The strong Phl peso

Many are asking us why the Philippine peso has been so strong despite most houses forecasting a weaker peso. In fact, the Philippine peso has been remarkably strong in the past 12 months. Even as the US dollar index (DXY) strengthened to the highest level in 28 months amidst the prolonged US-China trade war, the Philippine peso performed better.

Peso vs. Asian currencies

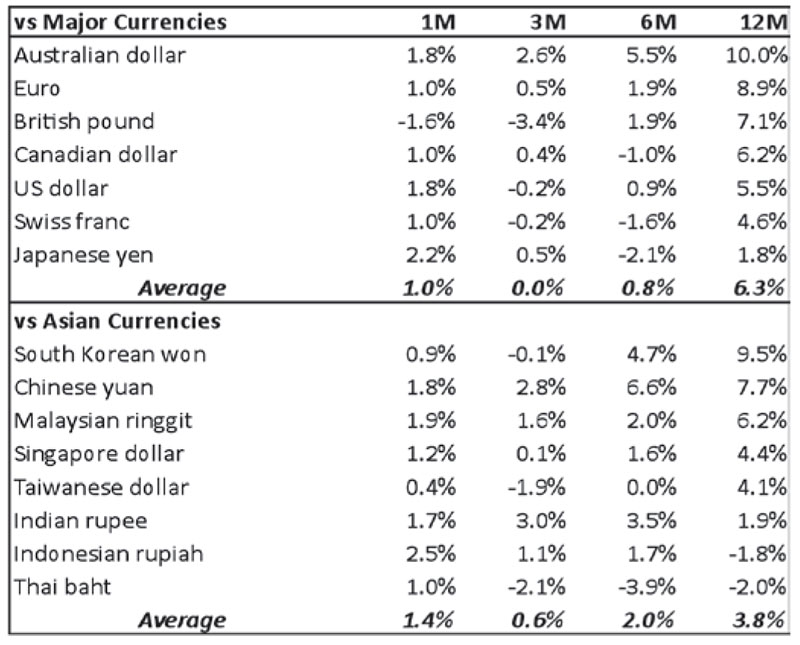

The Philippine peso’s outperformance is broad-based, as shown in the table below. It is among the best-performing currencies in Asia over the past year. Relatively insulated from the US-China trade war, the Philippine peso strengthened the most against the South Korean won (+9.5 percent YoY) and the Chinese yuan (+7.7 percent YoY) over the past 12 months.

Peso vs. major currencies

The peso has also shown significant strength against major currencies. It has appreciated the most against the Aussie dollar (+10 percent YoY), the Euro (+8.9 percent YoY), and the British pound (+7.1 percent YoY). Trade concerns have weighed on the Aussie dollar due to the close ties of Australia’s economy to China. Brexit uncertainty has caused weakness on the pound, while negative interest rates have affected the euro.

Performance of peso vs. select major and Asian currencies (%)

Source: Bloomberg, Wealth Securities Research

Source: Bloomberg, Wealth Securities Research

Search for yield

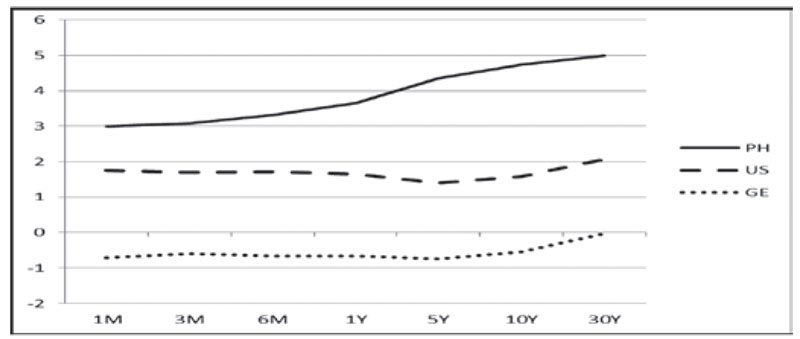

With $17 trillion worth of global bonds carrying a negative return today, the absence of yields in traditional safe havens have made Philippine bonds and the Philippine peso attractive and a place for investors to park their funds. The graph below shows the spread of Philippine bonds vis-a-vis US and German bonds.

Phl gov’t bond yields vs. US, German bond yields

Source: Bloomberg, Wealth Securities Research

Source: Bloomberg, Wealth Securities ResearchWhy is the peso strong?

1. Carry trade. The widening interest rate differential and significant positive carry have boosted the demand for Philippine bonds and the peso. For example, the spread between a 10-year Philippine government bond vs. 10-year US government bond is 317.2 basis points. Compared with a 10-year German bond yielding -0.54 percent, the spread is 528.6 basis points.

2. Record high GIR. The country’s gross international reserves (GIR) rose to a record high in September, reaching $86.2 billion. The record-high GIR is a positive development, according to Finance Secretary Carlos Dominguez III. “This will go along to make people confident that the currency is stable,” he said in one of his recent interviews.

3. Tax reform and credit rating upgrade. The government’s tax reform program has created the fiscal room for economic growth. This supports the infrastructure modernization project (Build Build Build) and other developmental programs of the government. This has also helped improve the country’s credit rating and confidence in the government.

4. Stable OFW remittances and BPO revenues. Our country’s two traditional sources of dollars are steady. OFW remittances grew 4.2 percent in August, bringing the January to August figures up by a respectable 3.6 percent.

5. Tourist arrivals are increasing. Tourist arrivals hit 5.55 million from January to August, up 14.1 percent year-on-year. Chinese tourists are the fastest growing inbound market, reaching 1.21 million in the first eight months, up 39.2 percent from the same period in 2018. For August alone, arrivals from China jumped 60 percent to 170,903.

6. POGOs. Another factor that contributes to the strong peso that was not there before is the Philippine offshore gaming operators (POGOs). POGOs are estimated to contribute $155 million in licensing fees and royalties, $219 million in office rent, and $680 million in annual housing rental. Leechiu Property Consultants CEO David Leechiu estimates that including the salaries of 470,000 POGO workers, the annual impact on the economy is around $9 billion.

7. Low oil prices and inflation, narrower trade and CA deficits, and BOP surplus. Low oil prices, benign inflation, and tempered current account and trade deficits have contributed to the strength of the peso (see Lower oil prices – bullish for the Philippines, Sept. 30). The country’s balance of payments (BOP) registered a surplus of $5.5 billion for the January - August 2019 period, reversing the deficit posted in the same period last year.

Where is the peso headed?

The Philippine peso closed at 51.27 vs. the US dollar last Friday and is now back at levels where it was trading before the Chinese yuan breached 7.00. With the break below 51.50 last week, technical analysis now points to the next target range of 50.50 to 51.00.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending