Crude oil hits 11-months high

One of the beneficiaries of the unprecedented monetary and fiscal stimulus, the Biden electoral victory, the Democratic “blue wave” win, and the discovery of the COVID-19 vaccine is crude oil. Optimism over the economic recovery lifted most asset classes and energy-related commodities rebounded from last year’s lows.

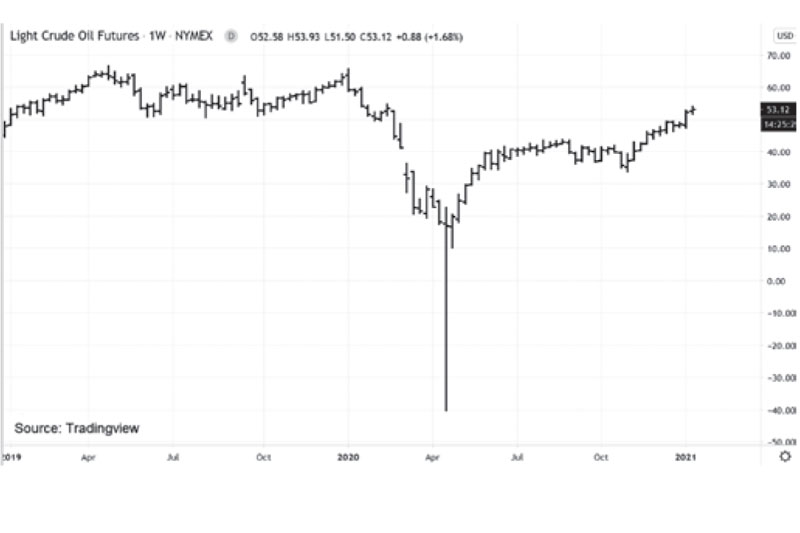

Below zero and back

After plummeting below zero in April 2020, crude oil prices have since recovered strongly to an 11-months high and are back to pre-pandemic levels. Note that during the depths of the pandemic, the West Texas Intermediate (WTI) crude oil for the month of May crashed to a record low of negative -$37.63 per barrel (see Below Zero, April 27, 2020). A negative price seems to be mind-boggling and impossible. But back then, the overflowing supply, absence of demand, and lack of storage facilities forced the sellers of short-dated futures to pay the buyers to take delivery and store the physical commodity.

A surprise cut by Saudi Arabia

The Organization of Petroleum Exporting Countries (OPEC), together with Russia and other big non-OPEC oil producers (known as OPEC+), resorted to historic production curbs since May 2020 to mitigate the slumping global demand for oil. In December, OPEC+ agreed to ease oil production by 500,000 BPD starting January of this year. But two weeks ago, Saudi Arabia surprisingly announced that it would voluntarily cut its oil output by one million barrels per day (BPD).

Crude oil jumps above $50

Crude oil prices immediately jumped above $50 per barrel after the unexpected announcement. This is the first time it has traded above $50 per barrel since March 2020. WTI crude prices settled at $52.36 per barrel last Friday, up +7.9 percent year-to-date. Brent crude prices closed at $54.96 per barrel last Friday, up +6.1 percent year-to-date. Dubai crude, which the country uses as a benchmark, soared to $54.53 per barrel, a jump of 6.6 percent year-to-date.

Including Saudi’s unilateral production cut, the 19 members of the OPEC+ will see their supply capped at 35.728 million BPD in February, an 8.125 million BPD reduction from October 2018 levels. This agreement locks in the quotas for the 1st quarter of 2021. The next meeting is set for March 4 to determine the April output levels.

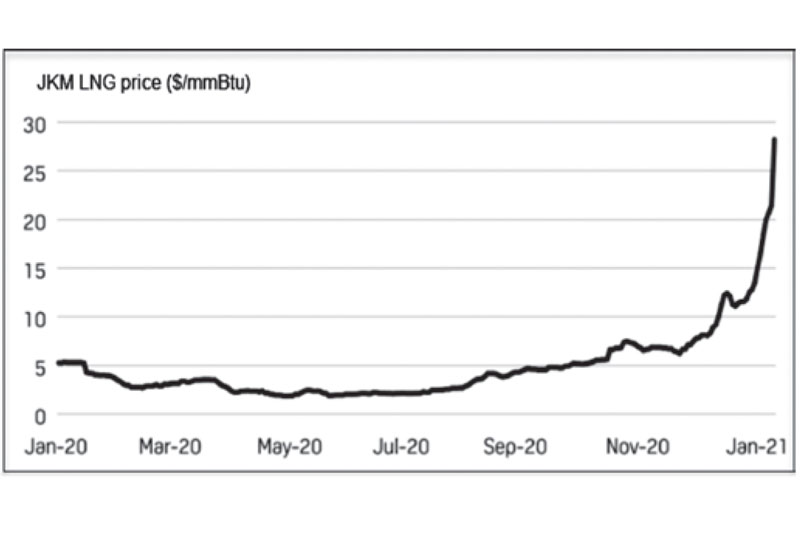

Natural gas hits record high in Asia

Natural gas appears to have hit a perfect storm. Supply disruptions, cargo shortages, shipping bottlenecks, strong demand due to record winter temperatures, plus heavy nuclear maintenance in Japan have pushed Asian LNG prices to record highs. JKM Asian LNG prices were up as much as 1,700 percent from the record low of $1.82 per mmBtu in May 2020 to a record high of $32.49 per mmBtu last January 12. This is the highest for the Asian LNG benchmark since it was launched in early 2009.

Risk of rising oil prices

Since the pandemic began, the country’s current account balance has improved. The Philippine peso has strengthened not only because of the weak US dollar but also because imports declined and crude oil prices tumbled. Today, global asset prices have recovered, and many stock markets are at new highs. But the rise in the price of crude oil bears watching. The reversal of oil prices will affect our balance of trade & current account, and it may pressure the peso. While reflation and reopening are beneficial to the economy, we should closely monitor if the oil price movement leads to a greater-than-expected increase in inflation. Higher oil prices is one of the risks to our country’s fragile economic recovery.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending