Falling oil prices: A boon to the Philippine economy

Oil prices have dropped by more than 25 percent since June on the back of weak global oil demand, a supply glut from North America and a strong US dollar.

The International Energy Agency (IEA) disclosed in its recent oil market report that world oil demand is softening at a remarkable pace as the European and Chinese economies falter. Supplies surged, particularly in the US, where the shale boom expanded total oil output to a 28-year high of 8.5 million barrels per day in July. In addition, there was no material impact on crude supplies by geopolitical events in Ukraine and Iraq.

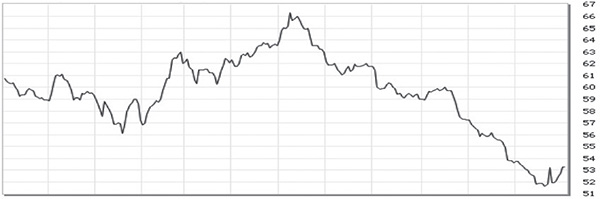

Crude oil prices

The global benchmark Brent crude oil, fell to four-year low to close at $85.86 per barrel last month. Meanwhile, the US West Texas Intermediate (WTI) oil fell to a two-year low to close at $80.70 per barrel.

Source: www.stockcharts.com

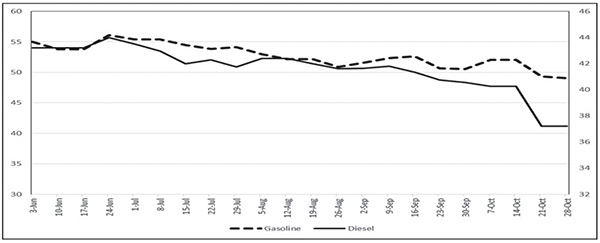

Coal prices

With the decline in crude oil prices, the price of coal also tagged along. CAPP coal for December 2014 delivery fell 19.7 percent to $53.25 per short ton from a peak of $66.28 in May.

Central appalachian coal (NYMEX) December 2014

Source: Marketwatch.com

Lower cost of living, higher savings & higher consumption

The impact of lower oil prices is broadly positive to oil-importers like the Philippines. The Philippines imports roughly 110 million barrels of oil per year. Hence, every $10 reduction in oil prices will translate to an annual windfall of $1.1 billion in savings.

Lower oil prices helps reduce the cost of living by lowering transport costs. In fact, the prices of diesel and gasoline (at retail levels) have already dropped by 14 percent and 11 percent, respectively since June.

Retail prices in Metro Manila (June 2014 to October 2014)

Source: Oil Monitor (Department of Energy), Wealth Securities Research

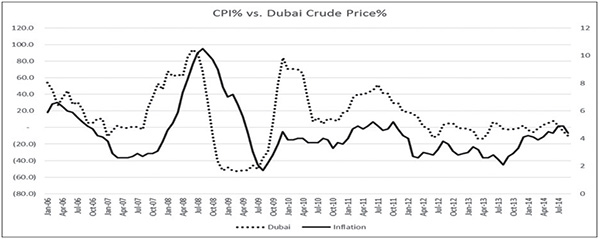

Lower inflation

Falling oil prices should help also help bring down inflation. Lower oil prices pass through directly into lower fuel costs and retail electricity prices. Headline inflation already fell to 4.4 percent in September from a peak of 4.9 percent in July and August.

The Bangko Sentral ng Pilipinas, in the latest assessment, expects sustained easing in inflation pressures as prices of the Asian benchmark, Dubai crude, slid to an average of $87.86 per barrel on Oct. 1 to 24 from an average of $96.59 per barrel in September.

Source: Quandl.com, NSCB, Wealth Securities Research

Positive effects on the economy

Lower oil prices, if sustained, should have a positive effect on domestic growth. A fall in oil prices is effectively like a free tax cut. In theory, the fall in oil prices could lead to higher purchasing power and consumer spending and hence add to real GDP.

Lower inflation expectations, in turn, would give the BSP ample room to refrain from monetary tightening which should further boost domestic demand. Last week, the BSP decided to keep policy rates steady as inflation is expected to settle within its target of three to five percent for this year.

‘Trick or treat’ from Kuroda

Last Friday was Halloween and “trick or treat” is a customary practice for children. It was also the day when Bank of Japan Governor Kuroda played a “trick” on short-sellers and delivered a “treat” to global investors. The BOJ announced an unexpected major increase in its quantitative easing (QE), bringing it to 80 trillion yen from 50 trillion.

Japan’s $1.2-trillion Government Pension Investment Fund (GPIF) also announced new allocations for its portfolio, which includes raising both domestic stock holdings to 25 percent from the current 12 percent. Likewise, holdings of foreign stocks will be increased to 25 percent from the current 12 percent. Meanwhile, holdings of domestic bonds will be cut to 35 percent from around 60 percent.

The treat from Kuroda and GPIF sent the Nikkei up by 4.83 percent and the US benchmark S&P 500 index by 1.17 percent on Friday. Stock markets all over the world went up substantially with many making new historic highs. Meanwhile, the PSE index was up by 0.62 percent as it hurdled past previous resistance of 7,200 to close at 7,215.

For further stock market research and to view our previous articles, please visit our online trading platform at www.wealthsec.com or call 634-5038. Our archived articles can also be viewed at www.philequity.net.

- Latest

- Trending