When is the right time?

“There is always a right time for everything.” It took years before I truly understood the meaning of those words.

Like most people, success was not handed to me on a silver platter. Success came only after enduring and persevering through a number of failures, setbacks, and feelings of self-doubt.

It was not easy to rise after every fall. But I was able to do it because my conviction to succeed and to achieve my goals was much stronger than the thought of throwing in the towel. In each of those moments when I finally attained what I worked so hard for, I realize that, indeed, there is always a right time for everything – a right time to graduate, a right time to pass the board exam, a right time to get a new job, a right time to get promoted, or even a right time to fall in love.

Apparently, the “right timing” has always been applicable in different aspects of life, including taxation.

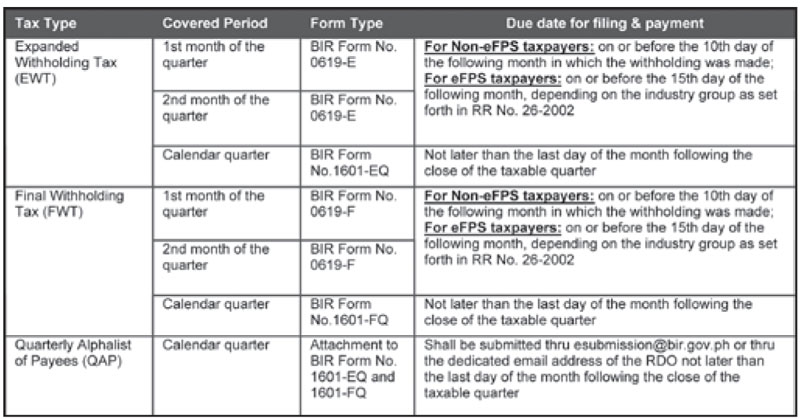

The Bureau of Internal Revenue (BIR) has often emphasized the importance of the timely filing of tax returns and being aware of the changes in the returns/forms to be filed and the deadlines of filing the same. In Revenue Memorandum Circular (RMC) Nos. 27-2018 and 73-2018, the Bureau of Internal Revenue (BIR) prescribed new and revised BIR forms for expanded withholding tax (EWT) and final withholding tax (FWT), effectively replacing old BIR form nos. 1601-E and 1601-F. Along with the issuance of the new forms, deadlines for the filing of the EWT and FWT returns have also been changed. This is pursuant to the enactment of Republic Act 10963 or the Tax Reform for Acceleration and Inclusion (TRAIN) Law.

A summary of the changes is provided in the table below for easy reference:

Source: RMC Nos. 27-2018 and 73-2018

Manual filers can download the new remittance forms (BIR form nos. 0619-E and 0619-F) and the new remittance returns (BIR form nos. 1601-EQ and 1601-FQ) from the BIR website (www.bir.gov.ph). However, for eBIRForms filers, the new remittance forms and returns are already available in the offline eBIRForms Package v7.1. Likewise, for eFPS filers, the new remittance and returns are already available in the the eFPS.

Amount to be indicated in the quarterly returns (BIR form nos. 1601-EQ and 1601-FQ) shall be the total amount/taxes withheld for the quarter. Thus, the remittances made for the first two months of the quarter using the new remittance forms (BIR form nos. 0619-E and 0619-F) shall also be reflected in the quarterly return.

In case the taxpayer has no withholding tax due for the month, the taxpayer is still required to file the abovementioned remittance forms/returns thru the use of eBIRForms or eFPS, whichever is applicable.

In view of the foregoing, I would like to reiterate that it is important to take note of the changes in the compliance requirements of the BIR, specifically on the filing of tax returns at the right time. Otherwise, taxpayers may experience their own setbacks in the form of penalties, surcharges, and/or tax audit investigations.

Karriza Mae G. Espiritu is a supervisor from the tax group of KPMG R.G. Manabat & Co. (KPMG RGM&Co.), the Philippine member firm of KPMG International. KPMG RGM&Co. has been recognized as a Tier 1 tax practice, Tier 1 transfer pricing practice, Tier 1 leading tax transactional firm and the 2016 National Transfer Pricing Firm of the Year in the Philippines by the International Tax Review.

This article is for general information purposes only and should not be considered as professional advice to a specific issue or entity.

The views and opinions expressed herein are those of the author and do not necessarily represent the views and opinions of KPMG International or KPMG RGM&Co. For comments or inquiries, please email [email protected] or [email protected].

- Latest

- Trending