Globe, Jack Ma company launch 'scan to pay' mobile service

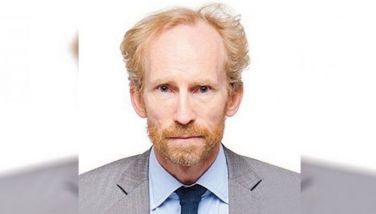

At an event in Makati on Wednesday, Oct. 25, 2017, Alibaba founder Jack Ma pays for taho, a local soy drink, with a mobile cashless payment system. He is accompanied by Globe CEO Ernest Cu. Globe/Released

MANILA, Philippines — The Ayala group owned Globe Telecom on Wednesday launched a mobile service in partnership with Ant Financial Services Group—owned by Chinese tech magnate and Alibaba Group founder Jack Ma—that would enable subscribers to do cashless payments by scanning QR codes.

According to Globe, the “scan to pay” feature of its mobile wallet app GCash is expected to be rolled out in Ayala-owned malls.

The feature would only require merchants to scan a QR code using their phones in establishments to complete a transaction, Globe also said.

“We’ve been nurturing GCash for almost a decade now and you know we just feel that today, this year in 2017... and 2018 is the right time to actually stage this relaunch,” Globe CEO Ernest Cu said.

“The country’s smartphone population has now gone beyond around 70 percent of the Globe network. So now the experience can be better with phones. Our network is in shape,” Cu added. “The Filipinos are ready for a cashless society.”

QR code technology has been in use for quite some time with many applications already in the market. However, wide adoption for payments had been previously hampered by various factors, such as lower smartphone and internet usage.

Mynt, Globe’s financial technology business, has a war chest of $55 million which would be used to expand its merchant and consumer base starting next year.

Mynt, or Globe Fintech Innovations Inc., is a fully-owned subsidiary of Globe Capital that provides innovative and first-in-world fintech solutions to consumers, merchants and organizations.

In August, Alipay Singapore Holding Pte. acquired 45 percent of Mynt while Globe Venture holds 45 percent and Ayala, 10 percent.

Alipay is a unit of Ant Financial Group that provides digital financial services to unbanked consumers and small merchants.

Ant Financial Group, owned by Ma, is a major third-party payment service provider in 70 overseas markets. It covers more than 100,000 retail stores and can carry out transactions in 18 currencies.

READ: Globe Capital rolling out fintech business in 2018

Meanwhile, the launch of Globe’s new payment technology came as PLDT unit PayMaya Philippines announced early this week that its scan-to-pay technology is now available across the country, with Smart Stores and select merchants in key cities now allowing consumers to conveniently pay by simply scanning QR codes through their PayMaya app.

"As PayMaya continues to grow nationwide, we take a giant step for our customers by making QR code payments available to all kinds of merchants. PayMaya is the leading digital payments wallet and on the merchant side, this will reinforce our position as the top mobile payments acquirer in the country," said Orlando Vea, president and CEO, PayMaya Philippines and Voyager Innovations.

READ: PayMaya, Smart further accelerate rollout of QR code payments nationwide

The global ranking of the Philippines in terms of providing digital and financial inclusion zoomed to sixth place this year from 15th last year amid the reforms being pursued by the Bangko Sentral ng Pilipinas, the latest report from Washington-based think tank Brookings Institution showed.

Based on the 2016 Financial and Digital Inclusion Project report titled Advancing Equitable Financial Ecosystems, Brookings said the Philippines got a score of 76 percent for sixth place this year from a score of 68 percent or 15th place last year.

The report noted mobile money interoperability arrangement between PayMaya Philippines of dominant carrier PLDT Inc. and GCash of Ayala-led Globe Telecom Inc. would further promote increased adoption of digital financial services in the country.

However, the report noted there remains a significant untapped opportunity for increased take-up of digital and financial services in the Philippines.

READ: Philippines climbs ranking in digital, financial inclusion

- Latest

- Trending