Senate rushes to approve tax reform bill

MANILA, Philippines — The Senate rushed to approve last night the proposed Tax Reform for Acceleration and Inclusion (TRAIN) bill – certified by President Duterte as urgent – that is expected to generate as much as P130 billion in fresh revenues with higher taxes imposed on fuel, coal and sugar-sweetened beverages, among others.

The senators voted 17-1 to pass the tax reform measure. Only Sen. Risa Hontiveros voted against it.

The certification from Malacañang allowed the measure to be passed on second reading, and then on third and final reading in one session amid lingering opposition to some of its provisions by several majority and opposition senators who said the measure could lead to higher prices of certain commodities and services.

TRAIN is the first of four packages the Duterte administration is proposing to generate revenues for its massive infrastructure program.

Sen. Sonny Angara, chairman of the Senate ways and means committee that drafted the tax bill, told reporters that 60 percent of the expected proceeds will go to flagship infrastructure projects; 27 percent to social mitigating programs, including the unconditional cash transfer of P300 per month for three years to the poorest 10 million Filipino families; and 13 percent to the Armed Forces for its modernization programs.

“There were amendments but the (expected) proceeds is close to the DOF (Department of Finance)’s target,” Angara said of the first TRAIN package that is expected to raise P100 billion on the low end.

Malacañang wants to have the measure signed into law before the end of the year and implement it by early 2018.

But Senate Minority Leader Franklin Drilon said the real battle would be in the bicameral conference committee when the Senate and the House of Representatives will reconcile the disagreeing provisions of their respective versions of TRAIN, particularly on the tax on petroleum products and sweetened beverages.

“The bicam will be difficult. The TRAIN is headed to a tough battle in the bicam,” Drilon said.

Under the Senate version, the exemption of annual taxable income for salary earners was raised to P250,000 but retained the P82,000 tax exemption for 13th month pay and other bonuses.

Data from the Bureau of Internal Revenue showed that at least 6.8 million or 90 percent of the 7.5 million individual income taxpayers will be exempted from paying taxes – more than triple the current two million exempt minimum wage earners.

For self-employed and professionals, the Senate introduced an eight percent flat tax in lieu of income tax and percentage tax to be filed once a year on gross sales or receipts.

The chamber also approved the amendment pushed by Senate Pro Tempore Ralph Recto that the filing of VAT and percentage tax returns are made quarterly and simplifying the income tax returns by shortening the forms to only two pages.

Sen. Joseph Victor Ejercito said the TRAIN bill also included provisions, particularly those on value-added tax, to shield workers from additional taxes.

“We worked hard to make sure that the tax reform measure being pushed by the administration will not be a burden to consumers,” Ejercito said.

Plenary debates on the TRAIN were contentious on sweetened beverages and housing, and on the excise taxes for petroleum, cosmetic surgery, coal and automobiles.

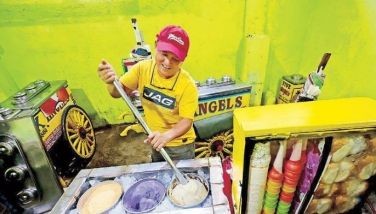

The Senate version slaps a P4.50 per liter tax on beverages with caloric sweeteners, P4.50 per liter on those with non-caloric sweeteners and P9 per liter on high-fructose corn syrup.

Exempted are milk, 3-in-1 coffee, 100-percent natural fruit and vegetable juices and beverages that use coco sugar and stevia.

It also wanted to impose a tax of P1.75 per liter on diesel and bunker fuel, P2 on the second year, and P2.25 on the third year. Kerosene was excluded as it is widely used as fuel for lighting and cooking by around three million households in far-flung areas. Liquefied petroleum gas was imposed a uniform P1 per kilogram tax.

The measure increased the value-added tax threshold from P1.9 million to P3 million – exempting small businesses with total annual sales of P3 million and below from paying VAT.

It also retained the VAT exemption of raw food/agricultural products, health and education, as well as of senior citizens, persons with disabilities, business process outsource firms and cooperatives.

The sale of prescription drugs and medicine will also be VAT-free.

TRAIN also retained the VAT exemption of leases or rents below P15,000 per month and of socialized housing (priced at P450,000 and below). Mass housing projects that are worth P2 million and below located outside of Metro Manila will also continue to enjoy VAT exemption.

Angara said VAT exemption of government-owned and controlled corporations, state universities and colleges and national government agencies will shift to a form of subsidy through the tax expenditure fund under the national budget.

For automobiles, the TRAIN also provided for a simpler two-tier tax of 10 percent for vehicles priced up to P1 million, and 20 percent for those priced over P1 million. Hybrid and electric cars are exempted to encourage greener and cleaner transportation options.

Documentary stamp tax on documents, instruments, loan agreements and papers was doubled while the final tax on foreign currency deposit units was increased from 7.5 percent to 15 percent, and capital gains tax for stocks not traded in the stock exchange was raised to 15 percent.

Cosmetic procedures and body enhancements undertaken for aesthetic reasons will be levied with 10 percent excise tax. But reconstruction of facial and body defects due to birth disorders, trauma, burns, disease and those intended to correct dysfunctional areas of the body shall be exempt.

The coal excise tax was increased from P10 per metric ton to P100 per metric ton on the first year, P200 in the second year and P300 in the third and succeeding years as pushed by Sens. Loren Legarda and Joel Villanueva.

The drastic increase in coal tax was strongly opposed by Sen. Sherwin Gatchalian, who warned of a spike in power rates because of the huge levy.

The measure also doubled the excise tax rates of all non-metallic minerals and quarry resources, and all metallic minerals including copper, gold and chromite from the current two percent excise tax to four percent.

- Latest

- Trending