Contrasting currency moves caused by COVID-19

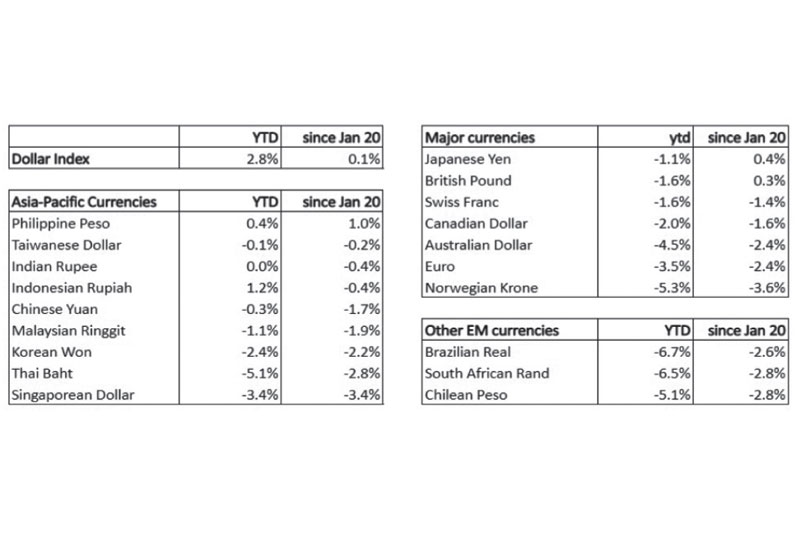

The coronavirus (COVID-19) epidemic in China has resulted in contrasting moves among global currencies. Concerns over a slowing global economy have intensified due to the travel bans, port closures, city-wide lockdowns, and factory shutdowns caused by the COVID-19 scare. These have weighed heavily on commodity currencies and countries highly dependent on tourism. The US dollar enjoyed safe-haven demand as the virus outbreak spread. The Philippine peso remains strong against almost all currencies.

US dollar – A safe haven

The US dollar index is back near the 100-level and is up 2.8 percent year-to-date. Against the euro, the US dollar is up 3.5 percent year-to-date. Amidst all the scare and panic, the US dollar strengthened. Investors have sought the greenback as safe-haven since the US economy is less vulnerable to the coronavirus threat. This is also evident in the US stock market, which is continuously making historic highs.

Chinese yuan – At the epicenter of the outbreak

The Chinese yuan, which was riding high on the back of the US-China Phase One deal, tumbled to a one-month low of 7.02 on Feb. 3 upon resumption of trading in China’s financial markets. The Bank of China unveiled liquidity and stimulus packages aimed at supporting the banks and the economy. Those measures have had subsequent effects on the yuan. So far, the BOC has been successful in stabilizing the yuan, which has fallen only by 1.7 percent since Jan. 20. Note that Jan. 20 was the day when the China CDC confirmed the first human-to-human transmittal of COVID-19.

Thai baht – bleak tourism outlook

The Thai baht is the worst performing currency in Asia year-to-date, down 5.1 percent. Since the virus outbreak started, the number of visitors from China has plummeted, hitting Thailand’s economy hard. China is the biggest source of tourism revenues for Thailand, with 11 million tourists making up 28 percent of the total tourists last year.

Singapore dollar – panic buying and hoarding

Singapore is Asia’s financial and travel hub, which is why many fear that it is vulnerable to the virus spread. Reports of its first local transmission caused panic buying and hoarding of groceries such as canned goods, rice, instant noodles, bottled water, alcohol, and toilet paper. This incident caused Singapore PM Lee Hsien Loong to publicly come out to allay fears. Meanwhile, a sales conference held at the Grand Hyatt Singapore in mid-January is reported to have spawned coronavirus cases in several countries. Singapore has the most significant number of confirmed COVID-19 cases outside of China at 67, more than half of which is through “local” transmission. The Singapore dollar, down 3.4 percent, is the worst-performing currency in Asia since Jan. 20.

Norwegian Krone – plunges to the lowest level in three decades

The worst performing major currency is the Norwegian Krone which is trading at its lowest level since the end of the 1980s. It is down 5.3 percent year-to-date. Oil prices, a critical factor in Norway’s economy, has declined 15 percent since the start of the year. A quarter of Norway’s GDP is related to oil and gas extraction. The International Energy Agency (IEA) recently cut its oil demand growth forecast by 365,000 barrels a day or 30 percent due to the economic slowdown in China related to the virus outbreak.

Aussie dollar – tumbles to 10-year lows on lower commodities demand

The Aussie dollar is the second worst-performing major currency this year, down 4.5 percent year-to-date. The fallout from the virus outbreak in China is crushing the demand for Australian commodities such as iron ore, coal, and LNG. Australia exports $60 billion worth of iron ore per year to China and supplies 40 percent of China’s LNG demand. China’s state-owned CNOOC recently invoked “force majeure” and canceled its LNG contracts with Queensland Curtis LNG. In addition to low commodity prices, the massive bush fires across Australia have also weighed down on the Aussie dollar which is now trading at its lowest levels in 10 years.

EM commodity currencies – Suffering from declining commodity prices

The Brazilian real is the worst-performing currency in the world (-6.7 percent YTD), followed by the South African rand (-6.5 percent YTD) and the Chilean peso (-5.1 percent YTD). Temporary cancellations on some commodity supply contracts with China, on top of declining oil and commodity prices, have caused these currencies to weaken.

Phl peso – best performing currency in Asia

Surprisingly, despite the BSP’s rate cut, the Philippine peso is the best-performing currency in Asia since January 20, up by one percent. Year-to-date, it is the second best performing currency in Asia after the Indonesian rupiah. The peso’s strength is brought about by Fitch’s upgrade on its outlook on the Philippines (from stable to positive), our positive real interest rate (interest rate minus inflation), and attractive yield differential. The fall in oil prices will improve our current account balance and benefit the country. Unlike Thailand and other Asian countries, our economy is not too dependent on tourism. Moreover, the Philippine domestic economy, which makes up 70 percent of our GDP, remains strong.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8689-8080 or email [email protected].

- Latest

- Trending