BOC forms task force for fuel marking program

MANILA, Philippines — The Bureau of Customs (BOC) has formed a team to oversee the implementation of the fuel marking program, a measure seen to fight oil smuggling in the country.

Created under Customs Special Order 49-2018, the Fuel Marking Task Force will be in charge of supervising the overall implementation of the fuel marking program which is among the provisions under the Tax Reform for Acceleration and Inclusion (TRAIN) Act.

The BOC said the team would coordinate with the Department of Finance (DOF) Fuel Marking Technical Working Group, the Procurement Service of the Department of Budget (PS-DBM) and other concerned agencies on the rollout of the program.

The Fuel Marking Task Force will be led by the BOC’s Enforcement Group and co-chaired by the Intelligence Group.

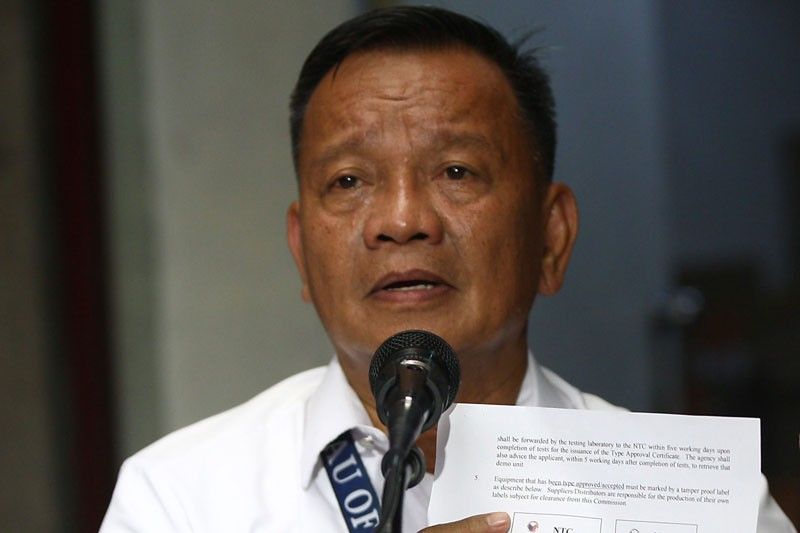

Customs commissioner Isidro Lapeña said the fuel marking program, as contained in the TRAIN Law, is envisioned to curb illicit trade of petroleum products in the country and plug the leakages caused by oil smuggling. He said the program would be mandatory for five years.

“We will implement the law to plug leakages caused by fuel fraud. A robust fuel marking program will help return the stolen revenue to the government,” Lapeña said.

According to estimates from the DOF, the government lost P26.87 billion in excise taxes and value-added tax (VAT) due to smuggled or misdeclared fuel in 2016. The fuel marking program is seen to boost the collections of the BOC and the Bureau of Internal Revenue (BIR) by P20 billion per year.

“The fuel marking is required on all petroleum products that are refined, manufactured, or imported into the Philippines that are subject to the payment of duties and taxes such as, but not limited to gasoline, denatured alcohol used for motive power, kerosene, and diesel fuel oil after the taxes and duties have been paid,” Lapeña said.

He said if the petroleum products do not contain the official marker, or do contain the marker but diluted beyond the acceptable percentage, it shall be presumed that the fuel was withdrawn “with the intention to evade payment of taxes due.”

The Customs chief said a total of 20,000 tests are expected to be conducted based on the BOC and BIR’s risk assessment and monthly operational plan to check if the duties and taxes on petroleum products available in the market were paid.

Section 265-A of the National Internal Revenue Code, as amended by the TRAIN Law, has laid out the offenses and penalties for those found violating the mandatory fuel marking program.

On June 28, the PS-DBM shortlisted two bidders to provide the fuel marking system. These are the joint venture between SICPA SA and SGS Philippines Inc. and Authentix Inc.

However, only SICPA SA and SGS Philippines Inc. submitted a proposal during the submission of bids last July 27.

- Latest

- Trending