From worst to best

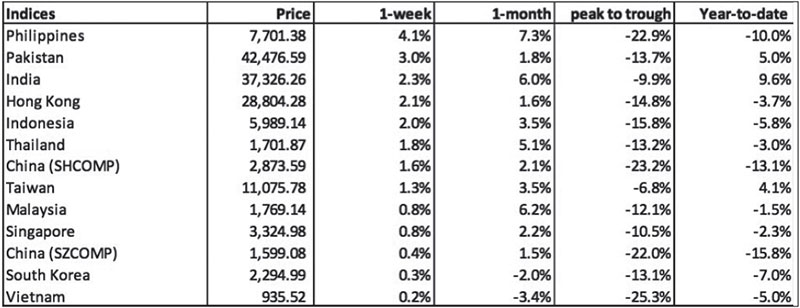

From one of the worst performing markets in Asia on a year-to-date and peak-to-trough basis, the Philippine stock market made a remarkable recovery. Last week, it was up 4.1 percent, outperforming its regional peers. It was also the best performing market for the past month.

The Philippine stock market was among the worst performing stock markets globally in the first half of this year, losing as much as 22.9 percent from its closing peak to its lowest close this year. The PSEi has since bounced back by more than 10 percent from its lowest close of 6,986.88 registered in June and is on track to become the best performing Asian market for the month of July.

Source: Wealth Securities Research

Domestic reasons for the sharp rally in Philippine stocks

Below are the domestic reasons why Philippine stocks have rallied sharply and outperformed regional peers in recent weeks:

1. Foreign funds return. Foreign funds turned net buyers of Philippine stocks last week, ending a record of 25 straight weekly net selling which started in February. The Philippine stock market had a net inflow of P 1.4 billion last week vs. an average weekly outflow of P3.01 billion for 25 consecutive weeks of foreign net selling.

2. Peso stabilizes. The peso has stabilized in recent weeks and is consolidating between 53.00 and 53.55 against the dollar. BSP’s decision to abstain from further RRR cuts this year following a rate hike last June is a clear signal that the regulator is further tightening its monetary policy stance to combat inflation. In a recent statement, BSP Gov. Espenilla vowed that they would act strongly and decisively to ensure that inflation returns to target by 2019. He said the BSP stands “ready to take decisive action in a timely manner to address emerging risks that could threaten the attainment of this target.” The BSP has also strongly intervened at around the 53.50 level, showing that they are decisively intervening not only in words, but also in deed.

3. Compelling valuations. The Philippine stock market is trading at 17.4x 2018E P/E which is one standard deviation below the 18.9x six-year average historical P/E. At its low last June, the PSE index was trading at 15.6x or two standard deviations from its 6-year average. That level is comparable to the 2013 multiple when the market suffered from QE tapering, EM current account crisis and Yolanda.

4. Technical support for PSEi and EPHE. Both the PSE index and the MSCI Philippines ETF held their major technical support levels. The PSE index bottomed out at around 6,900 which lies at a two-year support level, while the EPHE bounced upon $29 which corresponds to a six-year support.

Global reasons for the sharp rally in Philippine stocks

1. Trump wants a weaker dollar and lower interest rates. In a series of comments last week, Trump decried the strength of the dollar and accused China and Europe of manipulating their currencies which puts the US at a disadvantage. This followed an earlier Trump tweet that deplored the Fed for hiking rates and undercutting his efforts to stimulate the economy.

2. Dollar halts advance. Immediately after Trump’s comments, the dollar weakened and appeared to have halted its run which came dangerously close to breaking crucial resistance. The US dollar index (DXY) hit an intraday high of 95.44 before pulling back below 95 after Trump’s tweet. In a previous article, we said the US dollar is at the crossroads (see US Dollar: At the Crossroads, June 11) and a confirmed breach of 95 would point to a continuation of DXY’s uptrend towards the 100 to 102 levels.

3. China stimulus. China announced new economic measures to support economic growth through fiscal stimulus (tax cuts, infrastructure spending) and further monetary policy easing. The People’s Bank of China has also injected about $180 billion into the financial system thru new loans and reduction in bank’s reserve requirements.

4. Emerging markets rebound relative to US market. The rally in Philippine stocks coincided with the sharp rebound of EM stocks relative to the S&P 500 index. The MSCI Emerging Market Index Fund ETF (symbol: EEM) returned 1.7 percent for the week vs. the 0.6 percent gain in the S&P 500 index. Emerging market stocks rose for the fourth straight week and climbed to a six-week high.

5. US, EU agree on zero tariffs. At the Trump-Juncker meeting last week, the US and the EU agreed to a “zero tariffs, zero barriers or subsidies” deal to avoid a trade war between the two groups. The US-EU agreement has dispelled fears of an escalating global trade war and raised hopes that US and China will likewise find ways to fix their differences.

Light at the end of the tunnel

With the recent moves of the Philippine stock markets and the reasons we cited above for the rally, it is likely that we have seen the lows in the market. Risks still abound (like rising interest rates, inflation and the trade war) and the market may consolidate near-term, but the recent low may prove to be an important low for the PSEi.The low of 6,986.88 that was registered in June and a consolidation thereafter may possibly be the start of a reversal.

Philequity Management is the fund manager of the leading mutual funds in the Philippines.Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending