Olympic and economic rivals

Since1996, only two countries have dominated the medal rankings of every Summer Olympics held: the United States and China. The US grabbed the top spot of the gold medal tally in six out of the last seven Olympic games, winning in Atlanta 1996, Sydney 2000, Athens 2004, London 2012, Rio 2016, and the recently concluded Tokyo 2020 Olympic games. On the other hand, China succeeded in Beijing in 2008.

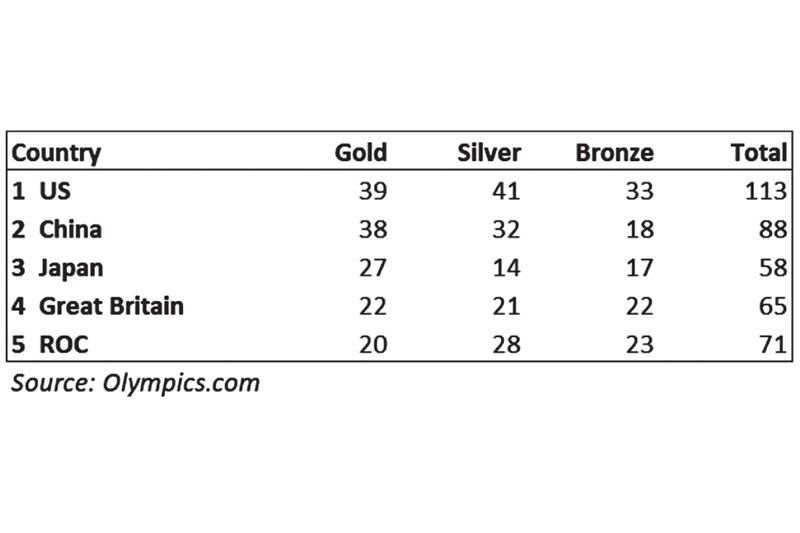

Tokyo Olympics leaderboard

The action in Tokyo was down to the wire. In the last few events of the final day, the US caught up to what initially was a sizeable lead by China in the gold medal race. China was leading with 38 golds vs. 36 for the US thru Saturday. But the US won three more gold medals on Sunday from women’s basketball, women’s volleyball, and women’s omnium in track cycling. So, in the end, the US clinched the race with 39 gold medals compared to China’s 38.

In terms of total medals won, the United States dominated in Tokyo with 113. China placed second with 88 total medals.

All-time Olympic Games medal tally

In terms of all-time Summer Olympic success, the United States is the clear winner, with a combined total of 2,636 medals in the past 28 Summer Olympic games. China is in fourth place (behind Russia and Great Britain) with 262 gold medals, 199 silver medals, and 173 bronze, totaling 634.

Economic rivals

Besides their Olympic rivalry, China and the US are also economic rivals. China is the fastest-growing major economy, with growth rates averaging more than nine percent over 30 years.

Meanwhile, the US is the world’s biggest economy. In 2020, the US GDP amounted to $20.9 trillion, while China’s GDP reached $14.7 trillion. China’s V-shaped recovery from the COVID-19 pandemic enabled it to narrow its GDP gap vs. the US from $7.1 trillion in 2019 to $6.2 trillion in 2020.

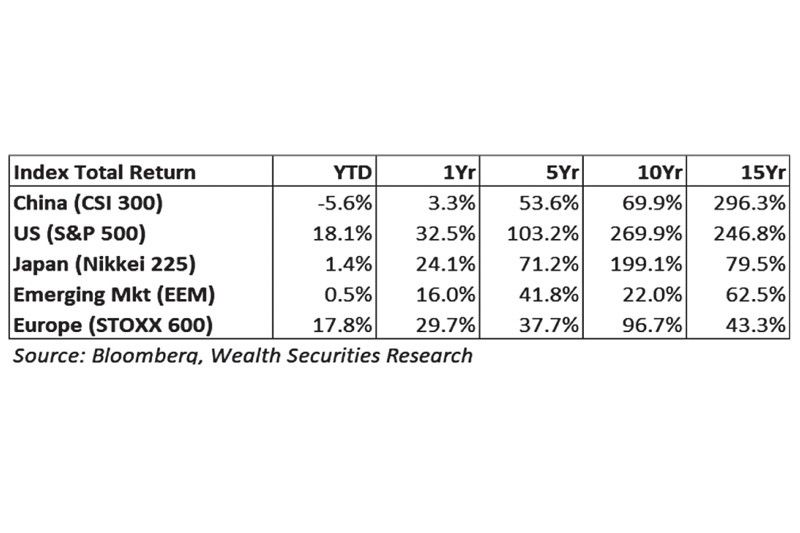

US stock market leads in 2021

The US stock market has done exceptionally well this year, with the benchmark S&P 500 index closing at a new record high of 4,436.52 last Friday. It is already up 18.1 percent year-to-date, spurred by the expansive vaccine rollout and the unprecedented fiscal and monetary stimulus.

On the other hand, China’s CSI 300 index has lost 5.6 percent this year. The regulatory crackdown on Chinese tech behemoths, private education, gaming companies, and monopolistic big-sized companies like food-delivery giant Meituan triggered a sharp sell-off in Chinese stocks. At one point, the CSI 300 was down as much as 20 percent from its February high of 5,930.91.

Other major indices were mixed, with Europe’s STOXX 600 index gaining 17.8 percent, while Japan’s Nikkei 225 and emerging market index languished with 1.4 percent and 0.5 percent returns, respectively.

US stock market, the biggest winner the past years

US stocks have also provided the best returns for investors in the past one-,five-, and 10-year periods. The S&P 500 index has increased 32.5 percent in one year, 103.2 percent in five years, and 269.3 percent in 10 years, easily beating the returns from China, Europe, and emerging markets. Japan’s Nikkei 225 registered noteworthy returns of 24.1 percent in one year, 71.2 percent in five years, and 199.1 percent in 10 years.

Over 15 years, China beats US

Over the past 15 years, China’s CSI 300 has returned 296.3 percent, easily beating the S&P 500’s 246.8 percent gain. Japan’s Nikkei 225 ended with a 79.5 percent return over 15 years, while the emerging market index and Europe’s STOXX 600 increased 62.5 percent and 43.3 percent over the same period, respectively.

Who’s winning?

In terms of returns, the US stock market is far outpacing China’s stock market this year. The China crackdown has undoubtedly put the regulatory risk of owning Chinese stocks in the limelight, dampening investor’s appetite in the short run. But time and again, China has shown that they are willing to sacrifice short-term returns to achieve a longer-term objective of promoting equality and shared prosperity with it’s 1.4 billion citizenry.

Twin engines of global growth

China and the US, economic and Olympic rivals, are the twin engines of global growth. Combined, China and the US accounted for half of the worldwide growth over the past five years. Their tenuous rivalry encompasses the Olympics, the global economy and trade, geopolitics, military, technology, data, AI, electric vehicles, sustainability, political doctrine, and ideologies. The rivalry can sometimes be helpful, but it is also volatile and may become bitter and escalate. Hopefully, it could be a friendly rivalry that can develop and be beneficial to both. As long as their economies continue growing and maintain a mutually beneficial relationship, these two superpowers will pull other economies with them.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending