Bank loans on the brink of unusual fall as growth hits 14-year low

MANILA, Philippines — John Lesler Antonio, a 24-year-old business owner from Pampanga, is filing a loan next year to build a home on his newly acquired land. He was told by his agent he should have no problem getting bank credit because of his advertising business.

“I was told advertising is not among the sectors which their bank would not be extending loan to,” Antonio said in Filipino in an online exchange.

Such is the reality on the ground hampering the central bank’s efforts to encourage banks to lend to consumers and help on reviving an ailing economy. To be fair, lenders had not been amiss of their duty, calling clients and offering them loans. The problem, however, begins once the application is filed and processed.

“Many of them get denied for various reasons like type of job, or their bank records. It’s really difficult to get a loan these days,” said an agent for a foreign bank based here who requested anonymity because she was unauthorized to speak to the media.

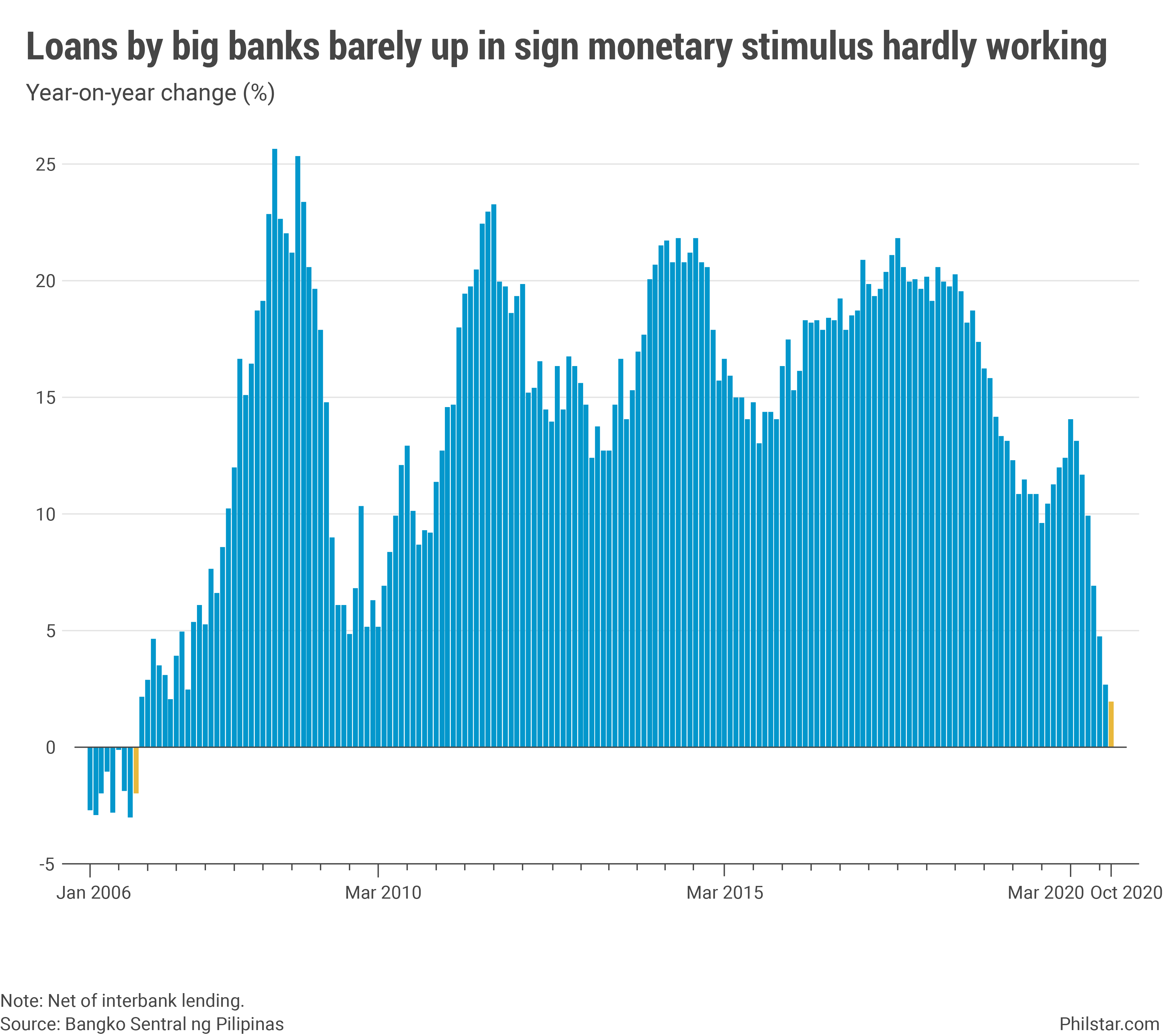

This hesitation from banks, coupled with what Antonio said was “fear to borrow” among consumers, is derailing recovery from the pandemic. Loans from big banks, net of their lending among each other, inched up a measly 1.9% year-on-year to P8.96 trillion in October, the weakest in 14 years. The performance was worse month-on-month when lending declined 0.4%.

It’s a weakening trend that started in April when lockdowns hobbled business activities and government encouraged consumers to stay home to get the coronavirus under control. That was a prescription warranted at the time, but when government was ready to reopen the economy again in June because of record job losses, enterprises did not follow instantly and now, the rebound is taking longer than anticipated.

“We have always doubted the effectiveness since 2Q2020 at a time when SMEs (small and medium enterprises) and consumers aren’t sure about how their cash flows will look like in the coming quarters,” Emilio Neri Jr., lead economist at Bank of the Philippine Islands, said in an email.

For the Bangko Sentral ng Pilipinas (BSP), this was all expected, but something that also did not stop monetary authorities from pushing money down to the economy to the tune of P1.9 trillion. Most funds, however, had not reached consumers and only gone back to BSP through term deposit and security auctions constantly swamped with bids.

“The overall slowdown in bank lending growth reflects the combined effects of muted business confidence and banks’ stricter loan standards attributed mainly to continued disruptions in business operations,” BSP said in a statement on Thursday evening.

It also did not help that banks are finding themselves saddled with unpaid loans after grace periods extended during lockdowns began to taper off. As of September, non-performing loans accounted for 3.4% of loan books, the highest since May 2013.

BSP Governor Benjamin Diokno, who vowed to do whatever it takes to pump prime the economy set for its worst decline in post-war era, expects lending growth to pick up only next year.

This suggests that lending may soon contract, following its current slowing trend. “Bank lending should be in step with the pace of economic activity. I expect the year 2021 as a recovery year and that the economy will be back to where it was in 2019 by mid-2022,” Diokno said in a Viber message.

BSP data showed that among loan types, credit to production activity grew 2% on-year in October, down from 2.3% the previous month. Household loans, which typically were growing in double-digits, slowed further to 8% annual growth from 9.8% in the same period.

After cutting interest rates by 200 basis points this year, Sanjay Mathur, ANZ economist, said the central bank had already maximized its options and that government should now do the heavy lifting.“In this scenario, the central bank cannot and should not be forceful. The recovery process will take its own course. However, two steps from the fiscal side can be useful,” he said in an email.

But Diokno's former peers at the Duterte Cabinet continues to reject proposals for more fiscal push, even coming from the BSP chief himself. The central bank, for its part, appears to be not yet done.

“The BSP will remain vigilant in monitoring domestic liquidity and credit dynamics and reassures the public of its readiness to deploy necessary measures to ensure that liquidity and credit remain adequate amid the ongoing COVID-19 health crisis,” BSP said.

- Latest

- Trending