Early shift to EMV chip technology seen

MANILA, Philippines - The shift to EMV (Europay, MasterCard, Visa) chip cards may happen earlier than 2017, the Bangko Sentral ng Pilipinas said, as more local banks move to protect their systems and consumers from fraud.

EMV chip is the new global standard for chip-based credit and debit transactions that is considered more secure than magnetic stripe cards.

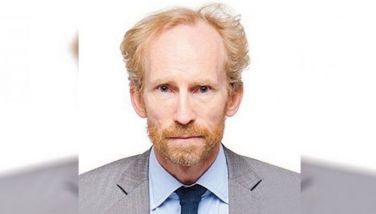

“The migration to EMV may actually happen as a practical reality earlier than 2017 because of commercial reasons. Banks are motivated to have EMV chips because of all these skimming (incidents),” BSP Deputy Governor Nestor A. Espenilla Jr. told reporters.

The central bank in November last year released the guidelines for the replacement of magnetic-stripe cards in favor of EMV-chip carrying ones in preparation for the required adoption of the new technology by 2017.

“It’s because when there are problems with an ATM card, let’s say it has been skimmed, the banks shoulder the cost. So it’s costing them more money to maintain a weaker technology,” Espenilla said.

“It makes more sense for them to adopt the EMV technology sooner than the regulatory timeline and that’s actually what we expect to happen,” he said.

EMV-chip enabled cards carry unique codes for every transaction, making thieves unable to use stolen information for a separate business deal.

Consumers will not necessarily be charged for new cards although Espenilla stressed that since this is a business decision for banks, it may vary from one lender to another.

The upgrade of cards are on track, Espenilla said, noting there are also market forces such as Visa’s “liability shift” that is set to happen October this year. This liability shift means retailers non-supportive of the EMV technology will have to be liable for any fraud due to compromised magnetic-stripe card transactions.

“That’s a commercial incentive for a bank to move away from magnetic-stripe to EMV,” Espenilla noted.

In October last year, the BSP ordered banks to put up additional measures to guard against card fraud and skimming attacks pending the migration to EMV standard by 2017.

Aside from the adoption of EMV-chip carrying cards, the BSP in 2013 required banks to equip their ATM units with end-to-end Triple Data Encryption Standard starting this year to strengthen the electronic retail payment networks and also protect consumers against fraud.

- Latest

- Trending