Oil prices continue to surge

In previous articles, we wrote that a significant risk to the Philippine economy and stock market are rising oil prices and inflation. Crude oil prices are back above pre-pandemic levels, and many commodities are now at record or multi-year highs. These developments may exacerbate global inflationary pressures. Recent data from China and the US show that the pick-up in inflation has accelerated to its fastest pace since 2008. Domestic inflation at 4.5 percent is above the upper end of BSP’s target range.

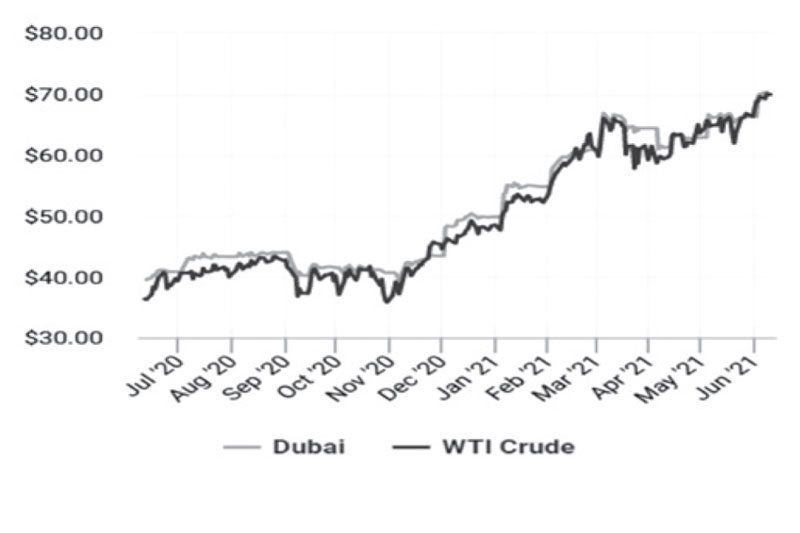

Crude oil surges above $70

A continued recovery in oil demand and dwindling global stockpiles drove crude oil prices to their highest level since November 2018. Rising vaccination rates and falling COVID-19 cases in the US and Europe fueled robust oil demand. Improving mobility, coupled with seasonal summer demand, supports gasoline and diesel prices. West Texas Intermediate (WTI) prices hit $70.80 per barrel last week, while Brent crude surged to $72.59 per barrel. Philippine benchmark Dubai crude jumped to $70.52 per barrel. On average, these contracts are up more than 40 percent year-to-date and 90 percent year-on-year.

Goldman Sachs recently raised its oil price target, saying that the “case for higher oil prices remains intact given the large vaccine-driven increase in demand in the face of inelastic supply.” The US investment bank forecast prices reaching as high as $80 per barrel this summer.

Source: Oilprice.com

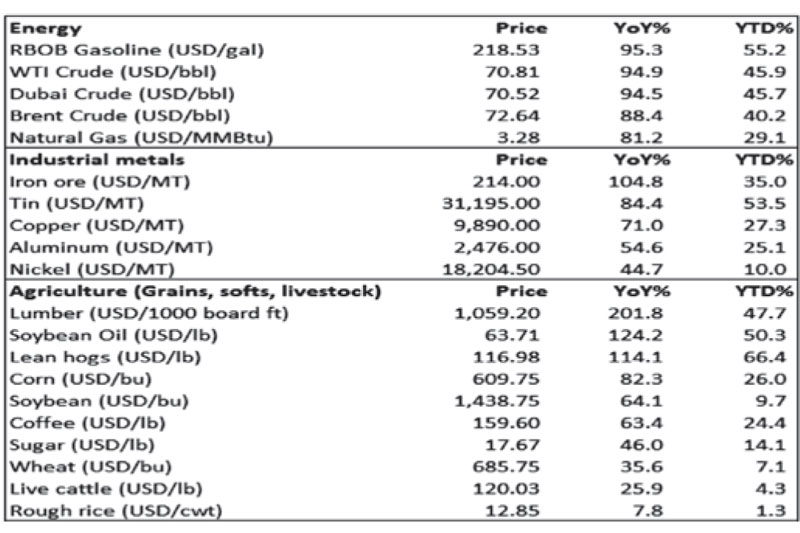

Commodities at multi-year highs

It is not only crude oil that is rising. Commodity prices have also surged across the board. The prices of industrial metals like copper and iron ore hit record prices last month. Meanwhile, the prices of grains and livestock such as corn, soybeans, wheat, and lean hogs have climbed to multi-year highs. Lumber prices have more than tripled. Many of these commodities now cost double what they were a year ago when most of the world was in COVID lockdown.

Source: Bloomberg, Wealth Securities Research

China PPI soars 9 percent

Soaring commodity prices drove the Chinese Producers Price Index (PPI) to 9 percent in May, the biggest since September 2008. Chinese PPI has been rising sharply in recent months, following a 6.8 percent increase in April. Although consumer price increases remain subdued in China, the soaring producer prices mean that Chinese factories absorb the rising costs rather than pass them on. But as business profits are squeezed, it may just be a matter of time before Chinese manufacturers and exporters pass on their increased costs to consumers worldwide. Following the release of the red hot PPI numbers, Chinese authorities launched price controls and vowed to increase the supply of key consumer goods to stabilize prices.

Source: Bloomberg, Wealth Securities Research

US core CPI surge fastest since 1992

US inflation is also accelerating rapidly as the headline Consumer Price Index (CPI) soared to 5 percent in May. This is the highest level of inflation since August 2008. The core CPI (excludes energy and food) caught the market by surprise, soaring to 3.8 percent – the fastest rate since 1992. Prices are rising for many goods and services, such as used cars and airline fares. The 29.7 percent increase in used car prices may partly be a result of the semiconductor supply bottlenecks that have plagued the car industry. Meanwhile, US airline fares are up 24 percent, boosted by rising oil prices and strong demand after the pandemic lockdowns.

Transitory or persistent inflation?

Despite the recent spike in US inflation, the Fed assures that it is likely short-lived and will not affect Fed policy soon. The market seems to agree as the yield on the 10-year US Treasury note fell to a three-month low of 1.43 percent. The S&P 500 rose for the third straight week to a new record high. The movement in crude oil prices may eventually tilt the balance on whether inflation is transitory or persistent. Countries that import most of their oil and food supplies like the Philippines may be more vulnerable. We must therefore remain vigilant and proactive on the movement of oil, commodity prices, and inflation.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending