Back to the USA

With fears of a full-scale trade war hovering over investors in the past five months, investing in equities has proven to be quite torturous and unrewarding. This bloodbath was felt all over the world, with emerging markets suffering the brunt of the selloff.

USA vs. the world

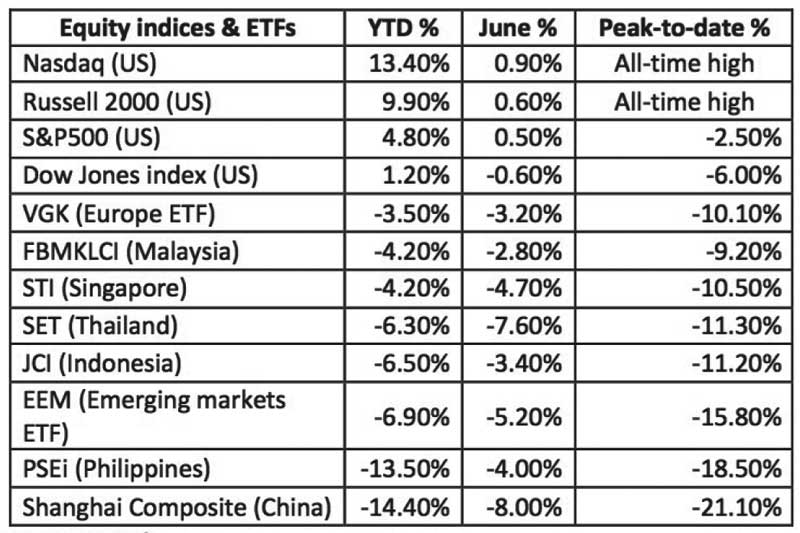

Since the trade war officially began on July 6, the US has trained its sights on China (see It’s Official – Trade War Begins, July 9, 2018). However, in this “US against the world” trade war, the numbers show that only one major stock market seems to be holding up amidst this violent selloff – the US itself. The table below shows the performance of US stock markets versus other countries. The outperformance of the US is very clear.

Source: Wealth Securities research

Sell EM assets, Buy US assets

With the US economy poised to grow four percent in 2Q18 as emerging markets flounder, investors have withdrawn money from emerging markets and plowed it into US assets – stocks, corporate bonds, US treasuries and US dollars. In fact, the dollar index (DXY) is close to its highs for the year as the US dollar has gained against most currencies. According to the Institute of International Finance, foreign investors dumped $12.3 billion in emerging market assets last May. Asia accounted for $8 billion of this outflow, which explains the heavy foreign selling for Philippine stocks and the depreciation of the peso. The following month was no better because in June alone, EEM saw $5.4 billion in outflows. On the other hand, ETFs tracking the US stock market attracted $6.4 billion in inflows.

Nasdaq and Russell hit all-time highs

As you can see from the table above, EEM is down more than seven percent YTD. ASEAN equity indices performed even worse. On the other hand, investors have clearly gone back to the USA as the Nasdaq and Russell 2000 in the US have made new all-time highs. The S&P 500 has also retested the 2800 level with the Dow Jones index clawing its way back to 25000.

EM rout lifts US bond prices

The same phenomenon is unfolding in the bond markets. Emerging market bond funds saw 11 straight weeks of redemptions as rising US interest rates, a strengthening US dollar and the threat of a global trade war led to a rout in emerging market assets. Including the impact of currency depreciation, some EM bond ETFs have lost nearly 10 percent of their value last month. This is a sharp contrast to 10-year US treasuries whose yield dropped from three percent to 2.83 percent despite the prospect of 4 Fed rate hikes this year.

Fear triggers flight to safety of US Treasuries

It is also interesting to note that the spread between US 10-year and two-year bonds has dropped to 26 basis points, the lowest since 2007. This narrowing spread shows how pervasive fear is in the market. Note that when the world experienced a real trade war in the 1930s, the global economy stagnated and the US economy plunged into a recession. During this time, the US stock market lost nearly 90 percent of its value. It is precisely this fear that triggered a flight to safety, causing investors to pile into the safety of US Treasuries.

Record annual foreign outflow for Philippine stocks

Though the US’ main target is China, this trade war is also hurting innocent bystanders, like the Philippines. Accounting for one percent of the emerging markets index, the Philippine stock market was not spared from the selloff. As of last Friday, Philippine stocks have seen P67 billion in net foreign outflows - the largest annual foreign outflow on record. With foreign funds accounting for 50 percent of trading volume, it is no surprise that our market went from a high of 9078 (Jan. 29, 2018) to a low of 6923 (June 22, 2018) in just five months. This recent plunge erased more than $50 billion in the Philippines’ total stock market capitalization.

“When we have a trade problem, we should talk about it” – China

Fortunately, there seems to be a ray of light amidst this uncertainty. In a press conference last Thursday, China’s Vice Minister for Commerce Wang Shouwen called on his US counterparts to resolve the conflict through a new round of bilateral negotiations. He said “when we have a trade problem, we should talk about it.” He added that while China does not fear a trade war, it does not want a trade war. In a House committee meeting last Thursday, US Treasury Secretary Steven Mnuchin showed his willingness to negotiate when he said that “to the extent that the Chinese want to make serious efforts to make structural changes, I and the administration are available anytime to discuss those.” More importantly, the lack of retaliation from China emboldened investors, causing the market to rally last week. If both sides choose to talk and deescalate this one-week old trade war, then money may flow not just into the US, but into emerging markets as well.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending