Strong dollar again?

In a previous article, we said that US bond yields have spiked due to the country’s vaccine rollout acceleration, optimism over improving economic growth, rising inflation expectations, and the expected passage of a huge fiscal stimulus bill. From a low of 0.5 percent last August 2020, the 10-year US Treasury yield has already tripled to 1.61 percent as of Friday. Consequently, the US dollar has strengthened as US yields surged.

Japanese yen targets 110

The dollar has gained sharply against the yen, moving to the 109-level for the first time since June 2020. Among major currencies, the yen has slumped the most in 2021, depreciating 5.6 percent year-to-date against the rejuvenated dollar. The yen is commonly used as a funding currency in the “dollar carry-trade” and is extremely sensitive to rate differentials between the US and Japan.

If US yields continue to rise, it is highly likely that the USD/JPY breaks above 110, a line of psychological significance. Note that further weakness in the yen has an impact on Asian currencies, including the Philippine peso.

Source: Tradingview.com, Wealth Securities Research

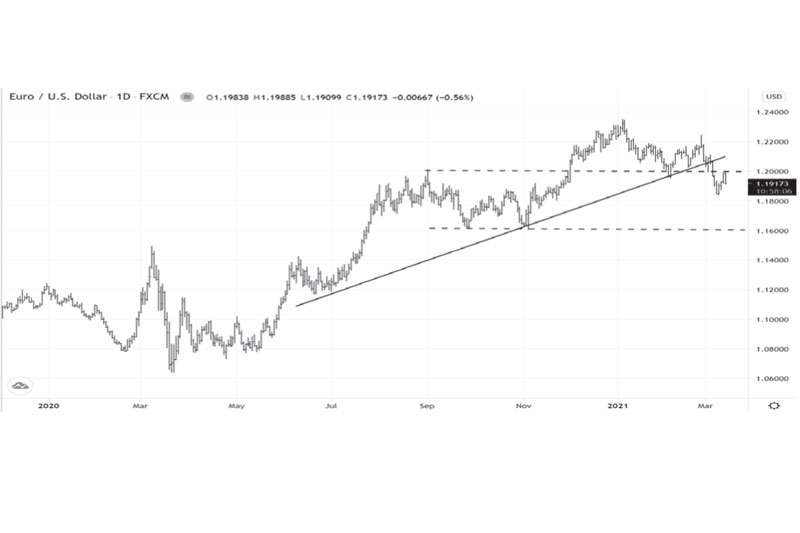

Euro registers 3-month low

The euro has, likewise, reversed its trend. It failed to hold above its breakout level of 1.20. Chart-wise, it appears to be on the way to test major support at 1.16. The dollar has made inroads against the euro due to improving economic conditions in the US. The US is also doing a better job with its vaccine rollouts compared to the EU, causing the euro to weaken as of late. The euro hit a three-month low of 1.1835 last week and is down 2.4 percent year-to-date.

Source: Tradingview.com, Wealth Securities Research

Dow and S&P register new highs

A significant reason for the recent reversal of the US dollar weakness is the US stock market’s strength. The Dow and the S&P 500 index hit record highs last week. Recovery or reopening sectors like banks, energy, industrial, material, travel, retail, restaurants, and casinos rose sharply on the back of the $1.9 trillion COVID Stimulus Bill and encouraging US jobs report. The DJIA gained 4.07 percent last week, while SPX increased 2.64 percent. The Nasdaq Composite, which recently has been lagging because of rising bond yields, was up 2.2 percent.

Accelerated vaccinations

One critical impetus for the S&P 500 and Dow’s historic highs is Biden’s accelerated plan to make all Americans eligible for vaccination by May 1. Currently, 20 percent of Americans have received at least one dose of the COVID-19 vaccine. Around 34 million Americans (or 10 percent) have fully been vaccinated. With more than two million Americans vaccinated daily, the number of those vaccinated is now greater than the number of COVID-19 cases. This puts the US closer to the path of normalcy.

The game changer

Vaccines have proven to be the game changer for economies and stock markets in 2021. The massive out-performance of the US stock market is a testament to this. Likewise, this is also reflected in the performance of the US currency. Countries with successful vaccination rollouts like the US will bounce back and normalize sooner.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending