Premiere Horizon Alliance signs options agreement to access equity financing

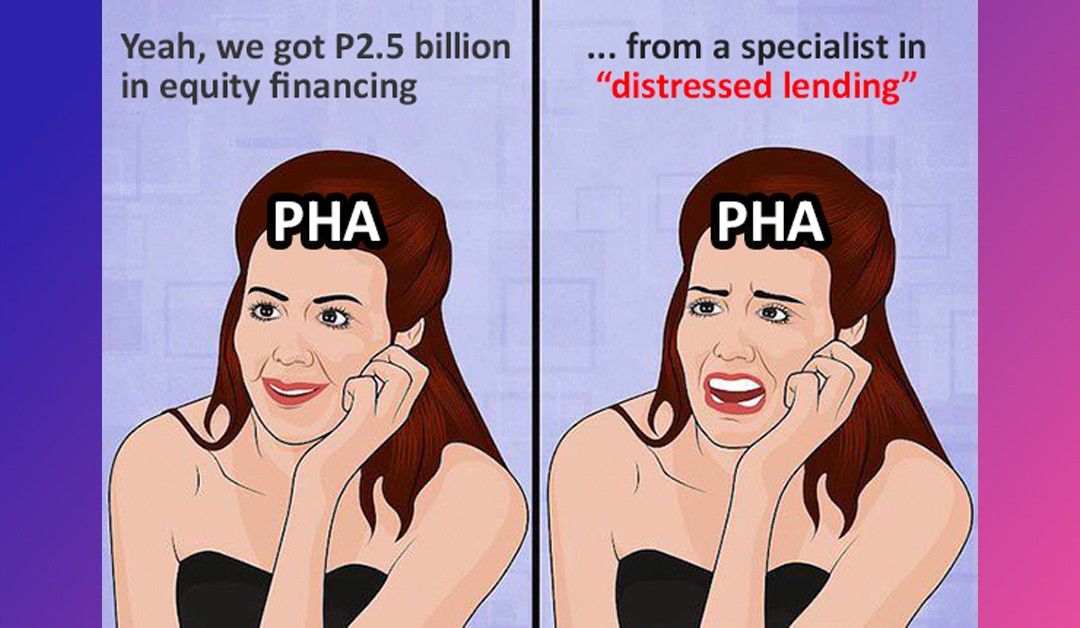

Mining, tourism, and real estate company Premiere Horizon Alliance [PHA 1.42 3.65%], which was recently purchased by Marvin Dela Cruz and friends, signed a “Put Option Agreement” with LDA Capital Limited (LDA) that, according to the disclosure, provides PHA with P2.5 billion in “committed equity capital over the next thirty-six months”.

The put option agreement gives PHA the right, but not the obligation, to sell PHA shares to LDA. The amount of shares that it will sell, and the price of those shares, is governed by a formula that is keyed to the date of the notice that PHA provides to LDA for each sale.

When PHA gives LDA notice that it is selling shares to LDA, the amount of shares that it will sell is based on the average number of shares traded a period of time leading up to the sale, and the price will be 90% of the volume-weighted average price for that same period of time. PHA also sold out-of-the-money call options to LDA, where LDA purchased the right, but not the obligation, to pay P2.26/share for up to 133 million PHA shares at any time in the next three years.

Together, the put option agreement and the call options give PHA access to about P2.8 billion in equity. Under the agreements, LDA’s potential ownership under this deal is capped at 19.9%.

MB BOTTOM-LINE

This isn’t the first time that LDA, a lender that specializes in “distress and event financing”, has signed an exotic options-based financing agreement with a local company.

Just about a year ago, Roxas and Company Inc [RCI 1.03 1.98%] signed a P800m put option agreement with LDA. At the time the agreement was signed, RCI was trading at about P1.78/share. Immediately after the announcement, the stock price fell off a cliff, shedding 34% of its share price in 10 weeks following the agreement. After a brief Christmas rally, the stock continued its losing streak and currently trades at around a peso. Now, RCI’s stock performance isn’t a roadmap of what we should expect with PHA, and the downward movement of the price was more or less a continuation of a general downward trend that started back in 2018; the point here is that this isn’t a great sign.

At best, the company ends up diluting shareholders by selling cheap shares to a distressed lender that won’t add any value to the boardroom. The stock was halted when the announcement was made on Wednesday, dropped when the halt was lifted, and then rose a bit yesterday to close a percent or so below the price it was trading at before the announcement.

I guess we’ll just have to watch and see what PHA does with this. They say the proceeds will go to working capital for its various projects “and in fentech such as SquidPay”; if I were a shareholder, I’d have a lot of questions.

--

Merkado Barkada is a free daily newsletter on the PSE, investing and business in the Philippines. You can subscribe to the newsletter or follow on Twitter to receive the full daily updates.

- Latest