Rules on tax-free imports of medical, learning kits OKd

MANILA, Philippines — The importation of medical supplies and online learning equipment for donation to public schools are now exempted from import duties and taxes, the Department of Finance (DOF) said yesterday.

According to the DOF, Finance Secretary Carlos Dominguez has approved Customs Administrative Order (CAO) N12-2020, which establishes the implementing rules and regulations for the tax-free importation of goods that are essential to strengthen the health care system and to facilitate the shift to a “blended” learning system amid the COVID-19 pandemic.

This is pursuant to Republic Act 11494 or the Bayanihan to Recover as One Act (Bayanihan 2).

Under the CAO, the importation of medical supplies are once again exempted from taxes, duties and fees until Dec. 19.

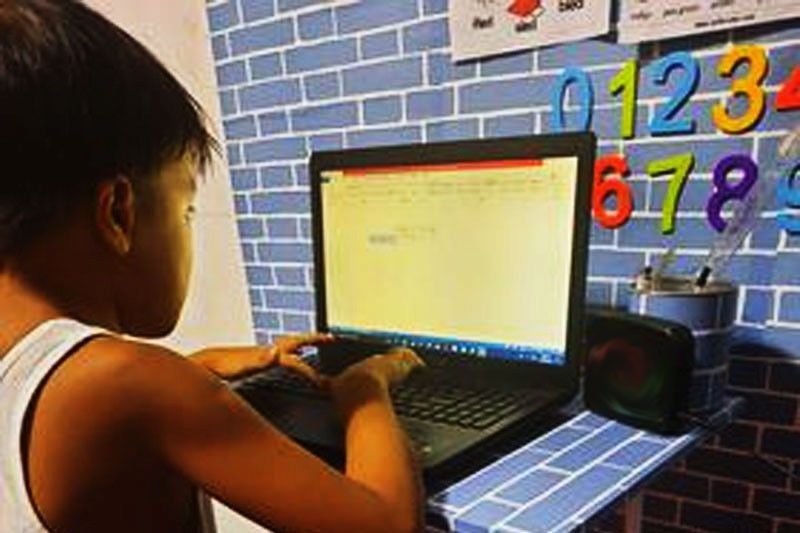

Personal computers, laptops, tablets, and other similar equipment donated to public schools, including state universities and colleges (SUCs), and vocational institutions under the Technical Education and Skills Development Authority (TESDA) will likewise enjoy the same incentives.

The CAO further specifies the operational procedures and regulatory clearances that importers or manufacturers need to comply with to avail of the tax breaks.

Imported health products for donation, certified by a regulatory agency or an accredited third party in the originating countries with established regulation shall automatically be cleared.

“The certification shall not be required for health products which are not subject to clearance from FDA (Food and Drug Administration),” the CAO states.

The order also provides for the retroactive implementation of tax exemptions on eligible imports beginning June 25, or upon the expiration of Bayanihan to Heal as One Act.

This means goods which arrived and were cleared by the BOC beginning June 25 would be eligible for a refund of the taxes and duties paid, provided that the importer secures a Tax Exemptions Indorsement (TEI) from the Revenue Office of the DOF.

To ensure the immediate release of the medical supplies and equipment covered by the order, the CAO also states that the joint memorandum order on Relief Consignment and Customs Memorandum Order 07-2020 on the interim procedure on the provisional goods declaration and its related issuances shall apply.

A PGD allows the tentative release of shipments when the declarant does not have all the information or supporting documents to complete the goods declaration, provided that the requirements shall be submitted within the period prescribed by law.

Shipments entitled to exemption may be released under PGD, subject to the submission of a TEI from the DOF-RO.

Earlier, the BIR also issued Revenue Regulations 26-2020, granting fiscal incentives for school equipment donated to public schools from Sept. 15 to Dec. 19.

Under the RR, donors of personal computers, laptops, tablets or similar equipment for use in teaching and learning in public schools shall be allowed to deduct from their gross income the amount of the contribution, subject to conditions.

- Latest

- Trending