Light at the end of the tunnel

Encouraged by the news that the pandemic curves have flattened in Italy and Spain, a possible peak of infections in New York and the accelerated development of potential vaccines, US President Trump declared last Monday that “there’s tremendous light at the end of the tunnel.”

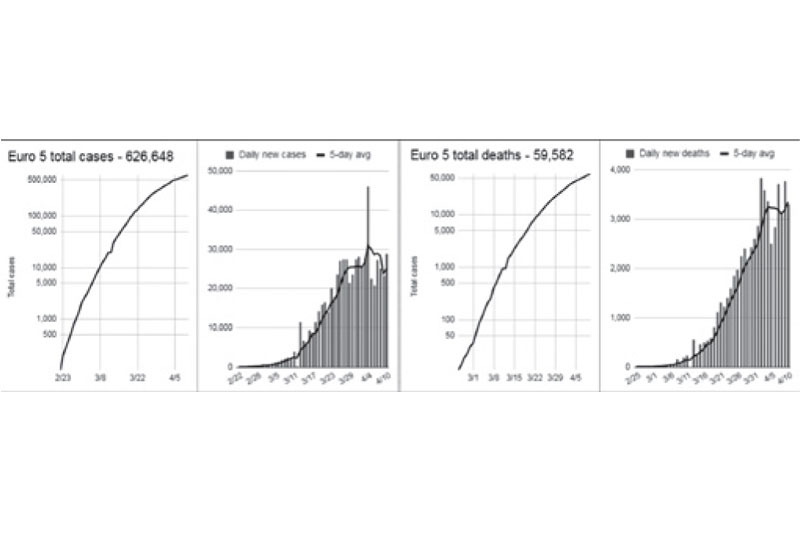

Europe turning the corner

Europe, which is now the epicenter of the pandemic, appears to be turning the corner. It now accounts for nearly half of the number of the coronavirus disease 2019 or COVID-19 cases worldwide. Daily new cases from Europe’s Big 5 (Italy, Spain, Germany, France, UK) may have peaked last April 4. Daily death tolls are starting to flatten.

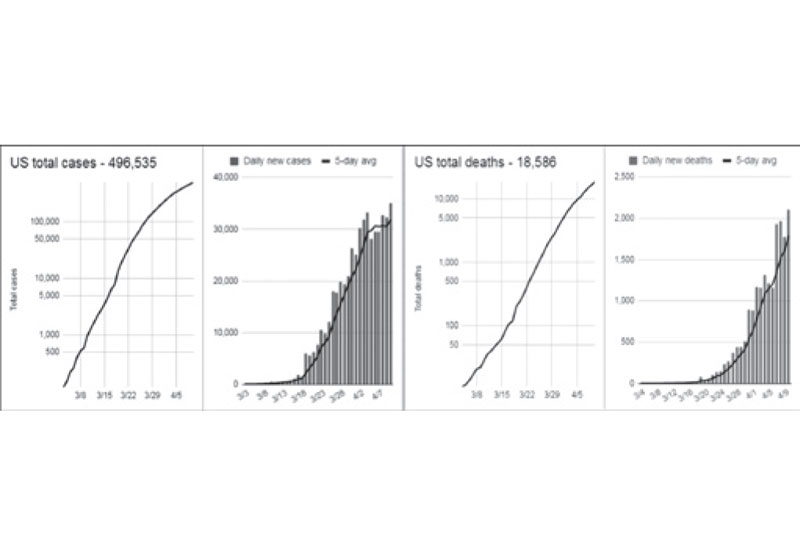

US showing tentative signs of progress

US leads the world with the largest number of confirmed COVID-19 cases at over 500,000. The death toll and new infections continue to climb, with further deaths surging to 18,586 as of Friday. The US accounts for roughly one-third of global daily deaths. However, White House health advisor Dr. Fauci stated that he expects a leveling of the curve in the US this week.

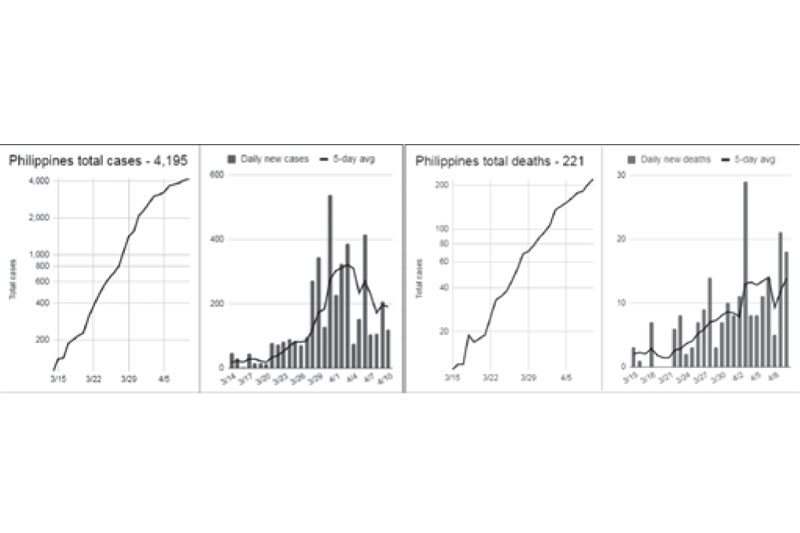

The Phl curve appears to be flattening

In the Philippines, the total confirmed cases have now reached 4,195 as of April 10. This figure implies a growth of 1.14/day the past 27 days (from the time the Philippines first recorded its 100th case). This growth is well below that of the US, which had 188,123 cases on its 27th day or equivalent to 1.32/day. More importantly, the Philippine growth rate has slowed down to 1.04/day the past five days. Some may doubt the accuracy of total cases because there were not enough tests in the early part of the epidemic, but the numbers in subsequent testings are encouraging. From the chart below, it is clear that the new infections and new deaths have begun to plateau. Credit this to our government’s decisive response to this pandemic and probably the hot climate conditions in our region. While testing and contact tracing may have been slow, the government’s decision to contain the epidemic through the enhanced community quarantine and social distancing measures was appropriate.

Fed unveils $2.3 trillion new stimulus

To counteract the economic disruption caused by the coronavirus, the US Fed announced last Thursday a new set of programs amounting to $2.3 trillion to support small and medium-sized businesses, as well as state and municipal governments. The Fed extended its buying to include municipal bonds, “fallen angel” bonds from companies who recently lost its investment-grade rating, commercial mortgage-backed securities (CMBS), and collateralized loan obligations (CLOs). The Fed is throwing the kitchen sink at this, and asset reflation has started to kick in. The high-grade bond ETF (LQD), which fell as much as 22 percent in March, is now two percent shy of its all-time high. Meanwhile, the high-yield bond ETF (HYG), which declined as much as 24 percent last month, has now rebounded 22 percent off its lows.

Easter’s message of hope

The recent market sell-off is by far the fastest and most brutal in stock market history. The monetary and fiscal stimulus packages by governments and central banks also have no parallel. These historic measures to prop up the economy, coupled with encouraging signs of abatement in the pandemic cases, triggered one of the strongest stock market rallies since 2008.

The stealthy, but deadly COVID-19 has taken an enormous toll not only on people’s finances and livelihood, but also on their lifestyle. This is a moment that everyone will never forget. As we celebrate Easter, we count our blessings and remain hopeful that this pandemic is indeed slowing down. If governments do not let their guard down with containment measures, and people continue to cooperate and make sacrifices, we may indeed be seeing the light at the end of this dark tunnel. A bottoming-out process in global financial assets may have already begun.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email [email protected].

- Latest

- Trending