Why do stocks give the highest returns among all asset classes in the long run? (Explain to me as if I were a 7-year old Series #3)

Last week I shared a story about my youngest son and how he, while in his early grades, articulated why it’s okay for children to be heavily invested in the stock market. (Click Why should kids be invested in the stock market? to read the story).

Today I will tell you another story that you may use to explain to children (and adults) why stocks provide the highest returns among asset classes in the long run.

To see for yourself how Wharton Finance professor Jeremy Siegel proved this, read Stocks for the Long Run. He showed data how even an investment in a parcel of land in New York City a hundred years ago was still no match to the returns of an investment in the stock market a hundred years ago. The same thing is true for gold.

Now here’s the story I overheard my husband use when he tried to explain why stocks can provide better returns than gold and real estate to our nieces and nephews.

An ounce of gold will always be an ounce of gold. So the value of this asset will rise and fall depending on the supply and demand. If the demand is higher than the supply, its price will go up. If the supply is higher than the demand, its price will go down. But an ounce of gold a hundred years ago will remain an ounce of gold today.

A parcel of land will always be a parcel of land. Yes it can yield you different crops if you decide to till it. It can bring you a home or commercial property if you develop it. But the land itself will be the same. That parcel of land will remain to be a parcel of land. It is limited by its physical size. If it was 100 square meters 100 years ago, it will remain 100 square meters today (unless it was eroded some way). Its price will also be affected by the principles of supply and demand, just like the ounce of gold in the previous discussion. Yes, the supply and demand will also be affected by the use of the land but the land will not grow, it will remain 100 square meters.

How about a share of stock? Among the three asset classes discussed here, the share of stock is the one that has the potential to grow. A corporation is a going concern; hence, it has the ability to grow. Since we’re explaining this to a 7-year old, let’s take Jollibee Food Corporation (JFC) as an example. On July 19, 1993 when it was listed in the Philippine Stock Index, its Initial Public Offering (IPO) price was PhP9.00 per share. Today the stock trades at PhP230 per share! If you bought at IPO price, that’s more than 25 times its original value in less than 23 years! Why? When it listed, JFC had only around a hundred stores in the Philippines. Today it has over three thousand stores including other brands such as Mang Inasal, Greenwich, Chowking, Red Ribbon, Yonghe King, Smash Burger, Burger King, etc. all over the world, and still growing.

And this is why a share of JFC in 1993 is not the same as the share of JFC today. Unlike the other asset classes, it has the ability to grow, and it did quite impressively.

But here’s the thing about stocks. Yes, it has the ability to grow, but it also has the ability to “die,” or cease to exist. If you had picked to buy a listed company that went bankrupt, your story would have ended with zero.

Don’t worry, even if you’re not a stock picker, you can still enjoy the returns of this asset class. Buy funds. Buy index funds. The Philippines is in a demographic sweet spot right now. Majority of our population is in the productive stage. That means that majority of our population is working, consuming and contributing to the growth in our Gross Domestic Product (GDP). If you regularly set aside a portion of your earnings and invest in the index, you will stand to reap the rewards of this asset class that delivers the highest return in the long run.

***************************

ANNOUNCEMENTS

1. I will speak at the Financial Wellness Program of Security Bank on May 19, 2016 at 10 am and 2pm.

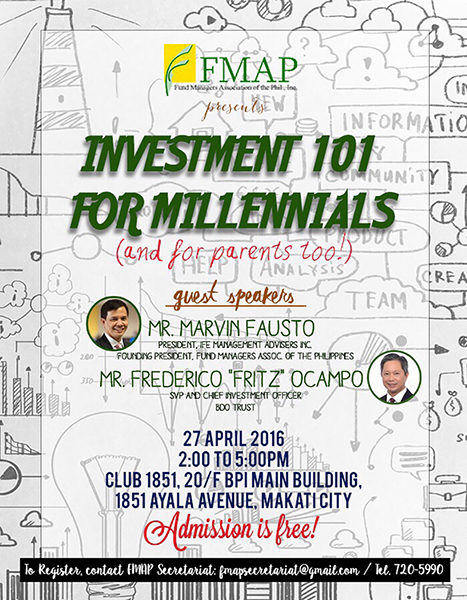

2. Marvin Fausto will speak at the FMAP’s Investment 101 for Millennials and their parents also on April 27, 2016.

3. I will speak at Kidzania about Financial Literacy on May 7, 2016 at the Kidzania Parents Lounge at 9:30am. This is open to all interested parents. There is no talk fee, just pay the usual entrance fee (with or without your kid) in the morning and join our conversation.

Rose Fres Fausto is the author of bestselling books Raising Pinoy Boys and The Retelling of The Richest Man in Babylon (English and Filipino versions). Click this link to read samples - Books of FQ Mom Rose Fres Fausto. She is the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards. Follow her on Facebook and You Tube as FQ Mom, and Twitter & Instagram as theFQMom.

ATTRIBUTIONS: clipartpanda.com, 123rf.com, alturasbohol.com, clipartpng.com, coolbuster.net, en_wikipedia.org, flickr.com, foodubai.com, gettyimages.com, greenbulbpr.com, ilovedavao.com, Jollibee.com.ph, jollibeeusa.com, mightysweet.com, moviepropcollectors.com, pagkalaagan.com, panoramio.com, perryscale.com, pretzelpress.wordpress.com, sidlakanglobaltravels.blogspot.com, taraletseat.blogspot.com, thongtindiadiem.com, turbotax.intuit.com, twitter.com, vietrf.com