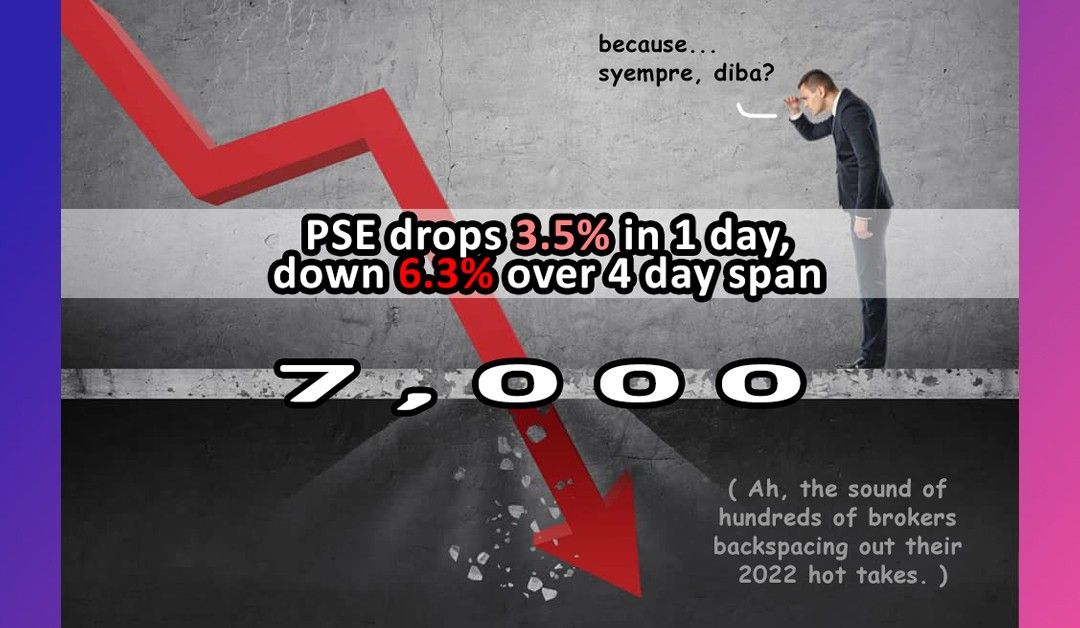

PSE suffers a massive drop back below the 7,000 level

The struggle to retain that “7” is real. The trading yesterday wasn’t panicked exactly, but the mood was definitely red from the start and only got “redder” as the day went on.

As one commenter put it, the PSE “started down, but not down down”. And that was true, but stocks just kept losing steadily throughout the day, and closed down over 3.5% right near the session lows.

If you do a search on Google, you’ll see “Omicron fears” in all of the headlines, but there’s something else lurking behind all of this: the US Federal Reserve.

The US is concerned about inflation and has signalled that it may be interesting to raise rates sooner than anticipated to combat the risk of prolonged, higher-than-optimal inflation.

To many traders, the US market acts as a “risk barometer” for global equities; not a perfect signal but definitely something that could help corroborate other trends that traders are seeing in the domestic market.

MB BOTTOM-LINE

I’ve said in the past, trying to tell why the market does something is tricky business.

How much of what happened yesterday was Omicron fear?

How much of it is a reaction to the change in US sentiment toward containing inflation? The reality here is that everyone needs to be especially careful about their trades during these times of uncertainty. Yes, there is a great amount of opportunity when things are uncertain, but that opportunity comes with a heightened level of risk.

For any traders that got stuck in trades yesterday and are now sitting on losses, make sure that you aren’t still holding on to those losses out of some “hope” that you’ll see a recovery.

If the basis of the original trade is dead, you need to take action to limit your risk. Holding indefinitely hoping for an uptick is probably not sustainable in the long term.

The advice is basically the same for long-term investors as well; if these developments and the trends they represent still support the investments that you’ve made, then perhaps you don’t have much work to do and you can wait for these short-term issues to play out.

However, if you made bets on a faster post-delta recovery that hinged on “revenge international travel spending”, you might want to reconsider how both of these trends might impact the medium-term upside and downside of your investment, and see if the cost/benefit is still pointing in the right direction.

--

Merkado Barkada's opinions are provided for informational purposes only, and should not be considered a recommendation to buy or sell any particular stock. These daily articles are not updated with new information, so each investor must do his or her own due diligence before trading, as the facts and figures in each particular article may have changed.

- Latest