Possible scenarios for the peso

Perhaps the most watched macroeconomic indicator the past two months was the peso-dollar rate. The USD/PHP rate broke above 48 last September and reached a seven-year high of 48.685 last Oct. 11. From a technical analysis standpoint, this break above 48 means a possible measured move towards 50. The 50 peso level is the 2009 global financial crisis low for the peso.

Note that when looking at the USD/PHP chart, a rising price means the peso is depreciating vis-à-vis the US dollar.

USD/PHP Daily Chart (January 2016 to present)

Source: Tradingview.com, Wealth Securities Research

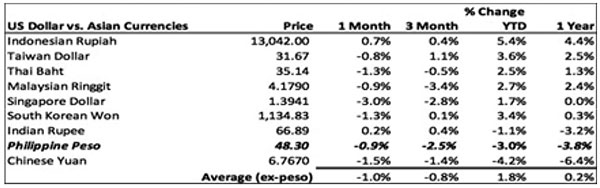

Peso, the worst performing currency in Asia for the month of September

Clearly, political noise have dampened investor sentiment in recent months, causing the peso to underperform regional peers over the short-term. For the month of September where the peso lost 4.1 percent, it was the worst performing currency in Asia.

The peso has declined 2.5 percent against the US dollar over a three-month period vs. an average decline of 0.8 percent return for Asian currencies. Year-to-date, the peso has also significantly underperformed, losing three percent vs. an average 1.8 percent gain for Asian currencies.

Over a one-year period, the peso has depreciated 3.8 percent against the US dollar vs. an average gain of 0.3 percent for Asian currencies. Only the Chinese yuan has performed worse than the peso both on a year-to-date and a one-year period basis.

Source: Bloomberg, Wealth Securities Research

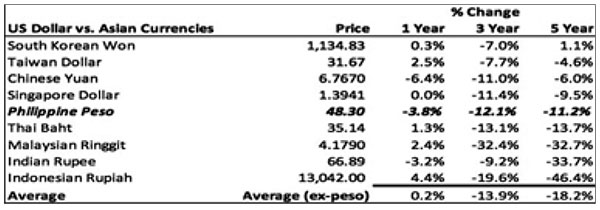

Reversion to the mean

Looking at the bright side, the peso over the long-term may just be reverting back to the mean. After being one of the best-performing currencies in Asia the past couple of years, the peso is back in the middle of the pack for both the three-year and five-year performance rankings.

Source: Bloomberg, Wealth Securities Research

Where is the peso heading? – two scenarios

Last week we saw a sharp pullback in USD/PHP and a retest of 48 before closing last Friday at 48.30. At this point, we’d like to point out that in technical analysis or charting, there is no such thing as certainty. At best, charting only deals with possibilities, but definitely not certainties. More often than not, patterns morph to form other patterns and in some cases fail altogether.

Below we lay out two potential scenarios for the peso:

Scenario 1: A confirmed break at 48, a retest and then a resumption of the move towards 50

One possible scenario is the USD/PHP indeed had a confirmed breakout above 48 which indicates a measured move towards 50. Hence, last week’s sharp pullback towards 48 was just a retest of the breakout level. After some consolidation, the USD/PHP rate should then continue upwards to test the next resistance at 49, and eventually 50 (see the chart above).

Scenario 2: A failed breakout at 48, followed by a wider and longer consolidation

Another potential scenario is a “failed breakout” which could lead to a wider and longer consolidation.

In fact, an “analog” for this is 2014. In technical analysis, chart analogs compare a market’s price action over two different time periods to see if similar patterns seem to repeat.

In 2014, the USD/PHP rate temporarily broke above 45 (see left chart below). During that time, many foreign houses were already calling for the peso to reach 48 (see EM Currency Contagion, Jan. 27, 2014). However, the peso was able to trade below 45 again, allowing for a much wider and longer consolidation. The USD/PHP rate then traded sideways for 1 ½ years before resuming its upward trend.

A similar scenario may unfold if the peso can successfully strengthen below 48 again. If it can consolidate below 48 and eventually take out 47.40, then we see a much wider and longer consolidation similar to 2014. If this happens, then we avert the sharp drop to the 50 scenario described above. The USD/PHP rate will then go back to a range between 46 and 48.50 longer term (see right chart below).

Source: Tradingview.com, Wealth Securities Research

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles.

- Latest

- Trending