Fed leaves key US interest rate unchanged, notes slowing investment

WASHINGTON — The US Federal Reserve kept the benchmark lending rate unchanged on Thursday, highlighting the continued strong performance of the economy but also pointing to a slowdown in business investment.

The central bank repeated that it expected "further gradual increases" in the key interest rate as the economy continues to expand but the statement gave no clear signal on whether it would have to move more aggressively to head off inflation.

In fact, the statement could be read as a sign the Fed believes the risk the economy will overheat may be retreating.

The policy-setting Federal Open Market Committee kept the federal funds rate at 2.0-2.25 percent at the conclusion of a two-day policy meeting and noted that inflation was running close to the central bank's two percent target.

Economists almost unanimously expect the fourth rate increase of the year in December, but with a recent report showing wages finally beginning to rise they are watching for indications about the likely pace of moves in 2019.

The Fed noted the economy "has been rising at a strong rate," with solid job gains, falling unemployment and household spending that is "growing strongly."

But markets will dissect a notable change in the FOMC's language, saying "business fixed investment has moderated from its rapid pace earlier in the year."

That could be viewed as an indication the Fed could move more cautiously, with fewer than the expected three rate hikes next year.

Slowing business investment

Or the comment might be read as the consequence of President Donald Trump's trade confrontations, which the Fed has repeatedly cited as a factor undermining business confidence and investment plans, as tariffs increase costs.

"This downgrade reflects the softness of Q3 (capital investment) in the GDP accounts," which slowed sharply, economist Ian Shepherdson of Pantheon Macroeconomics said.

But he expects investment to continue "rising at a decent clip," he said in a research note.

The 10-year US Treasury bond yield hit a seven-year high after the announcement, while stocks closed the day mostly lower, though likely affected more by oil prices than the Fed decision.

Shepherdson said "what we really want to see is how the Fed's thinking evolves over the first few months of next year if the labor market continues to tighten and wage growth picks up, as we expect."

That may become clearer when the Fed releases the minutes of this meeting on November 29 but the fact is the central bankers may not know as yet what they will need to do next year as they try to fine tune the economy.

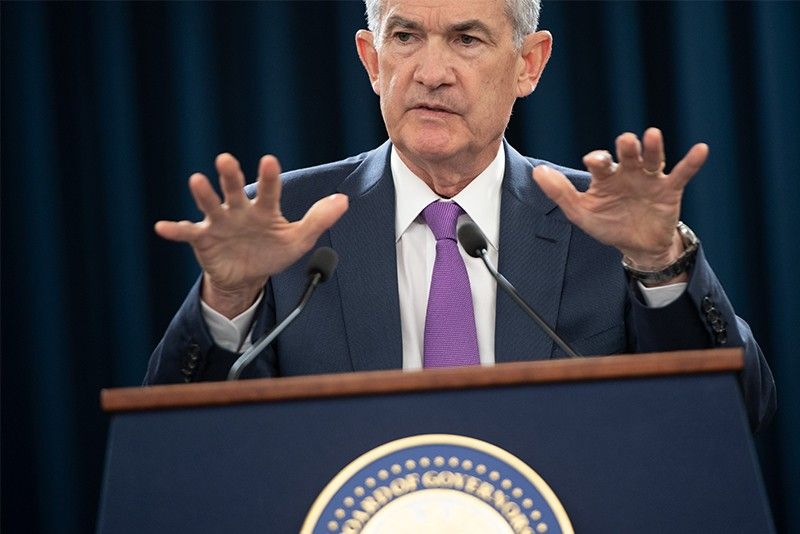

But Fed Chairman Jerome Powell will have ample opportunity to shine a light on the thought process as he will hold a press conference after every meeting starting in December.

Economist Mickey Levy of Berenberg Capital Markets said the Fed's upbeat assessments "essentially lock in a December Fed funds rate hike."

However, he said he expected the Fed "to take a slower approach next year, raising the Fed funds rate only twice and pausing through 2020."

The Fed's deliberations are increasingly conducted in a highly charged political atmosphere.

Trump has repeatedly attacked Powell, saying the central bank is raising rates too aggressively, which means any slower tightening could cause critics to question whether policymakers have yielded to political pressure.

- Latest

- Trending