2019: A historic year for US, global markets

This year is shaping out to be a historic for global stock markets. Despite numerous hurdles and challenges throughout the year, including the US-China trade war, yield curve inversion, fears of a recession, US government shutdown, Trump’s impeachment, the US and other major indices are ending the year at or near record highs.

With two more trading days to go, several significant milestones were already achieved throughout the course of 2019. Among them are the following:

1. The longest bull market in history. This bull market, which is 129-months old (10 yrs. and nine months) and counting, is the longest in history. It tops the 1990s bull market, which lasted 113 months (9 yrs. and five months).

2. US markets close at an all-time high. All three major US indices posted record closes in 2019. The Nasdaq Composite, S&P 500, and the DJIA have surged 35.7 percent, 29.2 percent, and 22.8 percent, respectively, as of Dec. 27.

3. MSCI’s All-Country Weighted index (ACWI) rally to record highs. ACWI has gained 24 percent so far this year, on track for its best year since 2009.

4. S&P 500 & Nasdaq above key psychological round-number levels. With two days left to go, this may be the year that the S&P 500 will end above 3,000 and the Nasdaq Composite above 9,000.

5. S&P 500 on track for the best year since 1997. The benchmark S&P 500 index is up 29.2 percent as of Dec. 27. Just 0.4 percent shy of 2013’s return of 29.6 percent, it may be on track for best year since 1997.

6. Nasdaq 100 on track for the best year since 1999. If there will be no sharp corrections in the next two days, the Nasdaq 100, which is up by 38.6 percent as of Dec. 27, may end with the best return in 20 years.

7. Nasdaq posted the longest streak of record closes since 1998. The Nasdaq notched an 11th-straight closing high, which ended last December 27, the longest since July 1997.

8. Trillion-dollar market capitalizations. 2019 also marks the first time that three public companies will end the year with at least a trillion-dollar in market capitalization: Apple ($1.29 trillion), Microsoft ($1.21 trillion), and recent IPO, Saudi Aramco ($2 trillion).

A great decade for stocks

Not only was 2019 a historic year, but the past decade was also equally momentous. The current bull market, which we repeatedly point out in this column, is the longest in history. We also discussed how to spot the bull market and how to profit from it in our book, Opportunity of a Lifetime. Indeed, 2010-2019 proved to be an outstanding decade for the stock market and an opportunity of a generation for investors.

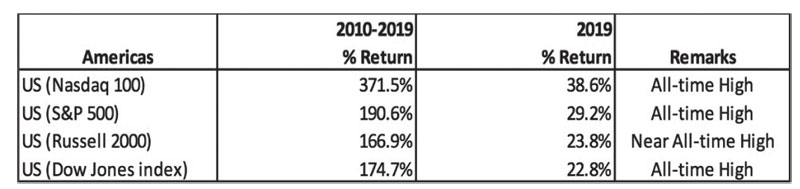

Below we show the performance of different global indices in 2019 and the past decade.

Returns of selected stock indices in the Americas

Source: Bloomberg (prices as of Dec. 27)

During the past 10 years, the Nasdaq 100 Index beat all indices with a return of nearly 371.5 percent, while the S&P 500 gained 190 percent.

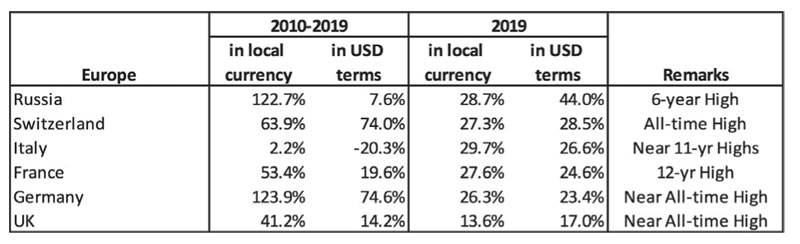

Returns of selected European stock indices

Source: Bloomberg (prices as of Dec. 27)

In 2019, many global indices are up with double-digit returns both in local currency and in USD terms. Several major stock indices are on track to end the year at record highs.

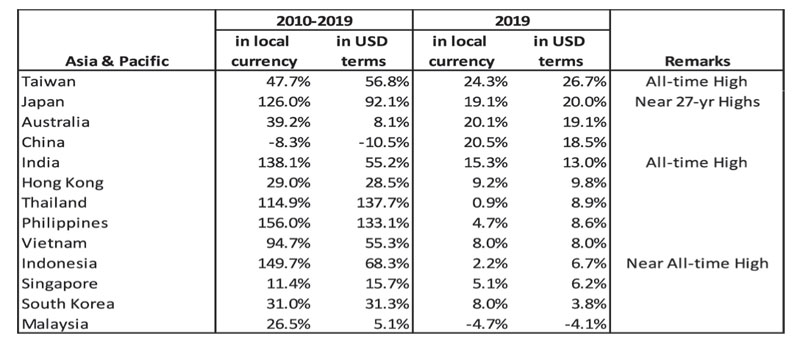

Our own PSEi returned 156 percent (in local currency terms) over the past 10 years, getting the no. 1 spot in the Asia Pacific region. This year the PSEi is up 4.7 percent in local currency terms as of Dec. 27. In dollar terms, it is up 8.6 percent year-to-date, which takes into account the peso’s appreciation.

Returns of selected Asia Pacific stock indices

Source: Bloomberg (prices as of Dec. 27)

Opportunities abound

With stock markets at record highs, the Fed and major CBs back on accommodative mode, and US-China reaching a trade truce, the outlook remains bright as we start the New Year. There will always be opportunities to come, just as we stated in our book, Opportunity of a Lifetime. Recognize and seize them when they arise. We wish you all a prosperous New Year!

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending