It’s official – trade war begins

World War I, described as the “War to End All Wars,” was triggered by the assassination of Archduke Franz Ferdinand of Austria on June 28, 1914. Twenty-five years later, Germany’s invasion of Poland on Sept. 1, 1939 sparked World War II. Now, with the US firing the first salvo, our generation is witnessing the start not of a military war, but of a global trade war.

Trump pulls the trigger

Trump pulled the trigger when he gave the go signal for an initial $34 billion worth of tariffs on Chinese products. This came into effect on July 6, 12:00 a.m., US Eastern Time, marking the official start of the global trade war. China refused to blink and instead fired back with their own set of equivalent tariffs exactly one minute after.

US stocks vs. China stocks

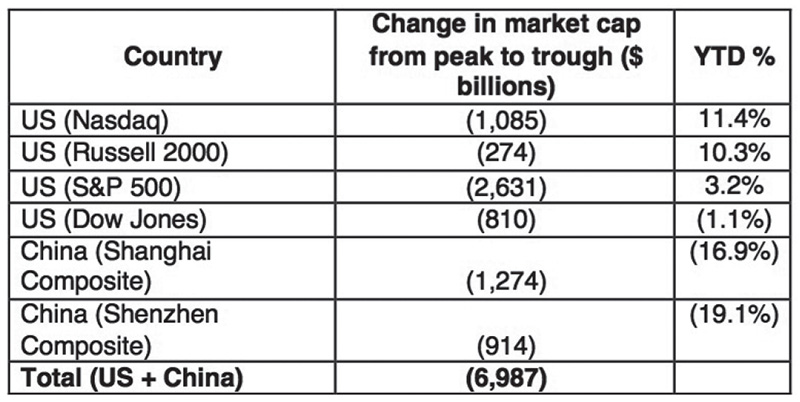

Even prior to the global trade war finally commencing, fear of the impending conflict was enough to send investors scampering for cover. In total, the US and China lost a combined $7 trillion of their combined market cap at their lowest point this year.

Change in market capitalization from 2018 peak to trough and YTD performance of US and China stock markets

US winning?

Based on the table above, one can conclude that the US is performing better and may probably win the trade war. Most US indices have since recovered their losses, while China still languishes at the lows. This has likely emboldened Trump to initiate and start a full-blown trade war.

Chinese yuan taking heavy fire

It is not only China’s stock market that is suffering, but the yuan as well. Although China’s currency is only down two percent YTD against the US dollar, it has actually weakened as much as 6.4 percent from its 2018 peak. Bulk of this depreciation occurred when trade war rhetoric intensified, leading to a four percent drop for the renminbi in just three weeks. This swift depreciation further exacerbated the selloff in Chinese stocks.

Phl caught in the crossfire

Similar to the trade war of the 1930s, this trade war can be both disruptive and destructive. Equity markets globally are already showing the collateral damage that has been brought about by the trade war. Asian assets were especially hard hit, including Philippine stocks and the peso. At its 2018 intraday low of 6,923, the PSEi was down as much as 23.7 percent from its peak. At current levels, we are down 16 percent YTD and still more than 20 percent below our all-time high of 9,068. The Philippine peso has also been caught in the crossfire and is down seven percent YTD against the US dollar.

‘Largest trade war in history’ – China

Realizing the potential danger and damage of a full-scale trade war, China made it clear that they did not start this trade war. In a statement after the first salvo from Trump, China’s Ministry of Commerce said they “refused to fire the first shot,” but it was being forced to respond to the “largest trade war in history.”

Sell on uncertainty, buy on fact

Over the past months, it is uncertainty that has caused markets to drop. However, last Friday, we saw US and China stock markets recover despite the trade war finally starting. What happened was investors chose to sell on uncertainty and buy on fact. This is the opposite of buy on rumor and sell on news. This means that the initial salvo on trade was likely baked into the price of equities already. Thus, when shots were actually fired, markets rebounded instead of dropping.

Escalation or resolution?

However, we have to remember that July 6 just marks the initial salvo. It remains to be seen whether this trade war will end in an amicable resolution or continue its escalation. If the US and China continue their tit-for-tat on trade, we may see a repeat of the 1930s trade war. Additional tariffs exacerbated the Great Depression in the US, causing the S&P 500 to lose nearly 90 percent of its value over two years. On the other hand, if both parties can agree on a compromise that is beneficial to everyone concerned, then markets will heave a sigh of relief as this economically destructive trade war is averted. Only time will tell which path the US and China will choose.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending