Quick facts: What you need to know about the new excise tax rates for cars

Under the TRAIN, personal income tax rates will be reduced while projected revenues to be foregone from lower personal income tax will be offset by higher excise levies on petroleum and automobiles, among others. File Photo

MANILA, Philippines — Are car prices going to double following the approval of a new law that restructures the rates on excise tax imposed on automobiles?

President Rodrigo Duterte on Tuesday, December 19, signed into law Republic Act No. 10963, or the Tax Reform for Acceleration and Inclusion (TRAIN) bill.

The TRAIN law overhauls the country’s 20-year-old tax regime in a bid to make the tax system fairer and simpler. It will take effect 15 days after it is published in the Official Gazette or publications of general circulation.

Under the TRAIN, personal income tax rates will be reduced while projected revenues to be foregone from lower personal income tax will be offset by higher excise levies on petroleum and automobiles, among others.

About 70 percent of revenues from the TRAIN will be used to bankroll the Duterte administration’s ambitious infrastructure drive.

READ: What TRAIN law means to ordinary Filipinos

The Department of Finance earlier said the new excise tax system for automobiles was not just a revenue-enhancing measure but also a way to address pollution and congestion. According to a survey done by the DOF, 80 percent of families in the Philippines do not own cars.

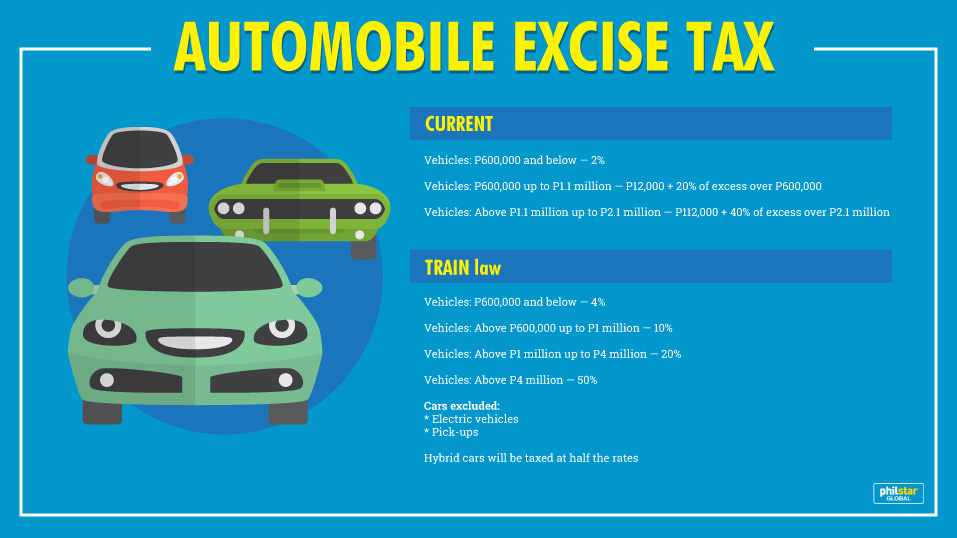

To encourage cleaner transportation, electric vehicles are exempt while hybrid cars will be taxed at half rates. Meanwhile, pick-ups, which are commonly used by businessmen and entrepreneurs for commercial and agricultural purposes, are excluded as well.

Below is the breakdown of tax rates adjustments for cars under TRAIN:

The DOF earlier flagged what it called “misleading social media and news reports” on the price increase of cars under TRAIN, and assured the public that there would be “no doubling of car prices” as the tax hike would be “moderate, not extreme.”

The DOF likewise pointed out that with the substantial cuts in personal income tax rates, “Filipinos would have more money in their pockets, making entry-level cars more affordable for them.”

“The tax base is not the retail price but the manufacturing or importation price. The difference is between 10 to 50 percent. In fact, the import price can be as low as 50 percent of retail price,” the DOF explained.

Car companies do not release data about manufacturing or importation prices.

According to Toyota Motor Philippines Corp. president Satoru Suzuki, the company is still studying how much would be the actual retail price of the Vios under the new excise tax rate, with the said model subject to the TRAIN’s higher 10 percent excise tax in 2018.

- Latest

- Trending