Price spikes expected in Ompong aftermath

MANILA, Philippines — The rise in consumer prices further accelerated this month after the onslaught of Typhoon Ompong, prompting the Bangko Sentral ng Pilipinas (BSP) to deliver stronger monetary action this week.

Nicholas Mapa, senior economist at ING Bank, said the projected crop damage from the recent typhoon would put more pressure on the overall September inflation figure.

“The market expects inflation to peak in the third quarter and although the September reading may remain elevated, we continue to believe that the path of inflation will eventually move towards target going into 2019,” he said.

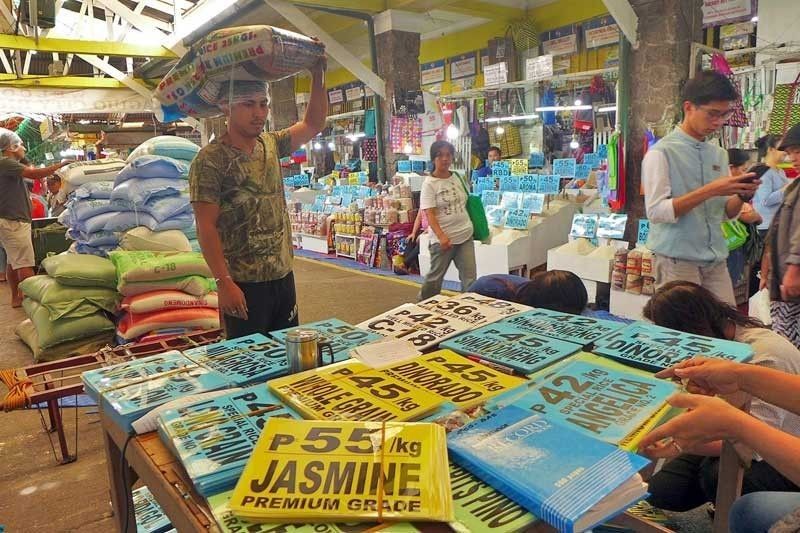

Mapa said the latest report from the Philippine Statistics Authority (PSA) showed retail prices for regular-milled rice jumped 20.26 percent to P45.71, while the month-on-month prices of the main staple increased 7.35 percent, largely due to the adverse weather conditions in the Philippines.

Rice, a staple food in the Philippines, is one of the heaviest single item contributors to overall inflation.

Mapa said the most recent reading from the PSA does not account for the projected crop damage from the recent typhoon.

Initial estimates from the Department of Agriculture showed damage to agriculture reached almost P17 billion.

Mapa said the BSP would enact “substantial” monetary action at the upcoming Monetary Board meeting on Sept. 27.

“Although the protracted inflation overshoot may be tied in large part to bad weather and rising oil prices, monetary authorities will look to anchor inflation expectations and remain vigilant against a possible de-anchoring,” he said.

Mapa added the BSP needs to maintain its current hawkish stance and continue to assure markets it remains committed to bringing inflation back to target over the medium-term.

For his part, HSBC economist Noelan Arbis sees the BSP’s Monetary Board delivering another 50 basis point rate hike as the impact of Ompong poses further upside risks to headline inflation in the months ahead.

“To make matters worse, rice production losses from Typhoon Ompong were estimated to be equivalent to 8.6 days of rice consumption. Corn and livestock production also suffered significant losses,” Arbis said.

Arbis said inflation would average 5.2 percent this year and 4.5 percent next year, exceeding the BSP’s two to four percent target for both years.

Inflation leapt to a fresh nine-year high of 6.4 percent in August from 5.7 percent in July. The consumer price index averaged 4.8 percent in the first eight months due to higher oil and food prices, weak peso, and the impact of the new tax reform law implemented at the start of the year.

This prompted the BSP to raise interest rates by 100 basis points so far this year. It first lifted rates by 25 basis points for the first time in more than three years last May 10, followed by another 25 basis points last June 20, and 50 basis points – the biggest in a decade – last Aug. 9.

Arbis said the Monetary Board would deliver another 25 basis point hike in the first quarter of next year after 50 basis points this month as the second tranche of excise tax increases under Republic Act 10963 or the Tax Reform for Acceleration and Inclusion (TRAIN) Law takes effect in January.

- Latest

- Trending