Bull markets don’t die of old age

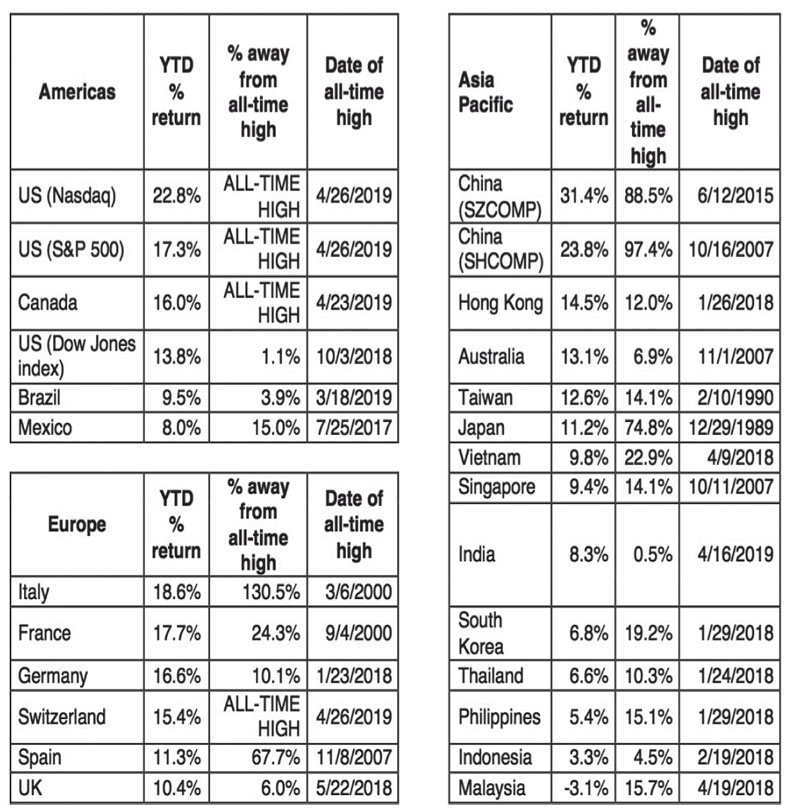

After a disappointing 2018, the year 2019 has proven to be a good year for global stock markets. Last Friday, the S&P 500 and Nasdaq both hit new all-time highs. On April 26, the S&P 500 hit a record close of 2940, while the Nasdaq ended the day at 8140. Above forecast 1Q19 US GDP growth and strong earnings from some corporates, especially tech heavyweights, gave US equity indices the impetus they needed to notch new milestones. This proves that trying to measure bull markets according to seven or 10-year cycles does not work. The historic highs last week show that bull markets don’t die of old age.

Near death experience before new highs

Just last December, it would be hard to imagine that US stocks would make new highs this year. In December 2018, the US stock market experienced the worst Christmas Eve on record, the worst week since 2008 and the worst December performance since 1931. From peak to trough, both the S&P 500 and Nasdaq lost about 20 percent of their value last year. Fortunately, this near death experience turned out to be the darkest moment before a march to all-time highs.

Source: Wealth Securities research

US hits records on trade deal hopes and Powell U-turn

The table above shows that the US is one of the very few countries that hit a new all-time high. There are two main reasons behind the US strength this year. First is Trump’s decision to reopen trade negotiations with China. Being very sensitive to the stock market’s movement, the Christmas bloodbath prompted him to restart negotiations in earnest (see Tweet by Tweet, April 15). Second was Fed chairman Jerome Powell’s dramatic u-turn regarding interest rates. With Powell insistent on raising rates as much as four times in 2019, investors were worried about a potential policy mistake that might plunge the global economy into a recession. This was one of the main reasons behind the sharp plunge in December. Thus, when he went from hawkish to dovish, markets cheered as one risk to global growth was removed (see U-turn, April 1).

Will other markets catch up?

However, it is important to note that it is not the US, but China which is the best performing stock market YTD. Monetary and fiscal stimulus, hopes for a trade deal and A-share inclusion in MSCI EM indices reversed bearish sentiment for Chinese equities. That said, the table above shows that many markets are still very far from their all-time highs. For example, despite China’s stellar performance this year, it still needs to rise 97 percent before matching its record. Our own PSEi would touch its closing high of 9058 if it can manage to gain 15.1 percent.

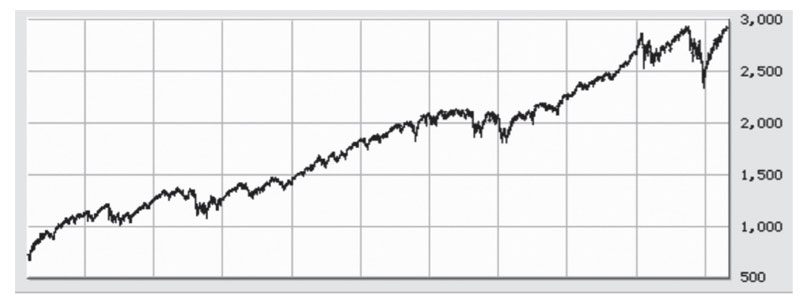

Don’t fight the Fed – since 2009

One of our most important mantras, “Don’t fight the Fed” signifies our belief that if central banks act decisively and correctly, they will win the battle against bear markets and recessions. In fact, the bull market we are experiencing now would not have been possible without the unconventional policies of ex-Fed chairman Ben Bernanke, which were continued by his successor, Janet Yellen. As can be seen in the chart below, the S&P 500 has risen 340 percent since the bottom on March 6, 2009. Today, we are in the same situation once again, but this time it is Powell battling a global economic slowdown.

S%tP 500, March 2009 to present

Source: Bigcharts.com

‘Expansions don’t die of old age, they get murdered’

The chart above clearly shows that the 10-year old bull market is alive and kicking. As Bernanke said on Jan. 4 this year, “expansions don’t die of old age. They get murdered instead.” If the global economic expansion persists, the bull market in stocks will continue as well.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending