Crude oil turns bearish

Due to concerns of a slowing global growth and a stronger US dollar, crude oil registered its biggest weekly decline since November 2020.WTI crude price dropped 9.2 percent for the week, closing at $62.14 per barrel. Crude oil prices tumbled 16 percent since the start of August, with investors worried that the Delta variant would delay the global economic recovery. Many countries worldwide were forced to reimpose restrictions and lockdown measures, thereby reducing economic activity and lowering fuel demand.

Surging Delta variant

According to the International Energy Agency (IEA), global oil demand growth abruptly reversed in July. They cited the surging Delta variant as the cause of weakening oil demand. As a result, IEA slashed its global oil demand forecast by 100,000 barrels per day for the rest of 2021. On the other hand, global supply expanded after the OPEC+ members agreed to gradually restore supply, adding 400,000 barrels per day starting this month. Other producers have also increased output by 600,000 barrels per day this year, with the US accounting for 60 percent of the growth.

China, US slowing down

The slowdown in global growth is evident from the recent data coming from China and the US. China’s retail sales slowed to 8.5 percent in July, worse than the expected drop of 10.9 percent and below the 12.1 percent growth the month before. Likewise, July retail sales numbers in the US missed expectations, increasing the likelihood that growth in the US may have peaked.

China’s regulatory crackdown

China’s wide-ranging regulatory crackdown has caused a meltdown in Chinese tech stocks. This has stoked fears that the crackdown on big business has gone too far and that it will hurt China’s economy. Consequently, this will severely harm global economic growth and hamper fuel demand. Last week, China passed the Personal Information Protection Law (PIPL), a data protection law curbing data collection by technology companies. China also announced new rules to ensure that internet platforms do not stifle market competition and affect fair transactions in the market.

China initially targeted tech giants like Alibaba and Tencent Holdings as part of the widening crackdown. However, it has since spread not just to e-commerce, online music, and digital payments, but also to ride-hailing, AI, big data, online tutoring, video games, video streaming, and more recently, liquor, cosmetics, and online pharmacies, as part of its rolling regulatory crackdown.

Fed taper boosts the dollar

The rally in the US dollar also weighed on oil prices. The US dollar index (DXY) jumped 1.21 percent to close at a nine-month high of 93.63. The sharp dollar rally came after the minutes from the Federal Reserve’s July meeting showed that policymakers may start tapering bond purchases before the year ends. As a result, crude oil, industrial commodities, and global stocks fell as investors rushed to the safety of Treasuries, sending yields lower and the dollar higher. Historically, the price of oil is inversely related to the dollar. Since oil is priced in US dollars, oil prices are more likely to fall whenever the dollar strengthens.

Technical outlook

From a technical perspective, the daily chart of WTI crude paints a bearish picture. As shown in the chart below, crude oil has already broken below its 100-day moving average. It has likewise pierced the critical support level of $65. It appears that WTI crude is gearing up for a move towards the next support level at the $60 to $61 range.

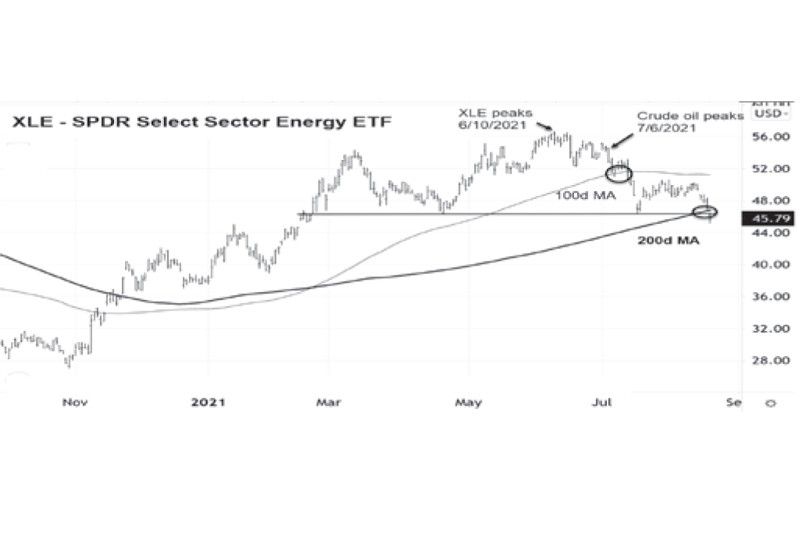

Energy stocks – a leading indicator

The performance of energy stocks may have given an early warning on the direction of crude oil. Energy stocks are a way for investors to leverage oil. Smart money tends to move into these stocks even before the underlying commodity moves. The chart below shows that the Energy Sector ETF (XLE) peaked a month earlier than crude oil. It also broke its 100-day moving average well ahead of crude oil. Last week, XLE broke below the 200-day moving average, which investors consider a key indicator for determining the long-term price trend.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending