Is it a strong peso or a weak dollar?

In last week’s article, we showed how the Philippine peso and the Chinese yuan strengthened against the US dollar. The peso is now trading below the psychological 50-level. The yuan is trying to break the USD/CNY support at 7.00. One of the reasons that contributed to the peso strength is the weakening US dollar.

Euro’s sharp rise against the dollar

The euro, which comprises 60 percent of the trade-weighted dollar index (DXY), has risen sharply in recent months. It has rallied 6.2 percent from its March low registered at the height of the pandemic scare. The ECB’s $1.35 billion European Recovery Fund opens the door for a future fiscal union and is positive for the euro. And with US interest rates near zero, the US dollar-euro carry trade has stopped. This means less demand for US dollars.

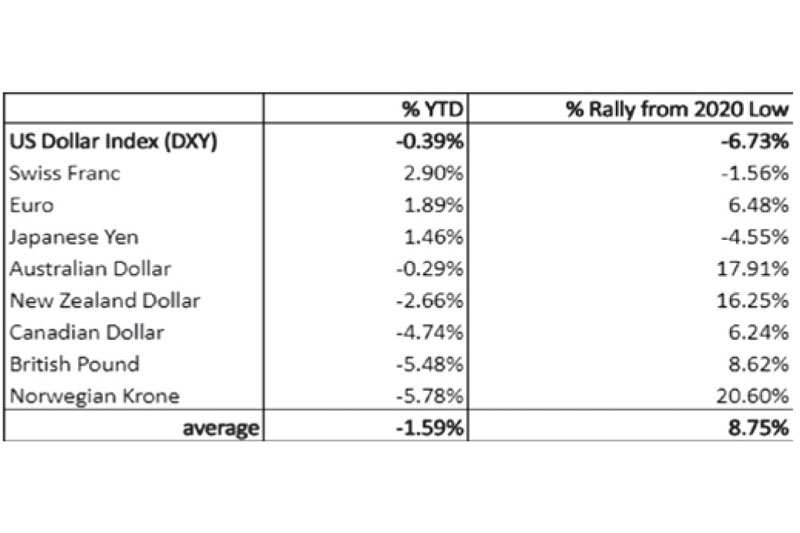

Developed market currencies vs. US dollar

Aside from the euro, other developed market currencies also rallied solidly against the US dollar. Currencies heavily linked to oil and commodities such as the Norwegian Krone (+20.6 percent), the Aussie dollar (+17. percent), and the New Zealand dollar (+16.3 percent), rose significantly. Developed market currencies have risen an average of 8.75 percent from their March lows, erasing most of their year-to-date decline against the dollar.

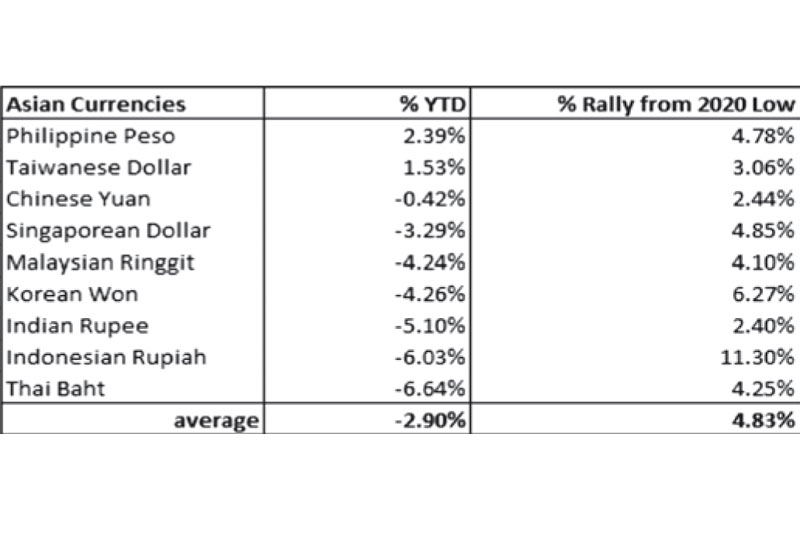

Asian EM currencies vs. US dollar

US dollar weakness is also evident in Asia. On average, Asian emerging market currencies have rebounded 4.8 percent against the US dollar from their March lows. The Indonesian rupiah, which is the most commodity-linked currency in the region, gained 11.3 percent from its March low. The best performing Asian currency year-to-date is the Philippine peso.

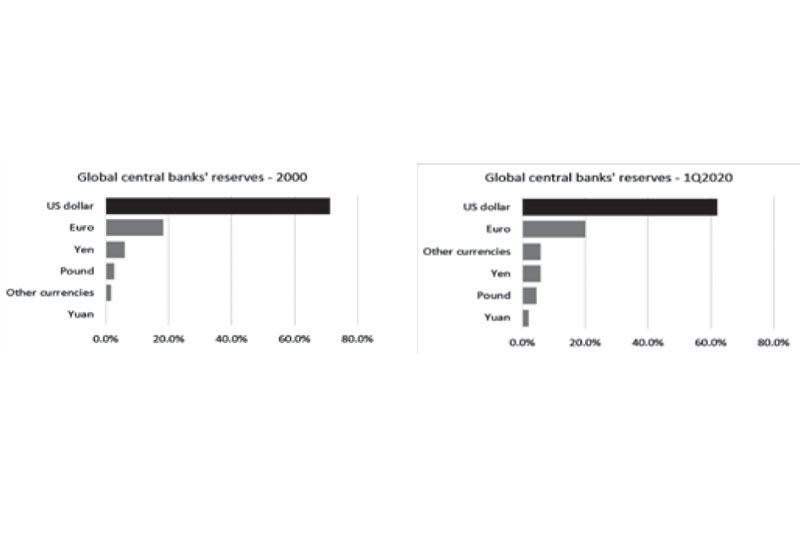

Declining share of the US dollar in global reserves

In the aftermath of the 2008-09 global financial crisis, the United Nations Conference on Trade and Development (UNCTAD) recommended moving away from the US dollar as the most dominant reserve currency. While the US dollar remains the world’s primary reserve currency, its share of global reserves has shrunk to 62 percent in 1Q2020 from 71 percent in 2000. China has made some progress after the yuan officially became a reserve currency in 2016. However, the yuan’s share of global reserves remains low, at two percent, as of 1Q2020. With the US-China cold war, China is now taking steps to promote its currency and increase the Chinese yuan’s percentage share of global currency reserves.

Goldman sees the yuan at 6.70

The Chinese yuan could hit 6.70 to the dollar in the next 12 months, according to Zach Pandl, co-head of the global FX, rates, and EM strategy at Goldman Sachs. Pandl cited the health of the Chinese economy as the reason for the yuan’s appreciation. China is the first economy to return to growth during this pandemic, expanding by 3.2 percent in the second quarter. Its June exports and imports also showed an increase, beating expectations of a decline.

Dollar weakness to accelerate as the global economy recovers

The Philippine peso indeed has shown remarkable strength. In fact, it is the best performing Asian currency year-to-date. While the peso has been strong, the dollar’s weakness, as can be seen in the tables above, contributed much to the peso strength. The dollar is the ultimate safe-haven in times of crisis, but many global investment banks now expect the dollar to decline as the global economy recovers from the pandemic. Faster economic recovery in China, as opposed to the US, means that dollar weakness could accelerate over time. If the US dollar continues to weaken against most major currencies, emerging market currencies, including the peso, are expected to maintain their resiliency.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending