Banks' hesitation to lend persists with loan growth at 13-year low

MANILA, Philippines — Banks continued to disappoint monetary authorities relying on them to propel recovery, slowing down lending to its weakest pace in over 13 years in August despite sufficient money supply in the financial system.

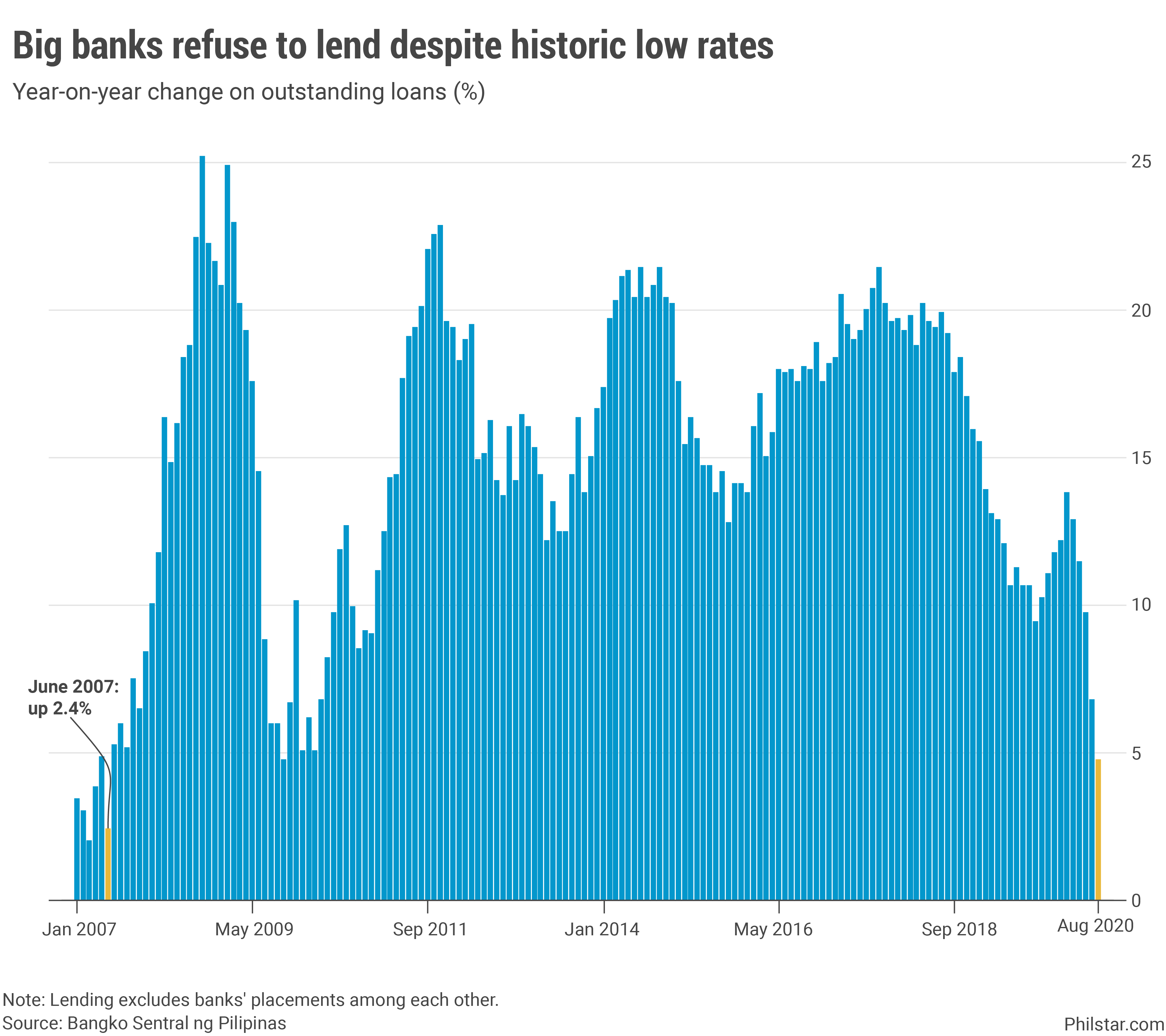

Outstanding loans extended by big banks, excluding funds lent among themselves, cooled down to 4.7% on-year to hit P7.9 trillion in August from 6.7% growth in July, the Bangko Sentral ng Pilipinas (BSP) reported Friday.

The latest reading matched the annual growth clocked in October 2009 but it was the worst performance since the 2.4% year-on-year expansion chalked up in June 2007 when the global financial crisis was just starting to engulf global markets.

Month-on-month, the lending picture was worse with credit down 1.1% from July.

“Bank lending growth continued to moderate as a result of weaker corporate sector performance, declining loan demand, and risk aversion among banks,” the central bank said.

Sought for further comment, BSP Deputy Governor Chuchi Fonacier is optimistic the holiday season would prompt households to borrow, especially after BSP capped credit card fees starting November. “We’re optimistic that lending will start to pick up towards the end of the year!” she said in a text message.

If anything, the August outturn highlights the limits of the BSP’s power to rescue the economy from a pandemic-induced recession. BSP officials are aware of this, but have nonetheless gave everything in their power to prompt banks to lend and consumers to borrow and spend, albeit so far failing.

Nicholas Antonio Mapa, senior economist at ING Bank in Manila, said BSP cutting rates to historic lows are not driving borrowers to secure credit, not when they are about to struggle paying it up during hard times.

“With job losses mounting and uncertainty on future earnings prospects limited, households and corporates have opted to preserve cash for immediate concerns while shelving expansion or investment plans to a later date,” Mapa explained.

“Unfortunately, as we’ve seen many times before, you cannot simply throw money at the problem as the root cause of anemic bank lending is poor demand and not lack of supply of funds,” Mapa explained.

Government drives money supply growth

Indeed, a separate BSP report showed a financial system swimming in liquidity. Money supply, as measured by M3, expanded 14.2% year-on-year to P13.6 trillion. But broken down, growth mainly came from the government where claims accelerated 49.8% annually. Credit claims from the private sector went up a weaker 4.5% as lending slowed.

On Thursday, the central bank extended a pause on its easing cycle, saying decisions to cut benchmark rates by 175 basis points and mandated reserves for banks by 200 bps have not fully been reflected by lenders. A rate cut is supposed to lower loan rates, while a reduction in reserves gives banks more funds to lend out.

More specifically, lending to production activities grew 4.2% annually in August, slower than 5.9% expansion recorded the preceding month. Data showed loans across all sectors either slowed down or slumped year-on-year, except for businesses engaged in education, human health and social work activities, where loans jumped by 45.9% from year-ago levels on the back of rising pandemic needs.

Growth in household loans, meanwhile, sustained a deceleration to 12.9% on-year in August from 17.2% in July on the back of sluggish expansion in credit card, motor vehicle and salary loans during the month, figures showed.

- Latest

- Trending