Bangko Sentral holds key rate as inflation eases

MANILA, Philippines (Update 2, 5:20 p.m.) — The Bangko Sentral ng Pilipinas on Thursday kept its key rate unchanged, saying prevailing monetary policy settings “remain appropriate” amid cooling inflation.

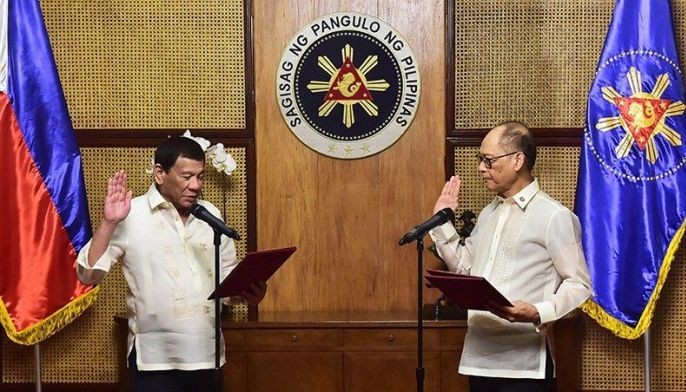

At its second meeting for 2019 that was chaired by new Governor Benjamin Diokno for the first time, the policymaking Monetary Board left the benchmark rate untouched at 4.75 percent. Interest rates on overnight lending and deposit facilities were likewise held steady.

“Inflation pressures have eased further since the previous monetary policy meeting, reflecting mainly the decline in food prices amid improved supply conditions,” the BSP said.

The central bank hiked its policy rate by a cumulative 175 basis points last year after inflation hit a near-decade high in September and October. Soaring prices have eased since then.

In February, headline inflation decelerated to 3.8 percent, the first time in a year since the monthly rate fell within the central bank’s 2-4 percent target range.

According to the BSP, its latest forecast showed inflation settling within target, with soaring prices seen averaging 3 percent in 2019 and 2020.

“The Monetary Board also noted that the risks to the inflation outlook remained broadly balanced for 2019 even as it observed that further risks could emerge from prolonged El Niño and higher-than-expected increases in global oil and food prices,” the central bank said.

“For 2020, the risks lean toward the downside as tighter global financial conditions and geopolitical risks temper global economic activity and potential upward pressures on commodity prices,” it added.

Commenting on monetary authorities’ decision, London-based Capital Economics said interest rate cuts “are now looking increasingly likely” amid declining inflation.

“We are expecting the first cut at the BSP’s next meeting in May,” the think tank said.

“Another reason we expect the central bank to cut interest rates is the worsening outlook for the economy,” it added.

Known for his expansionary fiscal policy stance as budget secretary, Diokno — who is widely seen by the market as a dovish BSP governor — earlier said there’s room to loosen monetary policy, but stressed that the timing and magnitude of any tweaks would be “data dependent.”

In 2018, the Philippine economy grew 6.2 percent — its weakest pace in three years and below the state’s 6.5-6.9 percent goal after red-hot inflation and higher borrowing costs sapped consumer spending, which has traditionally been the driving force behind growth in the Philippines.

Also on Thursday, the US Federal Reserve sent a strong signal the US economy is slowing, indicating it will not raise its benchmark lending rate again this year amid a drop in spending and broader global uncertainty.

- Latest

- Trending