Political risks seen hurting Chinese bets in booming Philippine gaming industry

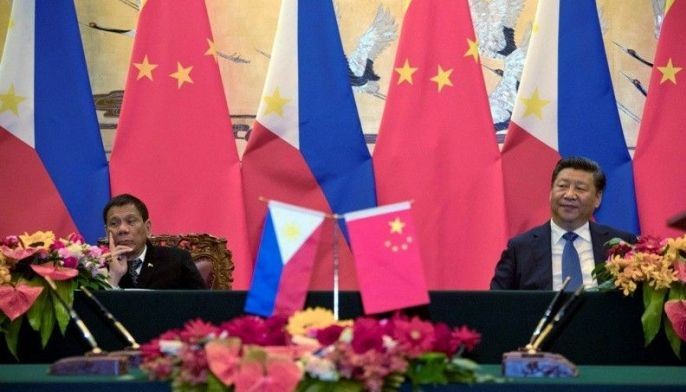

MANILA, Philippines — Philippine President Rodrigo Duterte has been cozying up with China—a move would not only help boost his nation’s economy but also fuel overseas Chinese punters’ “fever” for Philippine casinos.

However, as Manila and Beijing continue to spar over the resource rich South China Sea, Chinese gamblers’ appetite for the Philippines’ booming gaming industry could take a hit if Duterte’s successor adopts a less friendly stance in dealing with the Asian power.

“The Philippines' closer ties with China and relaxed visa rules help with the logistics of greater visitation to the country,” Bloomberg Intelligence gaming analyst Margaret Huang told Philstar.com in an interview arranged by organizers of the Global Gaming Expo Asia, the premier gaming and entertainment exhibition and conference in Asia that was held in Macau from May 15 to 17.

“Part of the reason why Chinese gamblers go to the Philippines is due to relaxed visa requirements. They can now get visa upon arrival and more flight routes have been added,” Huang explained.

“If this were to reverse, there will be less incentive attracting the Chinese as they can easily go to Macau,” she added.

Duterte has made a dramatic shift in his nation’s foreign policy since assuming office in June 2016 by forging closer ties with Beijing while berating traditional treaty ally, the United States.

Data from the Philippine Amusement and Gaming Corporation show that as of May this year, 55 offshore gaming operators that accommodate Chinese gamblers have been greenlighted to operate.

Meanwhile, a total of 3.12 million Chinese citizens arrived in the Philippines from January 2016 to May 2018, data provided by the Bureau of Immigration to Philstar.com showed. Of that figure, 2.44 million came from mainland China while the rest were from Hong Kong, Macau and Taiwan.

In the first five months of 2018 alone, the influx of Chinese nationals already reached 717,638.

Last May 4, Bloomberg reported that Chinese migration to the Philippines—which was partly stirred up by a gambling boom in the Southeast Asian country—has been pushing up property prices in the capital Manila, where offshore gaming operators hired thousands of employees, most of whom are Chinese nationals.

According to Huang, the Philippines’ gaming industry may be appealing for Chinese gamers partly due to less government scrutiny compared to gambling in Macau, which is in bird's eye view of Mainland China.

She also said there are other attractions in the Philippines that could extend Chinese visitors' stay.

“In addition, Chinese premium mass gamblers in Macau can opt to visit the Philippines and be considered a VIP patron as wagers in the latter is smaller compared to Macau,” Huang said.

“Junket operators are also likely to offer Chinese premium mass gamblers an opportunity to gain a VIP experience at the Philippines,” she added.

Potential

Despite the high Chinese demand for Philippine casinos that was partially motivated by Duterte’s warm relations with Beijing, Huang stressed that the Philippines has a long way to go before it can match Macau in terms of revenue.

“Macau is heavily integrated with China, its largest source of premium gamblers. With the sustained growth of Macau's revenue growth through greater connectivity to Mainland, it is not a fair comparison to the Philippines,” Huang told Philstar.com.

But she pointed out that the Philippines has a great potential to capture a share of Chinese premium mass gamblers, adding that the success of Manila’s gaming market mainly hinges on the country's casino regulatory framework.

“PAGCOR must focus on regulation rather than being both operator and regulator,” she said.

Last January, Finance Secretary Carlos Dominguez III said the government will proceed with its plan to sell PAGCOR-run casinos this year in a bid to help the agency improve its regulatory functions and remove any conflict of interest.

The planned privatization of PAGCOR-operated casinos will be completed within the next few months, Dominguez disclosed. At present, the regulator, which is the government’s third largest revenue collecting agency, operates 46 casino properties in the Philippines.

Meanwhile, Huang likewise said it is critical for PAGCOR to stop extending casino licenses to an already extensive pipeline of new projects, amid intensifying competition among Manila casinos.

“The reason for this is to provide an opportunity for the foreign and domestic casino operators to ramp up operations with lower risk of cannibalization, which we have already seen at Entertainment City versus Resorts World Manila,” she added.

Three casinos are currently operating within the PAGCOR-owned Entertainment City, a sprawling gaming and entertainment complex in Manila.

Amid fears of oversaturation, Duterte in February ordered PAGCOR to stop issuing licenses for new casinos, at least until the market can take in new entrants again.

“The Philippines' gaming market is highly tilted to the domestic market and with that there is only so much demand that can be tapped before it reaches saturation,” Huang said.

- Latest

- Trending