The Punisher shines, big win for stocks

After a gruelling three-week period defined by election jitters and fears of an imminent Duterte presidency, the market suddenly bounced strongly against most expectations. While many fund managers were unnerved by his campaign theatrics, the Punisher has surprisingly done and said all the right things so far since the elections concluded.

Philippines – green in a sea of red

The peso and PSE index outperformed their peers last week after Duterte emerged as a clear winner with a strong mandate. Below, we enumerate some of the notable moves in the peso and stock market last week after the conclusion of the elections.

1. Last Wednesday (May 11), the PSE index gained 3.65 percent, the biggest gain so far this year. Moreover, net foreign buying for the stock market amounted to P1.88 b, also the biggest for the year.

2. Despite the four-day work week following the elections, the PSE index was up 6.4 percent last week, soundly outperforming other DM and EM indices.

3. The PSE index was up 1.5 percent last Friday even as most other indices were down. This means the PSE index was green amidst a sea of red. In a past article, we said that when a stock or a country index is green or positive when everything else is down, it means there is something good happening to that stock or country, which makes it special (Green in a Sea of Red, March 30, 2015).

4. Last Wednesday and Friday (May 13), value traded in the stock market reached P12.52 b and P12.33 b, respectively. For the year, these are the biggest and second biggest days in terms of value traded. Moreover, value traded in those days were almost double the P6.38 b average for the year.

5. The peso was up one percent last week while most DM and EM currencies weakened against the dollar. Like the PSE index, the peso last week was green in a sea of red.

Duterte’s stock market win vs. past presidents

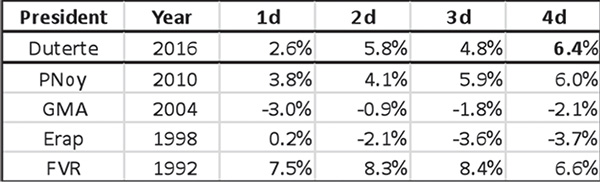

In our article two weeks ago, we compared the returns of the stock market after past elections (Phl presidential elections and the stock market, May 2). In the table below, we compare the stock market returns immediately after the 2016 presidential elections vs. past elections. From the table below, it can be seen the 6.4 percent cumulative return following Duterte’s victory is the best four-day post-election performance of the stock market since the 1992 elections which was won by FVR.

Historical returns of PSE index after presidential elections

Sources: Bloomberg, Wealth Research

Positive surprise vs. low expectations

The explosive movement of the stock market last week was due in large part to the surprising change in Duterte’s words and actions especially against the poor expectations from fund managers who did not know him. They wanted to hear clear-cut economic plans and his coyness about his economic agenda led many to doubt his capabilities. Moreover, his ludicrous statements, fiery rhetoric and gutter language only contributed to investor anxiety. However, immediately after racing to a commanding lead in the unofficial tally, incoming President Duterte has taken a different tact. He has since conducted himself in a more presidential and statesman-like manner. This has been a huge positive surprise for the market which seemingly expected the worst from him.

Groundswell propels Duterte to Malacañang

We wrote about the Duterte groundswell in the weeks leading to the elections (Groundswell, April 18). The groundswell was fuelled by avid volunteers who shelled out their own time and money to contribute and make the Duterte campaign happen. We thus find it amazing that a grassroots campaign came out of the blue and baffled veteran politicians, political analysts and sociologists. We believe that understanding this groundswell phenomenon will allow investors to appreciate what is happening with the Philippines and the stock market.

Davao knows best

The strong support from Davao citizens gave credence to Duterte as a candidate. Davao City stood strong behind its mayor. Based on the unofficial tally, Duterte secured 96.6 percent of the votes from Davao City. Throughout the campaign, Dabawenyos gave credible testimonials about Duterte. They knew first-hand how he worked to balance the interests of different sectors and make Davao one of the most successful and progressive cities in the country.

What is noteworthy is that Davao businessmen strongly vouched for Duterte as they shared their personal anecdotes about how well he works with the business sector. They admire his common sense approach to business, which involves promoting peace and order (since crime and violence are bad for business), minimizing government red tape and simply letting businesses flourish. Those who know him personally say he listens well to his constituents, businessmen and other sectors of the society. Davao has become the proof of concept for Duterte’s style of governance.

All the right things

Last week, at the height of election uncertainty and investor anxiety, we said Duterte had a chance to shine after he wins (Election Day 2016, May 9). Below is an excerpt from our article last week subtitled “Chance for ‘The Punisher’ to shine.”

“If Duterte wins, this is his chance to shine and calm the nervous market. He should take the opportunity to lay out his economic agenda and appoint credible people to his Cabinet and government. We are certain he has competent economic advisers around him, so all he has to do is show us who they are and explain how he plans to bring the country forward. The Punisher should tone down his fiery rhetoric and instead take a conciliatory tone to unite the country after this polarizing election season.”

Indeed, the Punisher did shine. And wow, what a shining moment for the stock market that was. Duterte has actually begun saying and doing all the right things after his resounding win.

8-point economic agenda

Last week, former Agriculture Secretary Carlos Dominguez, a Davao-based businessman and one of the incoming president’s closest advisers, bared the Duterte administration’s 8-point economic agenda. Dominguez said the incoming administration would continue the successful policies of the Aquino administration while addressing bottlenecks that hamper project delivery. To this end, the Duterte administration seeks to exercise decisiveness and strong leadership in executing projects and solving problems. The Duterte team also brings a unique element to the table with their stated focus on promoting peace and agricultural development in Mindanao, which is our country’s bread basket.

Right people for the right jobs

Aside from Dominguez, one of Duterte’s most trusted advisers is Jesus Dureza, a lawyer who served as Press Secretary and Presidential Adviser on the Peace Process during the GMA administration. Both Dominguez and Dureza have Cabinet experience and are well-respected by people who know them. They will likely lead the selection committee and vet candidates for various Cabinet positions. Hopefully, they will keep the performers from the PNoy Cabinet and replace non-performers with new names who can handle the jobs better. If Duterte is indeed a listening leader, he can easily get feedback from businessmen and other sectors to help his team put the best people in the right Cabinet positions.

Politics does matter

Our country’s strong fundamentals are intact and will ultimately drive the direction of our stock market. We remain bullish on the Philippines because of the strength of our consumption-based economy which is fuelled by OFW remittances and BPO revenues. We also note to our fiscal position remains strong. However, politics still matter and it can shape our country’s fundamentals, for better or worse. Poor leadership can cause fundamentals to deteriorate. Conversely, strong and decisive leadership, efficient execution and a coherent reform agenda can be the positive catalysts that will propel our country to greater heights.

We have seen how the election of reform-minded and popular leaders, such as Joko Widodo of Indonesia and Narendra Modi of India, pushed their respective stock markets to new highs. We have also seen how a populist regime almost pushed Greece out of the EU or how the possible impeachment of an ineffective populist leader in Brazil has led to a strong rally in their stock market. Based on the Duterte administration’s 8-point economic agenda, we have reason to believe the implementation of important reforms will continue to build on our country’s resilient growth and strong fundamentals.

Possible consolidation near-term but long-term trajectory is positive

Last week, the Philippines was green in a sea of red. We take this as an extremely bullish signal that was caused by the Punisher’s shining moment after the elections. Near-term, a slight correction or consolidation might be in order as we hit technical resistance levels and global markets start to pull back. However, our market may continue to outperform on the back of the positive pronouncements from Duterte and his incoming administration. Their statements about continuing macroeconomic reforms, while addressing bottlenecks that hamper project execution have resonated well with the business and investment community. Moving forward, the right moves and the right policies from the Punisher can enhance our country’s strong fundamentals and be the catalyst for our stock market’s upward trajectory.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending