Tweets, twists and turns

Since Trump’s tweet on May 5 announcing an increase in tariffs on Chinese products, equity investors have been taken on a rollercoaster ride (see Deal or No Deal?, May 13). The past two weeks saw increased volatility, with alternating vicious down moves and sharp rallies. These twists and turns in the stock market can be traced to Trump’s many tweets regarding the trade deal, often with contradicting messages and contrasting tones. Below are excerpts of some of Trump’s most significant tweets and press statements regarding trade in the past two weeks:

May 5 – “China has been paying tariffs to the USA of 25 percent on $50 billion of high tech, and 10 percent on $200 billion of other goods… The 10 percent will go up to 25 percent on Friday. $325 billion of additional goods sent to us by China remain untaxed, but will be shortly, at a rate of 25 percent... The Trade Deal with China continues, but too slowly, as they attempt to renegotiate. No!”

His May 5 tweet marked the opening salvo for the current escalation of the trade war. Chinese equity indices fell as much as seven percent the following day. After China announced that it would take retaliatory measures against US tariffs, US markets tanked, with the Dow Jones index losing nearly 500 points.

May 8 – “China has just informed us that the vice premier is now coming to the US to make a deal. We’ll see, but I am very happy with over $100 billion a year in tariffs filling US coffers...great for US, not good for China!”

May 9 – “President Xi just wrote me a beautiful letter. I’ll probably speak to him by phone.”

After seeing the sharp drop in stock prices, Trump posted conciliatory tweets, causing the markets to rally from their lows.

May 10 – “The process has begun to place additional tariffs at 25 percent on the remaining $325 billion… there is absolutely no need to rush a deal…”

Trump’s tweet saying that he is in no rush to make a deal meant that trade negotiations would be protracted. Markets dropped nearly two percent during the day as investors feared more uncertainty.

May 11 – “The deal will become far worse for them if it has to be negotiated in my second term.”

May 12 – “They broke the deal!”

May 13 – “China should not retaliate – it will only get worse… You had a great deal, almost completed, and you backed out!”

Over the weekend, Trump went on a tweetstorm, changing his stance from “no need to rush a deal” to accusing China of breaking the deal and urging them to resume negotiations. Trump also threatened China over potential retaliation. Instead of backing down, China announced that it would impose tariffs of up to 25 percent on $60 billion worth of US imports. As a result, US markets experienced their largest drop in this current phase of the trade war. The S&P lost 2.4 percent on May 13, while the Dow Jones index shed more than 600 points. As for the Chinese currency, the yuan depreciated 2.7 percent against the dollar since Trump’s tweet.

May 14 – “We’re having a little squabble with China… we have a dialogue going. It will always continue.”

“We can make a deal with China tomorrow… When the time is right, we will make a deal with China. It will all happen, and much faster than people think.”

“China will be pumping money into their system and probably reducing interest rates, as always, in order to make up for the business they are, and will be, losing. If the Federal Reserve ever did a “match,” it would be game over, we win! In any event, China wants a deal!”

After seeing markets plunge, Trump put on a conciliatory tone to restore calmness. In a press conference, he referred to the trade war as a “little squabble”, even hinting that a trade deal may come soon as both sides want a deal. He even opened up the possibility of the Fed matching China’s stimulus by cutting rates. This was music to the ears of stock market investors. As a result, US equity indices were up for three straight days, erasing half of the recent plunge before resuming its decline last Friday.

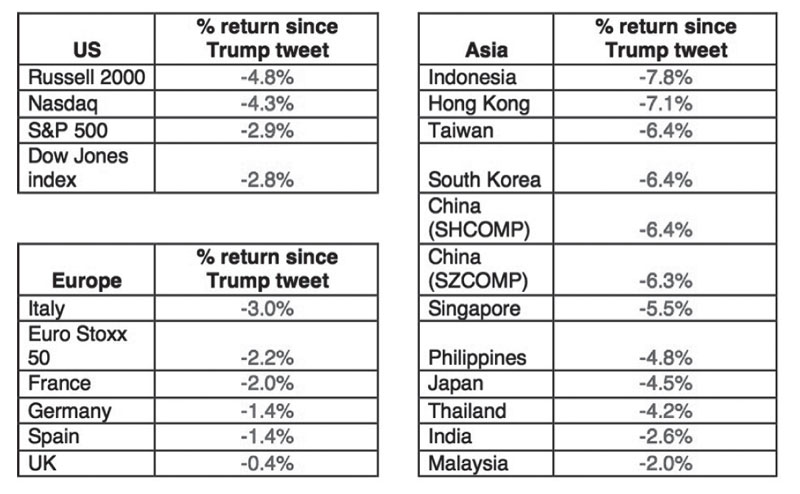

Percentage drops of major equity indices since Trump’s tweet

Source: Wealth Securities research

Everybody loses

Although the trade war is being fought primarily by the US and China, they are not the only ones getting hurt. Like any street fight, innocent bystanders can also get hurt. As can be seen in the table above, almost all major equity indices lost ground after Trump’s May 5 tweet. In fact, other countries even fell more than the US or China. The PSEi lost as much as 6.2 percent in the past two weeks, nearly erasing all of its YTD gains. Last March 2018, Trump tweeted that trade wars are good and easy to win. However, stock markets are telling a different story – a trade war is not only bad, but everybody loses.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending