Put things in perspective (Behavioral Economics Theories to Help Your Investing)

Human beings have a tendency to overreact. It’s our nature. Each time there’s a publicized plane crash, airlines experience a drastic drop in demand despite the fact that air transport remains the safest. Panic buying ensues after a calamity. I remember a mother who sent her bright son to tutoring school after he got a low grade in a 10-point quiz!

We allow ourselves to overreact because we think, “Better safe than sorry.” But the question is, “Are we really safer by overreacting?”

Last Monday the stock market took a deep dive, 487.97 points down equivalent to a 6.65% drop in a single day. Moreover, in the afternoon, market trading was halted due to delay in the PSETradex system. Of course, this might have exacerbated the panic to sell or buy, depending on which side of the market you’re calling.

In times like this, it gets even harder to convince the “stock market virgins” to join us. It gets harder to significantly improve our measly less than 1% stock market penetration.

I get asked the question, “Up to what level will the index go down?” “Is it time to buy now?”

Given my three decades of investing in the market, my answers to the above questions are, “I don’t know.” and “It is always time to buy because I’ve realized that what works best for me is cost averaging.”

I admit, my stomach still turns when I see how much value my portfolio loses after a day like Monday. But what I do is I remember those times when I froze during market downturns and didn’t invest a single peso. It’s a good thing that I kept record of my monthly stock investments to remind me. I also remember the times when I would complain and say, “It’s so hard to buy anything. Everything is expensive!” So on Monday morning my son said, “It’s funny and weird how you get happy and excited when the market goes down!” Well, that’s the product of being in the market for decades.

Everybody knows that to earn in the stock market you must buy low and sell high. Unfortunately, the overreacting human being finds it easier to do the opposite. And why is this so? There are some Behavioral Economics principles that explain why. Here are some of them:

1. Herd Behavior. This is the human tendency to follow the crowd. In Filipino it’s gaya-gaya puto maya. We are social beings and somehow, consciously or subconsciously, there is social pressure to conform to what everyone else is doing. We hate sticking out like a sore thumb. Better be wrong but be wrong with the rest of the guys than take the risk of being wrong by your lonesome. And of course, we also think that such a large group of people couldn’t be wrong at the same time, right?

2. Availability Bias. This is also called availability heuristic, a mental shortcut that relies on immediate examples that come to a given person's mind when evaluating a specific topic, concept, method or decision. We recently saw the Greek problem (and there’s no light seen yet as the telenovela leading man-looking Prime Minister Tsiparas recently resigned), the Chinese yuan devaluation and all their respective aftershocks seem to signal that the sky is falling! And we’re all connected in this circle of life so we also have to have our share of the crash despite all the good fundamentals that our economists are talking about.

3. Prospect Theory. This is also known as the loss aversion theory. This says that people value gains and losses differently. If a person is given two equal choices, one expressed in terms of possible gains and the other in possible losses, he would choose the former. This aversion to loss explains why a lot of people still choose the low savings or time deposit returns over the higher (but not guaranteed return in the stock market) even if their fund in question is long-term in nature. We are risk-averse in nature.

4. Overconfidence Bias. This is the well-established bias in which a person's subjective confidence in his or her judgments is reliably greater than the objective accuracy of those judgments. I once met a guy who loves predicting the stock market and on our first meeting he said, “I am never wrong!” Whoa! Up to now I still remember that arrogant remark whenever I see him and I can’t help but not believe whatever comes out of his mouth. The thing is, the great stock investors I know don’t even say those words. Maybe sometimes, that’s part of the job, people like him have to sound absolutely confident to convince others. The thing is, it did exactly the opposite to me.

5. Confirmation Bias. This is our tendency to look for information selectively, filtering them to pay more attention to those that support our opinions and beliefs while ignoring or rationalizing the rest.

The Behavioral Economics principles that affect our investing are not limited to the five above. But given these, let’s try to put things in perspective. Let’s understand our own biases and natural tendencies so that we can invest more effectively. In my own experience, I’ve come to realize that the more I admit that I’m not always rational, the more I am able to make rational decisions.

I just follow the three basic laws of money:

1. Pay yourself first. This is the discipline of cost averaging. Just invest money as you earn and prioritize it.

2. Get into a business that you understand and seek advice only from competent people. Well, needless to say, I don’t take the advice of the one who said he’s never wrong. In picking my stock investments, I choose those whose businesses I understand with good management. Ask yourself the question, “If a real crisis happens to us, which companies will remain standing?”

3. Make your gold work for you. Make an army of gold before you buy luxury. In this case, I just allow that long-term part of my portfolio stay put, allowing it to grow. One of the things that I would really want each person to understand is that we all have our long-term needs and we should match them with long-term investing. And studies have shown that the stock market is still the asset class that provides the highest return in the long run.

There, I hope I helped put things in perspective for you, so you could stay calm and keep investing.

************************

ANNOUNCEMENTS

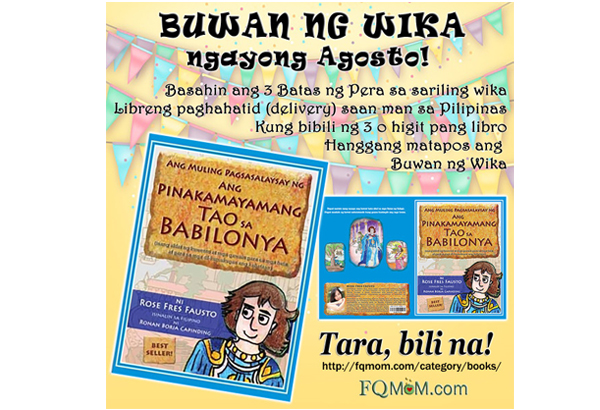

1. For the entire month of August, Buwan ng Wika, we have a promo to deliver your book order for FREE to any address in the Philippines! This is for a minimum of 3 copies of Ang Muling Pagsasalaysay ng Ang Pinakamayamang Tao sa Babilonya which is only 150 each. Click Pls deliver my books for free!

2. You may be interested to watch Ang Tatlong Yugto; Tatlong Babae – a play by Liza Magtoto, which features a story of 3 women and their journey through life on August 28, 2015 at 2pm at the GSP 901 Padre Faura St., Ermita, Manila.

3. The Family FQ Workshop by the Faustos goes to Iriga Cityon September 6, 2015! This is being arranged by Beam and Go, an online platform that caters to OFWs and others who support their families in an affordable and transparent way.

Rose Fres Fausto is the author of bestselling books Raising Pinoy Boys and The Retelling of The Richest Man in Babylon. Her new book is the Filipino version of the latter entitled Ang Muling Pagsasalaysay ng Ang Pinakamayamang Tao sa Babilonya. Click this link to read samples of the books. Books of FQ Mom Rose Fres Fausto. She is also the grand prize winner of the first Sinag Financial Literacy Digital Journalism Awards.

Attribution: Photo from crossroads.org modified by the author to help deliver the message of the article.

This article is also published in FQMom.com and RaisingPinoyBoys.com.