Phl peso – a paradigm shift

Last week, the Philippine peso hit an 11-year low, touching 51.89/$ before ending the week at 51.76. In the past week alone, the peso depreciated by 1.1 percent against the US dollar. It is also down 4.4 percent since the start of the year and 7.1 percent year-on-year. The reason behind the recent weakness of the peso this time around can be traced to the strong US dollar.

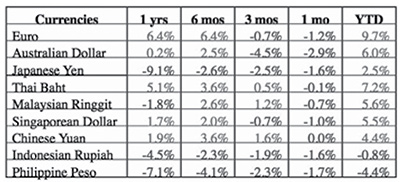

Performance of major and ASEAN currencies against the US dollar over different time periods (ranked by YTD performance)

Source: Wealth Securities research

As you can see from the table above, the US dollar has actually been weak for about a year. In the past few weeks, the dollar has since gained ground against almost all currencies. In the past month, one will see that the euro and the yen weakened by 1.2 percent and 1.6 percent against the dollar, respectively.

Reasons for the current US dollar strength

For our readers who are wondering why there is a resurgence in the US dollar, we list down below the reasons behind its recent strength:

1. Expectations of higher interest rates – In line with the Fed’s hawkish policy, Fed chairman Janet Yellen is expected to hike rates in December. Moreover, with Yellen’s term ending in February 2018, Trump has started looking for candidates to fill her post. There is a concern that the choice of Trump may be more hawkish than Yellen.

2. Bull market in US stocks – Strong US economic growth and rising corporate earnings have propelled US equity markets to record highs. Investors have continued to plow money into US stocks, underpinning the dollar’s strength.

3. Potential passage of tax reform in the US – Recent events have indicated that the “once in a generation” tax overhaul proposed by Trump is going to be passed. Expectations of its passage are likewise driving flows into US stocks and the US dollar.

Paradox of a weak peso and strong Phl stock market

As you can see in the table, the Philippine peso has been weakening for a year already. History shows that whenever the peso depreciates, the stock market weakens as well. Thus, it is interesting to note that even though the peso depreciated quite sharply over the past year, the stock market continued its march towards new highs. In fact, the PSEi is up 21.3 percent YTD.

Paradigm shift in the Phl peso

The paradox of a weak peso and strong stock market can be explained by the paradigm shift in the way investors view a weakening peso. Most people have a mindset that a weak peso is bad because it causes inflation to rise, imports to become more expensive and financial assets like bonds and stocks to fall. However, as we have written in a previous article, there are many reasons why a peso weakness can also be good (see Peso weakness – good or bad?, July 17, 2017). We reiterate the reasons below:

1. Higher spending power for OFW families.

2. Competitiveness of BPO sector.

3. Cheaper exports.

4. Import substitution.

5. Revival of manufacturing and agricultural sector.

6. Boost to the tourism industry.

7. Creation of more jobs.

8. Countryside development as a result of better performance of agricultural and tourism sectors.

Yen weakness boosts Japan’s stock market

Another example of a weakening currency that is beneficial to their economy is Japan. We see that whenever the yen weakens, the stock market actually goes up and vise versa. This can be explained by its export-driven economy which benefits greatly from a weaker currency. Similarly, in Europe, one will notice that European stocks tend to correct when the euro strengthens. This goes to show that with the right mix of economic drivers, the negative impact of a weakening currency can be mitigated. In fact, it may even be beneficial to the economy.

Paradigm shift in economic policies

The paradigm shift is not just contained to currencies, but the outlook on the economic landscape is changing as well. A decade ago, inflation and fiscal deficits were not viewed positively. In fact, the IMF prescription before for reviving a floundering economy were austerity measures. However, due to the subprime crisis in 2008, the views of central banks and economists have changed. Europe’s sovereign debt crisis also prompted policymakers to rethink the effectiveness of their old tools. Even Japan, which was stuck in a deflation and bear market for two decades, had to resort to a radical monetary policy. Central bankers were so afraid of deflation and a double-dip recession that they implemented unconventional monetary policies such as QE, Operation Twist, OMT and QQE (see The Great Global Monetary Easing, Oct. 22, 2012).

A whole new world

The paradigm shift in the effect of currencies, inflation, and fiscal balance on the economy, combined with the new normal of low interest rates, helped the global economy to recover. With this paradigm shift, central banks of developed countries are looking to hit higher inflation targets as this is now seen as a sign of growth. Economies that are attempting to recover are now expected to implement stimulus programs, even if it results in a contained fiscal deficit. The result of the paradigm shift is synchronized global economic growth and the global bull market in stocks that we are experiencing now.

A very different Phl

Fortunately, the paradigm shift has translated to the Philippines as well. Thus, even though the Philippines has a weakening currency and a programmed fiscal deficit, these are now viewed as signs that the country is spending on infrastructure as it embarks on its next leg of growth. Espenilla expressed confidence in the economy, saying “it’s a very different Philippines that we are dealing with, that is why we have some degree of confidence that we can survive uncertainties.” It is precisely this paradigm shift that has caused Philippine stocks to reach new all-time highs.

However, it is important that a peso depreciation does not become too abrupt, too sharp and disorderly. This could trigger a vicious cycle of rising borrowing costs, runaway inflation, falling financial asset prices and further peso depreciation. As long as our fiscal deficit does not go beyond the government’s self-imposed limits, the paradigm shift in the peso and economic policies will continue to underpin the strength of our economy and stock market.

********************************

On Nov. 8, Wednesday, Xavier School Batch 1993 will hold its first fundrai-sing event. In support of the charitable causes for Xavier, I have agreed to give a talk about my investment strategies and lessons using my own life and stock market experiences as a template. The event will be held at the Uno Seafood Restaurant in Annapolis St., Greenhills and will start at 6 p.m. Ticket prices are pegged at P3000 – dinner, wine and drinks included. All proceeds will go to Xavier School’s charitable projects.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending