Flirting with 8,000

After many attempts to decisively break the crucial 8,000 level, the Philippine Stock Exchange index failed to pierce it yet again, ending the week at 7,882. Since reaching the 8,000 level in 2015, the PSEi has failed to convincingly break above this hurdle.

Touching 8,000

We note that this year the PSEi has touched 8,000 multiple times. For the month of June alone, the index has reached 8,000 on 7 occasions, with the market closing above the 8,000 level twice. Unfortunately, these flirtations did not result in a convincing breakout.

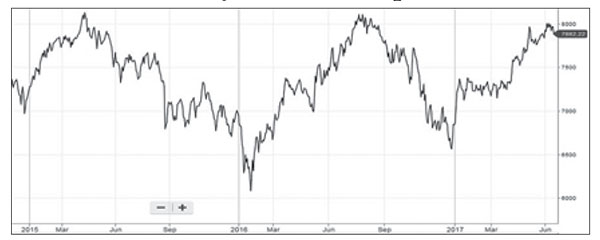

The first time the PSEi hit the 8,000 milestone was on March 30, 2015, with the index reaching a high of 8,008. Though it did not close above 8,000 on that day, our stock market would go on to make its still unbroken record all-time high a week later. Since the first time the PSEi hit 8,000, it has touched this level 36 times and closed above it 21 times. This can be seen in the chart below.

PSEi daily chart (2015 to present)

Source: colfinancial.com

Law of round numbers

Though fundamentals and flows can explain market movements, we cannot help but notice that the PSEi keeps correcting whenever it hits a round number, which in this case is 8,000. We have written about this principle previously as we noticed that people tend to make decisions at round numbers as they ring a bell to the public and make for better headlines (see The Numbers Game, 19 March 2012). We have also written articles whenever the PSEi reached a round number level (see 5000, 5 March 2012, 6000, 14 January 2013, 7000, 27 April 2013, and 8000, 13 April 2015).

Breakeven mentality

Another thing we noticed is that investors are averse to taking losses. They tend to hold on to their losing stock positions until it gets back to their cost. This “breakeven mentality” seems to be so ingrained in people such that whenever the PSEi or a particular stock goes back to its all-time high or other resistance levels, it experiences significant selling. This may well be the thinking of investors who bought around the 8,000 level.

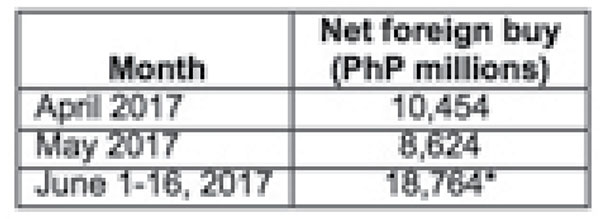

Foreign flows bring us back to 8,000

With 50 percent of our trading volume still dominated by foreign funds, the direction of foreign flows has a significant impact on our market. Fortunately, the passage of tax reform in Congress has attracted more foreign funds into the Philippines (see Stock market cheers tax reform passage by House, 5 June 2017). See below a table showing the monthly net foreign buying since April 2017. Note also that last Wednesday, the PSEi had P11.4 billion* in net foreign buying – the biggest one day inflow since January 2015. The resumption in foreign inflows also coincides with the PSEi’s breakout from its consolidation at the start of the year (see PSE Index breaks out after long consolidation, 10 April 2017).

* includes Meralco share placement

Source: Wealth Securities research

3rd time’s the charm or another pullback?

As can be seen in the PSEi chart, this is the third time that the index has hovered around the 8,000 level. If the popular idiom is to be believed, maybe third time’s the charm and we will soon hurdle over this milestone. On the other hand, it is likely that the stock market may experience another pullback in the coming weeks as 8,000 has proven to be a strong resistance level.

Timing the market vs. time in the market

At Philequity, we have always stated that corrections and short term movements are nearly impossible to predict. It is easier for us to forecast the long term performance of the stock market and the economy than determine how deep or how long a correction will last. If professional fund managers find it very difficult to time the market, then it will be almost impossible for individuals who are not full time investors. Thus, we have always advocated long term investing because time in the market will always outperform investors who are trying to time the market (see The Hare and the Tortoise, 5 April 2010).

Strength in numbers

The fans of the 2017 NBA champions, the Golden State Warriors, will know that this subheading is homage to their battlecry. However, this can also apply to the stock market. Though the market may correct, it has probed and tested the 8,000 level many times. The longer it takes to break 8,000 and the more times it hits that level, the stronger and more significant the breakout will be. The net foreign buying is also quite large and daily value traded is way above the average. Last Friday alone, value turnover was at P28.8 billion, nearly 4 times the average daily turnover.

Though a pullback or correction is possible, we advise long term investors to stay invested in Philippine equities. We continue to believe in the secular growth story of the Philippines. If the strength in numbers continues, the sheer weight of money will eventually overwhelm the sellers. Just like the Golden State Warriors who made records in their championship run this year, we believe that the crucial 8,000 level will eventually be hurdled and a record run for the PSEi will materialize in due time.

Philequity Management is the fund manager of the leading mutual funds in the Philippines.Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending