US dollar boosted by hawkish Fed

The US dollar surged across the board after the Fed’s surprisingly hawkish projections during the June 15 FOMC meeting. While the Fed kept rates unchanged at near-zero levels, it signaled that it would cut back on QE and start hiking rates sooner than expected. The Fed’s shift towards a faster tightening of monetary policy led to the unwinding of sizeable short positions in the greenback. This resulted in a sharp move in the US dollar that broke intermediate downtrends against major and emerging market (EM) currencies.

Morgan Stanley bearish on EM currencies

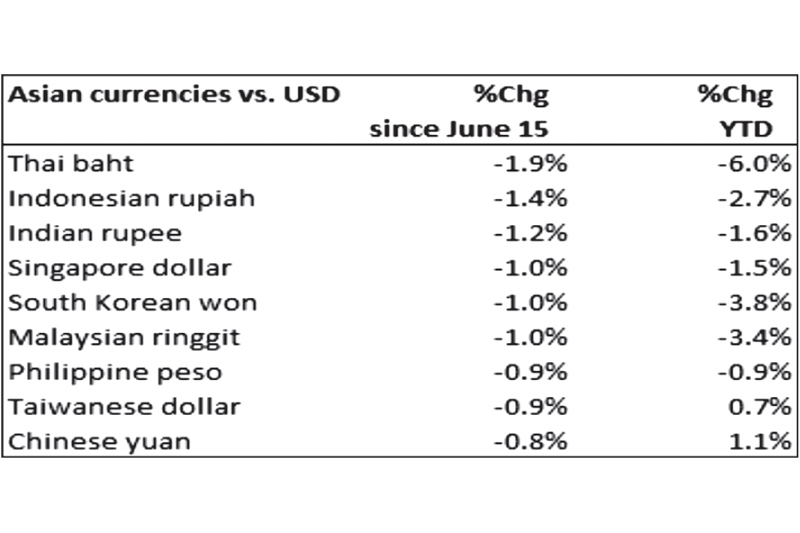

The Fed’s sudden hawkish turn led investment bank, Morgan Stanley, to turn bearish on EM currencies. Citing higher real rates in the US, heavy US dollar short positioning, overextended run in EM assets, change in risk sentiment, and the threat of a taper tantrum, the bank recommended buying the safe-haven US dollar. As a result, the Thai baht lost 1.9 percent since June 15, the most among Asian EM currencies. This was followed by the Indonesian rupiah and the Indian rupee, which slid 1.4 percent and 1.2 percent, respectively.

Euro reversal

Technical analysis points to a reversal in the euro against the US dollar. The euro crashed below the critical support level of 1.20 after the FOMC decision. It fell to a low of 1.1847 which is the lowest level since April. The chart shows a clear breakdown of the 15-month trendline that started in May 2020. Failure to recover above 1.20 would mean further downside for the euro.

U-turn in the Chinese yuan

The Chinese yuan, the best-performing Asian EM currency this year, appears to have made a u-turn. After hitting a three-year high of 6.36 vs. the US dollar in May, the yuan weakened sharply following the FOMC meeting. The chart below shows that the USD/CNY has broken the critical resistance level at 6.42 and the 12-month downward trendline. Unless USD/CNY breaks below 6.42, technicals point to the yuan weakening further.

Php peso targets 50

The Philippine peso hit an inflection point at 48. After several false breakdowns below that level, the USD/PHP has rallied substantially to close at 48.481 last Friday. USD/PHP also confirmed a break of the 15-month downward trendline. It traded as high as 48.92 last week. Near term, the peso may consolidate between 48 to 49. Based on technical analysis, a break above the critical resistance level of 49 would signal a target of 50.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending