Remittances sink deeper in May

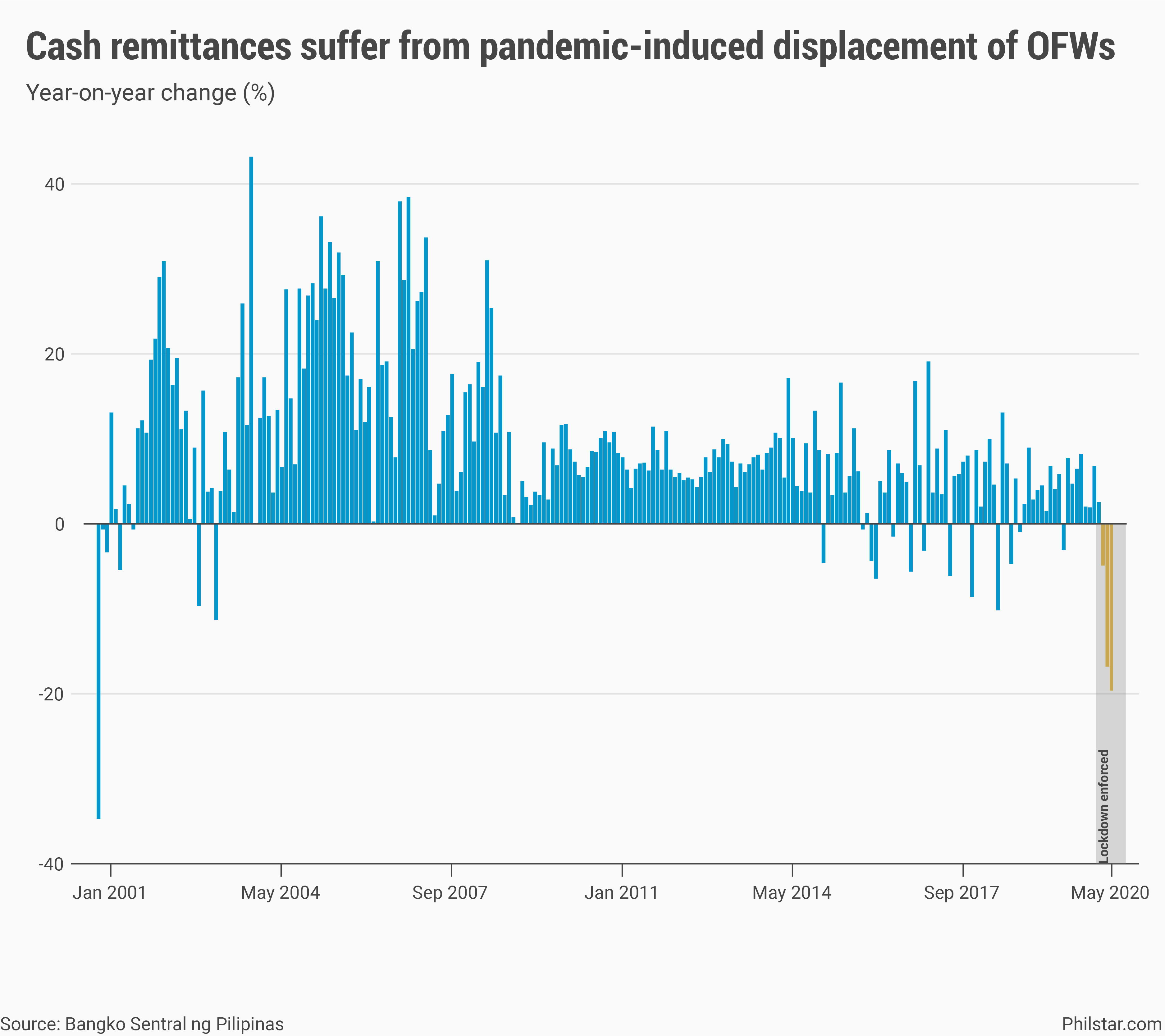

MANILA, Philippines — Cash remittances from migrant Filipinos plunged deeper into contraction in May, sustaining a year-on-year downward trend that began last March as migrant workers get displaced by the pandemic.

Cash inflows coursed through banks dropped 19.3% annually to $2.12 billion in May, wider than the 16.1% decline recorded in April, the Bangko Sentral ng Pilipinas (BSP) reported on Monday.

At that level, the contraction on remittances remained the largest since January 2001 when inflows plummeted 33.5%. One of the Philippines’ key dollar providers and source of income for families, remittances also power consumption and investments.

The decline was followed by personal remittances, which include hand-carry money from returning Filipinos abroad, as well as those transferred in kind. Personal remittances plummeted 19.2% year-on-year to $2.9 billion, data showed.

“This is the third consecutive month that personal remittances posted year-on-year contraction amid the adverse effects of the COVID-19 pandemic on global economic activity, travel, and employment, resulting in the repatriation or deferment of employment of many OFWs (overseas Filipino workers),” the BSP said in a statement.

From January to May, cash remittances already shank 6.4% to $11.55 billion. The tally is running worse than the central bank forecast of 5% drop by year-end, although the number may still improve or worsen in the coming months.

The Philippines was among the countries that enforced tight lockdowns from mid-March to June to slow the spread of the coronavirus disease-2019 (COVID-19), a decision that meant shutting off the entire country from foreign flights and preventing those inside, including OFWs, leaving.

In the middle of that lockdown, migrant workers with existing contracts were eventually allowed to travel, but global disruptions from the pandemic meant tepid deployment of workers that at one point was nearly wiped out in April. May figures have not yet been released.

For Filipinos already abroad, widespread business closures also meant difficulty sending earnings back home. “The decline in cash remittances was due to the negative effects of the continued limited operating hours of some banks and institutions that provide money transfer services…,” BSP said.

Inflows down in Middle East, Europe; up in US, Asia

For the first five months, BSP data showed the bulk of cash remittances coming from land-based workers, which on the flip side, also suffered a bigger annual drop of 7.2% than the 3.6% decrease on inflows from seafarers.

By region, remittances from the Middle East, where around 57% of OFWs were located as of 2017, shrank 13.9% year-on-year led by slippages from Kuwait, United Arab Emirates and Saudi Arabia, areas where most migrant workers were sent home. Cash from Europe dropped a faster 15.2% annually, BSP data showed.

The decreases in these regions were partly offset elsewhere, particularly in Asia where cash remittances grew 2.4% year-on-year led by those coming from Japan and South Korea. Remittances from the US, where 39.4% of inflows emanated, also expanded 7.1% on-year.

- Latest

- Trending