Proposed reforms to personal tax rates

It has been 17 years since the income tax rates for individuals were adjusted. The adjustment from 34 percent to 32 percent became effective on Jan. 1, 2000. Surely, it is high time to revisit the income tax rates for individuals.

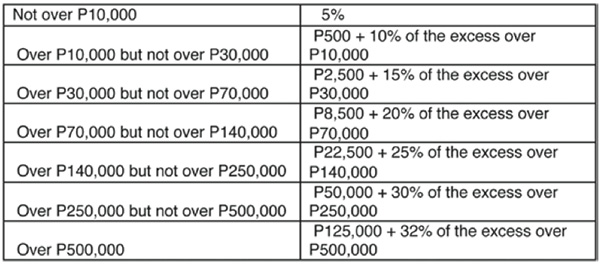

Five tax reform bills have been filed by the Senate and the House of Representatives. These bills propose to amend Section 24 (A) (2) of the 1997 Tax Code which provides for the current income tax rates for individuals based on the following schedule:

In Senate Bill No. 716 filed by Sen. Ralph Recto on July 10, 2013, it was highlighted that inflation of all commodity groups as measured by the Consumer Price Index (CPI) from 1998 to 2013 has almost doubled at 96 percent. Although salary adjustments have been made to keep the earnings in step with inflation, the increases also pushed many employees into the higher tax brackets. Under this bill, the tax rates remain to be five percent to 32 percent.

However, the minimum taxable income is adjusted from P10,000 to P20,000, but the maximum rate of 32 percent will apply to income exceeding P1,000,000 instead of P500,000.

On Nov. 21, 2013, Senate Bill No. 1942 was filed by Sen. Paolo Benigno “Bam” Aquino IV. This bill is proposed to effectively lower the taxes on the Filipino working class, allowing them to enjoy a higher net income and increasing their purchasing power without necessarily imposing a burden on the micro, small, and medium enterprises (MSMEs) that comprise a majority of the employers in the Philippines. Under this bill, income below P60,000 is exempt from income tax, while the lowest tax rate is adjusted from five percent to 15 percent for income over P60,000. Further, the maximum rate is increased to 35 percent for income exceeding P12,000,000.

Early this year, Sen. Sonny Angara filed Senate Bill No. 2149. The bill is part of a twin measure to reduce the country’s income tax rates for individuals and corporations in preparation for the Association of the South East Asian Nations (ASEAN) Integration. It was emphasized in the bill that next to Thailand and Vietnam, the Philippines has the highest top tax rate at 32 percent. Reducing the existing income tax rate, while maintaining the progressivity of our income tax system is a way to attract human capital and prevent migration of our own.

Unlike the bills filed by Sen. Recto and Sen. Aquino, Sen. Angara’s bill spreads the reduction of individual income tax rates over a period of three years to buffer the revenue impact of the individual income bracket adjustments and the reduction of tax rates. In the proposed bill, starting Jan. 1, 2015, the minimum income tax rate is adjusted to 15 percent, reduced further to 13 percent in 2016, and eventually 10 percent in 2017. On the other hand, the maximum tax rate will remain at 32 percent in 2015, lowered to 30 percent in 2016, and finally down to 28 percent in 2017.

Aside from the three Senate bills, the House of Representatives also filed their own versions. Marikina Rep. Romero “Miro” Quimbo filed House Bill No. 4829 to address the problematic situation of “bracket creep” which means a situation where inflation pushes income into higher tax brackets resulting in an increase in income taxes but without increase in real purchasing power. The income tax bracket proposed under this bill is similar to the one filed by Sen. Recto.

Valenzuela Rep. Magtanggol Gunigundo filed House Bill No. 4099 on March 10, 2014. Under this bill, individuals whose net taxable income is below P30,000 are exempted from income tax. The proposed tax rates ranges from five percent to 30 percent, the top rate to apply to income exceeding P730,000.

Please see below a quick comparison of the taxes due on assumed income levels under the different bills now pending in Congress:

It appears that Rep. Gunigundo’s bill is the most favorable in all levels of income presented above.

Any adjustment in the income tax rate or tax bracket that will increase the take home pay of ordinary employees is a much awaited development. That both the House of Representatives and the Senate are taking actions to expedite the enactment of the law allowing the adjustment is certainly good news. For now, we can only hope that the adjustments will be enacted before the tax filing season begins early next year.

Jaline G. Malit is an assistant manager from the tax group of R.G. Manabat & Co. (RGM&Co.), the Philippine member firm of KPMG International.

This article is for general information purposes only and should not be considered as professional advice to a specific issue or entity.

The views and opinions expressed herein are those of the author and do not necessarily represent the views and opinions of KPMG International or RGM&Co. For comments or inquiries, please email [email protected] or [email protected].

For more information on KPMG in the Philippines, you may visit www.kpmg.com.ph.

- Latest

- Trending