USA vs. the world

Led by the US stock market, the current bull run is almost 10 years old. It is now the longest running bull market in history (The Longest Bull, Aug. 30).

Opportunity of a lifetime

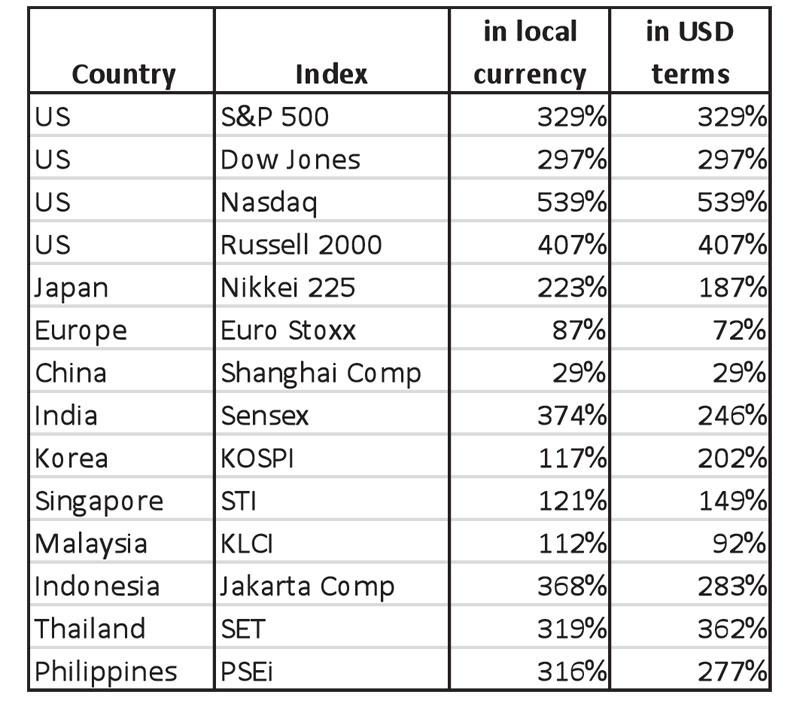

An opportunity of a lifetime was created when the S&P 500 touched a closing bottom of 676.5 on March 9, 2009. Since then, the S&P 500 has quadrupled in value. Similarly, the PSEi has quadrupled from its March 2009 low. Meanwhile, many international and local stocks have gone up by 10x or more in less than 10 years. In the table below, we show the performance of various global indices since the birth of the bull market.

Stock market returns since March 9, 2009

Sources: Bloomberg, Wealth Research

New highs in US stocks

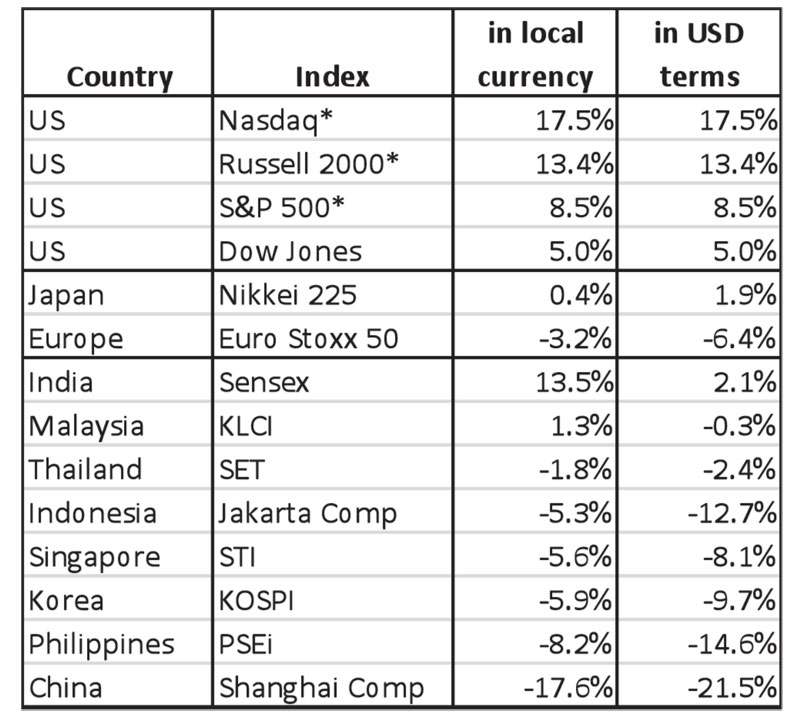

Notwithstanding several sharp corrections earlier this year, US stocks have performed exceptionally well year-to-date. All major US indices are up for the year, while the S&P 500, Nasdaq, and Russell are trading at their all-time highs. The robust year-to-date performance of US stocks was driven by strong earnings growth of American corporates and above forecast growth of the US economy. In 2Q18, the constituent companies of the S&P 500 registered an earnings growth of 25 percent while the US economy delivered stronger than expected GDP growth of 4.2 percent.

Sluggish performance of int’l stocks

Despite the strong performance of US stocks, international stocks have performed poorly this year, weighed down by the trade war between the US and China, slowing global economic growth and the crises in Turkey and Argentina. In contrast to the strong performance of the US market, the Euro Stoxx is down 3.2 percent while the Nikkei is up by only 0.4 percent year-to-date.

Meanwhile, the MSCI Emerging Index Fund (EEM) is down 8.1 percent year-to-date, weighed by the 17.6 percent drop of the Shanghai Composite for the year. The PSEi declined 8.2 percent year-to-date in Philippine peso terms and is down 14.6 percent in US dollar terms. Below, we show the year-to-date performance of various indices in both local currency and US dollar terms.

Stock market returns – year-to-date

*Nasdaq, Russell and S&P 500 are trading at all-time highs

Sources: Bloomberg, Wealth Research

Divergence between US and int’l stocks

The divergence between the US and other global indices has reached unprecedented levels, according to Marko Kolanovic, strategist from JP Morgan. He pointed out that the price momentum of US stocks is positive, while the reading for Europe and EM stocks is negative across various time horizons. However, Kolanovic believes that the unprecedented divergence between the US and the rest of the world will not persist and international stocks, particularly EM equities, will move higher.

Will the rest of the world catch up?

US stocks rose to fresh all-time highs on the back of strong corporate earnings growth and above forecast GDP growth. On the other hand, international stocks have faltered this year due to the ongoing trade war between the US and China, slowing global economic growth and fears of contagion arising from the crises in Turkey and Argentina. Will international stocks catch up with the US? Or will the US be dragged by the rest of the world? A timely resolution of the trade war will be a crucial springboard for the recovery of EM stocks.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending