A dramatic turnaround

The PSEi staged a remarkable rebound last Friday when it gained 3.48 percent, leading all countries in the region. This move also marked the PSEI’s biggest one-day gain since Jan. 25, 2016. Our stock market’s dramatic turnaround followed the sharp reversal in Chinese stocks last week. At the same time, the Dow and S&P 500 reached new all-time highs.

Turbulent times for emerging markets

In previous articles, we showed that many EM indices dropped sharply this year while certain markets hovered in bear territory. This was caused by the escalating US-China trade war, the normalization of US interest rates and EM contagion fears emanating from the crises in Turkey and Argentina. These developments triggered a selldown in emerging markets as money flowed back to the US (Back to the USA, July 30, 2018).

We are not alone

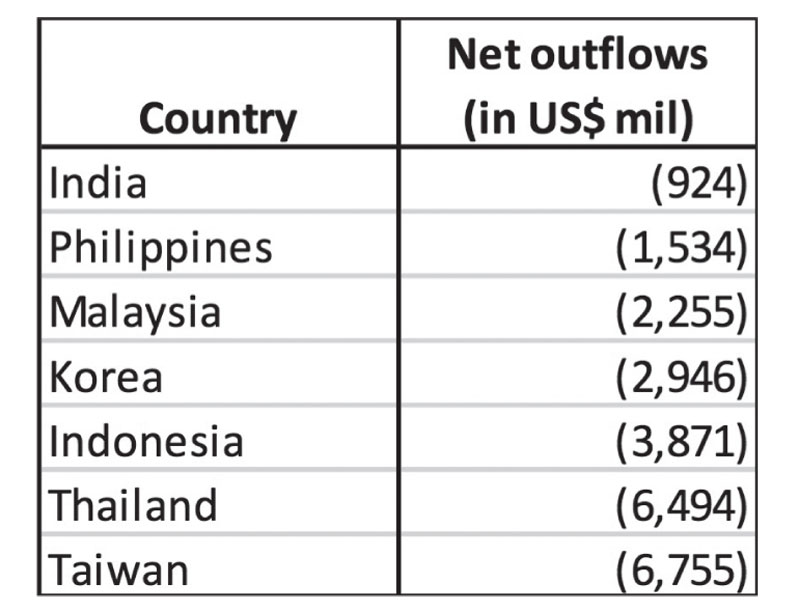

Plagued by rising inflation, a weakening peso, a widening current account deficit and unfavorable conditions in emerging markets, the Philippine stock market experienced net foreign outflows amounting to P81 billion year-to-date. However, the Philippines is not the only country which experienced heavy foreign selling. In the table below, we show that many Asian countries also experienced massive foreign outflows.

Portfolio flows of Asian countries – year-to-date

Source: Bloomberg

Turning point

In light of the poor performance of EM stocks this year, last week’s move may be a crucial turning point for emerging markets. Ironically, the announcement of US tariffs on China became the trigger for a remarkable turnaround in EM equities.

1. China’s comeback. Throughout the year, China led the drop in EM equities on concerns about the economic impact of its trade war with the US. Yet, Chinese stocks stunned the world when it gained 1.8 percent on Sept. 18, the day Trump announced $200 billion of tariffs on China. This fueled the 4.3 percent surge of the Shanghai Composite for the week and triggered a rally in emerging market stocks.

2. EEM’s bounce. The recovery in Chinese stocks drove the three percent weekly bounce of EEM (MSCI Emerging Market ETF). Problematic EM countries also rebounded as Argentina’s Merval Index soared 10 percent while Turkey’s Borsa Istanbul Index bounced 3.9 percent for the week.

3. US stocks hit fresh record highs. Last week, the S&P 500 and Dow Jones continued their ascent and touched new all-time highs despite a major escalation in the US-China trade war.

4. Pause in US dollar strength. The US dollar has recently started to pull back, signaling a pause in its strong rally since the start of the year. The pause in US dollar strength provided a much-needed respite for EM currencies, causing them to rebound last week.

5. Treasury yields rise. The yield on 10-year US Treasurys breached the three percent threshold last week, signaling the return of ‘risk-on’ sentiment.

Silver lining

Amid the gloom caused by rising inflation and Typhoon Ompong’s destruction, there are recent positive local developments which the market may have underappreciated. We enumerate these below.

1. OFW remittances sustain growth path. After dropping the previous month, OFW remittances resumed its growth trajectory as it reached $2.7 billion in July, 4.5 percent higher YoY. Year-to-date (January to July), OFW remittances amounted to $18.5 billion, up three percent year-on-year.

2. Inflation being addressed by government. Last week, Finance Secretary Sonny Dominguez said that the uptick in inflation should not be seen as a structural infirmity. According to Dominguez, higher inflation “is a transient phenomenon that all of government is now mobilizing to deal with decisively.” We believe that steps taken by the government should result in more manageable inflation next year.

3. Ample fiscal space. As presented by the country’s economic managers, the government has kept the budget deficit within target while also maintaining our country’s debt-to-GDP ratio at 42 percent. Considering this, the government still has a very strong balance sheet which can support the ramp up of infrastructure spending.

4. ‘NAIA super consortium’ receives original proponent status. Ten days ago, the ‘super consortium’ received original proponent status for its proposal to rehabilitate the Ninoy Aquino International Airport (NAIA). While the news was not given much attention, we believe that this is an unprecedented event as seven of the country’s largest conglomerates have banded together to undertake a single project. To us, this shows the willingness and ability of local conglomerates to support the government’s Build Build Build program.

Disclaimer

Philequity is an advocate of investor education and this is why we have published Philequity Corner for more than 14 years now. In all our articles and investor briefings, we have remained apolitical and refrained from discussing political views. Instead, we have focused our discussions on matters that affect the economy and the stock market in the hope of helping our readers and investors make better investment decisions. In this light, we disown any views, opinions or conclusions such as those that were circulated in social media last week. Our official views are stated only in this column.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending