Hardly rising, big banks' loans set to follow smaller lenders' in the red

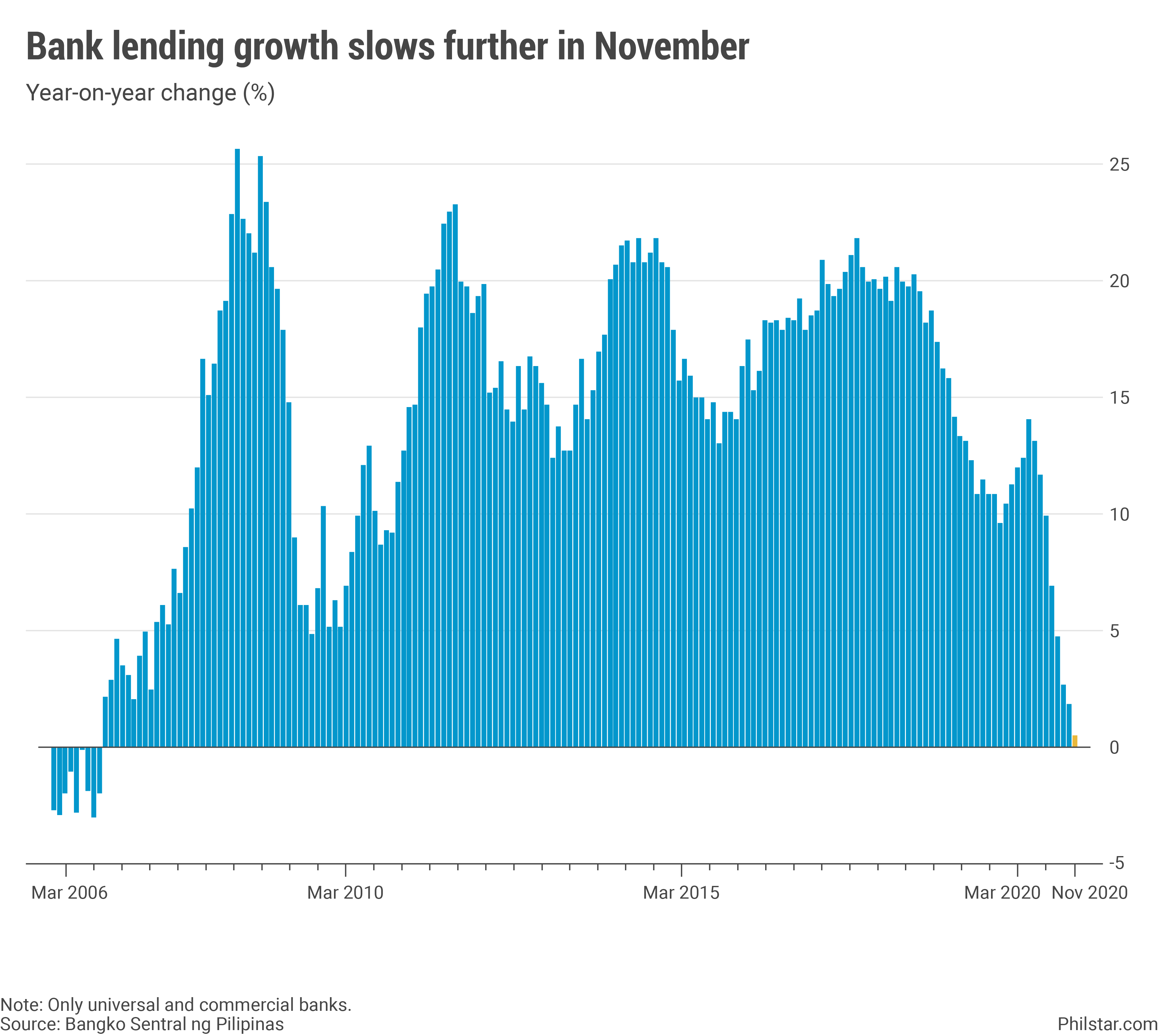

MANILA, Philippines — Lending by big banks slightly gained pace in November from previous month, but growth remained shallow and year-on-year expansion was at 14-year low, suggesting any improvement was temporary.

Outstanding loans by universal and commercial banks, net of their lending to each other, reached P8.99 trillion in end-November, up 0.46% year-on-year and sustaining a weakening trend from April, preliminary central bank data showed. The expansion was the weakest since a 1.9% drop in September 2006.

Yet compared to previous month, lending picked up a little by 0.4%, albeit still hovering below pre-pandemic levels in February last year.

A slight acceleration is welcome news to the Bangko Sentral ng Pilipinas (BSP) and the Duterte government relying on banks to extend credit to businesses and consumers slowly getting back on their feet from the pandemic’s wrath last year. For one, BSP had hoped a cap on credit card fees that took effect last November would encourage more borrowing.

However, the uptick was most likely to be a blip, rather than a trend and Emilio Neri Jr., lead economist at the Bank of the Philippine Islands, expects lending to return back in the red shortly after the holiday season is over. “Month-on-month (growth) was seasonal as you can see and consistent with mobility numbers,” Neri said in an online exchange on Monday.

“Year-on-year still slower means rate cuts need to be complemented by other policies, otherwise (lending is) likely to head towards contraction in early 2021,” he added.

Indeed, that is already happening at the broader level. Including loans extended by smaller thrift and countryside banks, lending actually contracted 0.23% year-on-year in November, a first since at least 2013, the latest period on which data is readily available. “This supports (my) points even more,” Neri said.

Banks not lending would be a problem for the Duterte government out to prove one credit rating agency that the Philippines would not be last in Asia Pacific to rebound from the health crisis. With lenders hesitating to assist shuttered business and jobless Filipinos, a struggle to revive the consumption-driven economy would only get harder this year.

In November, BSP data showed loans by big banks to production activities inched up a measly 0.7% year-on-year to P7.85 trillion. Household loans, including personal loans and credit card expenses, rose a larger 7.1%, although this growth was significantly below typical double-digit expansions in previous months.

BSP Governor Benjamin Diokno, who cut rates by a massive 200 basis points last year to aid the economy, vowed to keep rates low over an extended period if only to prompt consumers to borrow and lenders to lend. But borrowing costs are not the sole determinant in lending for banks already saddled with unpaid credit.

As of end-November, soured loans accounted for 3.82% of banks’ total loan portfolio, the highest in comparable record from 2013. These are loans that remained unpaid at least 30 days past due. BSP was prepared for them to rise to 4.6% by end of last year, while Fitch Ratings, a debt watcher, expects further pain this year.

“The deterioration in reported asset-quality metrics is likely to accelerate in early 2021, as debt moratoria expired in December 2020, but large preemptive general provisioning taken by banks in the preceding year should help…,” Fitch said in a statement.

- Latest

- Trending