No small fry to the BIR

The Bureau of Internal Revenue (BIR) continues to surprise taxpayers with the recent issuance of Revenue Memorandum Order No. 32, further amended by Revenue Memorandum Order No. 34. Audit investigations are aimed at individual and non-individual taxpayers belonging to the small category as part of its targeted tax collection efforts and compliance monitoring.

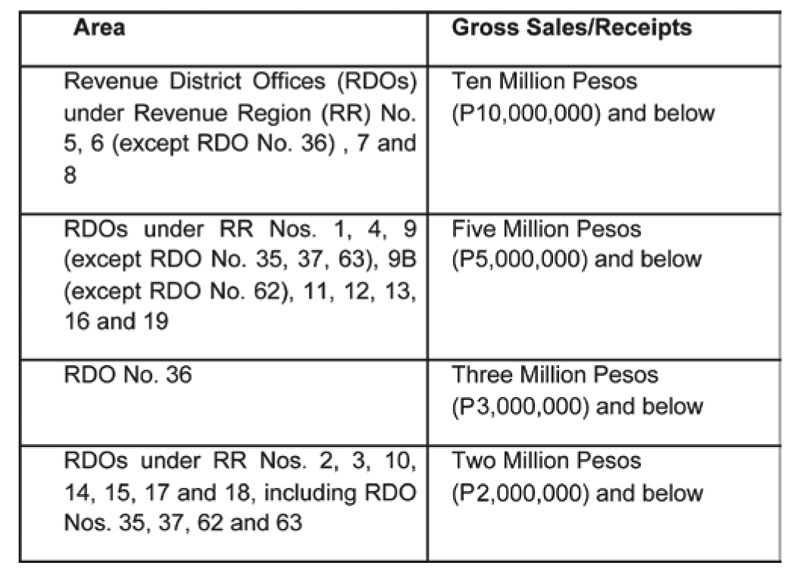

According to the orders, the audits will cover 2017 tax returns of taxpayers who fall under the gross sales/receipts thresholds per revenue area as follows:

Procedure-wise, an electronic Letter of Authority (eLA) shall be issued for each taxable year to include all internal revenue tax liabilities of the taxpayer except when a specific tax type has already been subjected to audit. The eLA shall only be issued to a taxpayer who has not been under audit in the last three years. The eLA will be sent to the taxpayer together with the Notice for the Presentation/Submission of Documents/Records via personal delivery of the Revenue Officer (RO) assigned to the case, another authorized BIR employee or through courier delivery.

The taxpayer will have 10 days from receipt of the notice to present the documents and records requested. Failure to comply will prompt the BIR to send a reminder to the taxpayer with a five day final extension. A memorandum report recommending the issuance of a Subpoena Duces Tecum (SDT) shall be prepared by the BIR in case of inaction from the taxpayer after the final extension. The report of investigation shall be submitted by the RO to the Review and Evaluation Section in the Assessment Division within 90 days from the issuance of the eLA.

By employing benchmarking and setting varying levels of thresholds per revenue area, the BIR widened its pool of audit targets. Taxpayers falling under the thresholds should begin preparations for an audit by ensuring they have supporting documentation for their 2017 tax returns and are prepared to explain the contents of such documentation. Awareness that an audit is imminent should move taxpayers to make honest tax reports and regular compliance going forward. They can seek the advice of tax professionals on how to properly address an audit situation and how to avoid them altogether in the future.

Jozette Issel G. Dizon is a senior manager from the Tax Group of KPMG R.G. Manabat & Co. (KPMG RGM&Co.), the Philippine member firm of KPMG International. KPMG RGM&Co. has been recognized as a Tier 1 tax practice, Tier 1 transfer pricing practice, Tier 1 leading tax transactional firm and the 2016 National Transfer Pricing Firm of the Year in the Philippines by the International Tax Review.

This article is for general information purposes only and should not be considered as professional advice to a specific issue or entity.

The views and opinions expressed herein are those of the author and do not necessarily represent the views and opinions of KPMG International or KPMG RGM&Co. For comments or inquiries, please email [email protected] or [email protected].

- Latest

- Trending