be the catalyst that transforms the deadly pandemic into something more like the seasonal flu.” Given such a scenario, he advised that investors should buy the recent dip in stocks, especially in cyclicals, commodities, and reopening plays.

Holding support but breadth remains weak

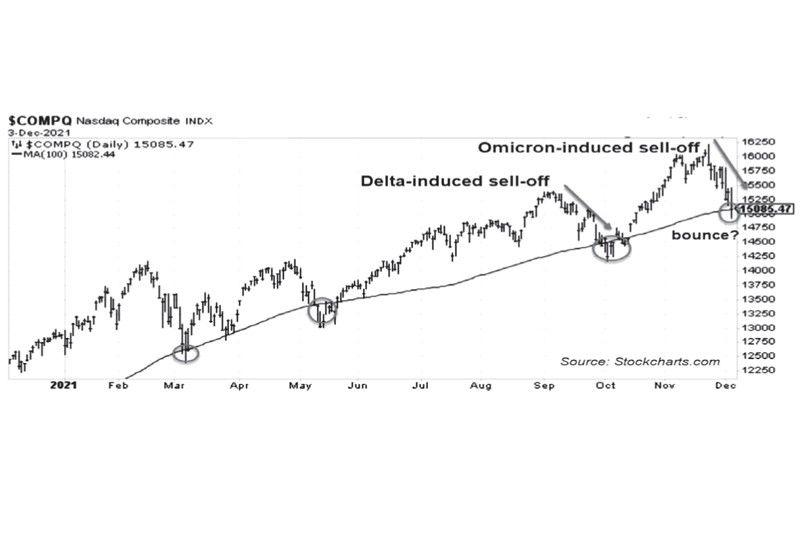

The Nasdaq Composite continues to be the leading index despite the recent poor action and distribution. From a technical perspective, the Nasdaq is at a level where it previously staged V-shaped recoveries. Currently, it has pulled back 8 percent from the recent all-time high, similar to the 8 percent pullback in September-October during the height of the Delta scare. The index is also sitting on top of the 100-day moving average, where it previously found support.

However, market breadth remains weak as it makes new lows. Only 28 percent of Nasdaq stocks are above their respective 200-day moving averages. During the past week, even the leaders such as big tech, chips, and EVs succumbed to overall breadth conditions. So, for now, it’s a wait-and-see if this sets up another leg higher or it grinds slowly further down.

PSEi consolidates after hitting 7,450

Likewise, Philippine stocks dropped sharply following reports of the Omicron variant. The PSE Index has pulled back as much as 9 percent since hitting the 7,450 resistance level early last month. It found support at 6,930, near its 100-day moving average. The PSE Index is expected to consolidate from here before attempting a retake of 7,450.

Omicron could dent global growth

Last Friday, the International Monetary Fund (IMF) said it is likely to downgrade its global growth projections due to the spread of the Omicron variant. Many governments have reimposed lockdown measures and tightened travel rules. This implies less economic activity moving forward, which has also been reflected in the 25 percent plunge in crude oil prices, bringing it to bear market territory. In all, the recent market mayhem reveals how dependent the economic recovery is on the path of the pandemic. Moreover, it shows how quickly sentiment can change with the evolution and transformation of the virus.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending