US-China trade war affects Phl peso

The Philippine peso, one of the more resilient Asian currencies this year, fell sharply against the US dollar last month as the US-China trade war escalated. Relatively insulated from the trade war throughout much of the year because of a robust domestic economy, the Philippine peso ultimately succumbed. Just two-and-a-half weeks after reaching a 16-month high of 50.80 vs the US dollar, the Philippine peso weakened to as much as 52.80 by mid-August.

Recent Trump tweets escalate the trade war

Trade tensions between the US and China soared when President Trump tweeted last Aug. 1 that the US would levy 10 percent tariffs on the remaining $300 billion of goods and products coming from China, in addition to the $250 billion of Chinese imports already tariffed at 25 percent. On Aug. 5, China responded by announcing a halt of US Agri product purchases and allowing the Chines yuan to weaken past the critical seven-level vs the US dollar.

On Aug. 24, Trump tweeted that the tariffs on the $300 billion of Chinese goods would jump to 15 percent from 10 percent starting Sept. 1, and the existing duties on $250 billion would be upped from 25 percent to 30 percent on Oct.1.

Phl peso and the PSE index fall

The day after Trump’s Aug. 1 announcement escalating the trade war, the Philippine peso fell 0.9 percent, followed by another 1.1 percent drop on Aug. 5, as shown in the chart below. The PSE index also suffered a three percent decline on Aug. 5 and another 1.6 percent drop the next day.

USD/PHP Rate Daily (January 2019 to August 2019)

Source: Wealth Securities Research

US-China trade war impact on the yuan and EM currencies

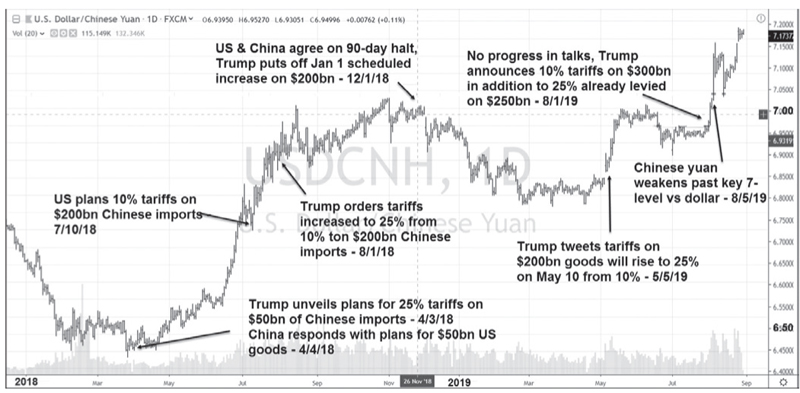

Over the past year-and-a-half, the tit-for-tat trade war escalation between the US and China has had a significant effect on the currency market. Since Trump first announced his plans to increase tariffs on $50 billion with of Chinese imports on April 3, 2018, the Chinese yuan has depreciated by nearly 14 percent vs the US dollar from 6.29 to the current 7.15. Looking at the chart below, one can see that for the past 18 months, trade war news flows steered the movements of Chinese yuan vs the dollar.

USD/CNY Rate Daily (January 2018 to August 2019)

Source: Wealth Securities Research

Weakness in the yuan has, likewise, put the brakes on EM currencies. The MSCI EM Currency Index, a primary index of emerging market currencies, has declined eight percent since Trump’s April 2018 tariff announcement.

Trade war impact on other financial assets

The escalation of the trade war has also affected other financial assets. It drove investors into safe havens such as US long-term Treasury bonds, gold and silver, and the Japanese yen. During the past month alone, the iShares 20+year Treasury Bond ETF (TLT) surged 11 percent, gold jumped eight percent, silver by 12 percent, while the Japanese yen gained by two percent.

De-escalation give markets a respite

Efforts to de-escalate the situation over the weekend have given the markets some break. The peso remained in a range to close at 52.06 last Friday, and the PSEi has rallied one percent to 7,979.66 for the week after the Chinese Ministry of Commerce said on Thursday that Beijing and Washington remain in “effective communication.” We had seen the adverse effects of the US-China trade war on the peso and Philippine stocks. While there is no clear end in sight, any improvement or even a positive statement with regards to a resumption of the trade negotiations would be welcomed by the markets.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending