PSEi’s stunning recovery continues

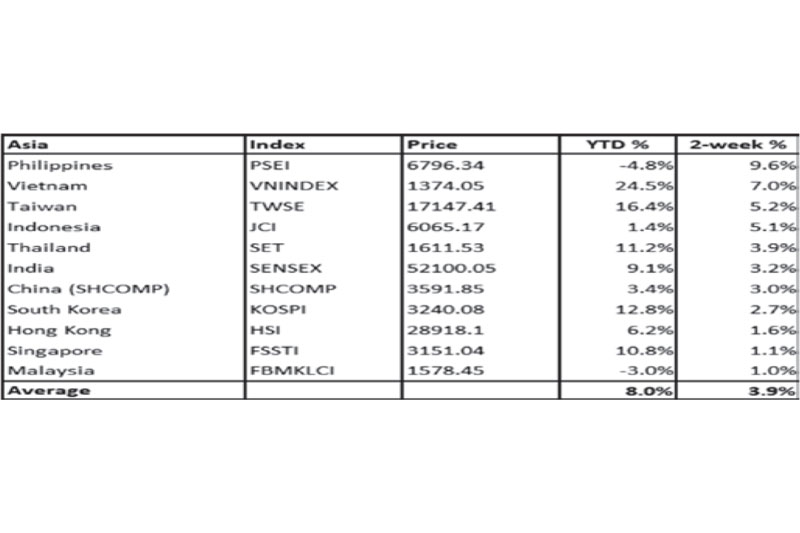

Last week, we wrote about the possible reversal in Philippine stocks coinciding with the “super blood moon eclipse.” On top of the staggering 7.7 percent return last week, the Philippine Stock Exchange Index (PSEi) gained another 1.9 percent this week. This performance brought the two-week return of the PSEi to an impressive 9.6 percent, making it the best performing Asian index over the same period.

While still at the bottom rung of Asian stock indices year-to-date, the PSEi has managed to recover much of its losses. From an intraday year-low of 6,080 in mid-May, the PSEi has bounced back 12 percent to close at 6,796 last week, its highest weekly close in three months.

Source: Bloomberg, Wealth Securities Research

Reasons for the sharp rebound

Below are the reasons why Philippines stocks rebounded sharply:

1) Improving vaccine rollout – As we pointed out in our previous articles, the better-than-expected vaccine rollout is the main catalyst for the reversal in the Philippine stock market. In the seven days to May 30, an average of 144,402 doses was administered daily. According to the IATF, the Philippines will have received 20 million vaccine doses by the end of June, with more than 20 million more scheduled for the latter half of the year.

2) Lower COVID-19 infections – COVID-19 infections are down considerably to a seven-day average of 6,785 last week from a seven-day average high of 10,845 last April 15. For NCR plus, the epicenter of COVID-19 outbreak in the country, the daily average is down to just 2,000+ cases.

3) Phl can fully reopen at a 50 percent vaccination rate – Citing the experiences of the US, UK, and Israel, Vaccine czar Carlito Galvez Jr. stated that the Philippines could fully reopen once half of the adult population is vaccinated. He said that in Metro Manila, 70 percent could be inoculated by year-end with just 120,000 jabs a day.

4) Stable peso – The Philippine peso is one of the most stable currencies in the region this year. It closed at 47.75 last week, up 0.58 percent vs. the US dollar year-to-date. Recently, the BSP raised the banks’ dollar holding limits for clients’ trades and investment needs, a move that the market sees will temper the peso’s rise. BSP Gov. Benjamin Diokno, however, clarified that this policy move is unbiased with no intention to promote either depreciation or appreciation of the peso.

5) Monde Nissin IPO – The $1 billion Monde Nissin IPO was timely. It secured 11 cornerstone investors and was several times oversubscribed. The successful IPO shows renewed confidence of investors in the post-pandemic recovery of the Philippine economy. More importantly, the listing on June 1 freed up funds tied up to the Monde Nissin IPO.

6) Foreign funds return – Foreign funds turned net buyers, ending a streak of daily net outflows. Last month, the cumulative net outflows for 2021 reached a high of P71.8 billion. But starting May 28, net foreign flows were positive for six straight days, totaling P6.1 billion.

7) Compelling valuation – Valuations have fallen to distressed levels. At its low last month, the PSE index traded at 14.8x one-year forward P/E or 2.2 standard deviations below the five-year historical mean of 18.6x. Our fair value estimate for 2021 is at 7,240.

8) PSE index and EPHE ETF held technical support – Both the PSE index and the iShares MSCI Philippines ETF (symbol: EPHE) rebounded sharply after hitting oversold levels. The PSEi bottomed out near a six-month support level at around 6,000, while EPHE bounced off its six-month support at $28.

9) Strong Chinese yuan – China’s relatively more robust recovery from the pandemic has strengthened the yuan to three-year highs against the dollar. The strong yuan has fueled record foreign flows to mainland Chinese bonds and other yuan-denominated assets.

10) Capital inflows to Asian EM – Capital flows to emerging market equities are slowly recovering, led by $11.3 billion inflows to Chinese equities in May. China has a positive impact on Asian emerging markets as it leads the post-pandemic recovery in the region.

Targeting 7,432

The major risks to the market are the resurgence in COVID-19 cases and inflation. However, from a technical standpoint, the PSEi has reversed its downtrend. The chart below shows the breakout above the five-month downward trendline and the recovery of the critical 200-day moving average. Therefore, any pullback that holds above the 200-day moving average will be positive. Based on the chart, the immediate target for the PSEi is the resistance level at 7,000. In the intermediate-term, the index is targeting 7,432.

Source: Investagrams.com, Wealth Securities Research

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending