Hurricanes and floods can’t stop this bull market

In the past weeks, the US was hit by record hurricanes and massive flooding. However, after dropping because of the catastrophic damage, US markets then shrugged these off and went on to make milestone highs last week.

Likewise in the Philippines, we had widespread flooding in Metro Manila which prompted the BSP to suspend clearing and the PSE to suspend trading. In spite of these, the Philippine market still made new all-time highs after trading resumed.

Record hurricanes

Unfortunately for the US, Texans felt the full power of Hurricane Harvey. This was the most powerful hurricane to hit Texas in more than 50 years, causing record floods. Peaking at Category 5, Harvey drowned Texas with floods that damaged more than 100,000 homes.

Seeing how devastating Harvey was, people braced for the worst as Irma approached. Also forecasted to be one of the strongest hurricanes on record, Irma spurred Florida to embark on the largest mass evacuation in US history. Gas stations ran out of fuel and grocery shelves were emptied as people evacuated. True enough, the hurricanes were a force to be reckoned with. As of this writing, total economic damage is already in excess of $200 billion.

Record highs despite record hurricanes

Headlines all over the world carried news about the hurricanes. Accompanied by graphic photos of destruction and headline news announcing the impending onslaught of Hurricane Irma, markets became jittery. However, despite all the fear and destruction wrought by the record hurricanes, investors were undeterred. Moreover, Irma weakened significantly as it made landfall in Florida. With Irma becoming weaker than expected, stock markets reversed losses and surged higher. In fact, the S&P 500 managed to close at a record high of 2,500 last week.

Markets drop because of devastating calamities

In previous articles, we have written about how natural disasters have affected stock markets. As we have seen in the past, equity indices do fall sharply after deadly catastrophes. Disasters not only cause panic and fear, but also cause real economic damage. Most vivid in our memory is the devastation wrought by Yolanda. Already on the road to recovery, the PSE index fell 12.5 percent, plunging from 6,585 to 5,762.

Effect of calamities is temporary

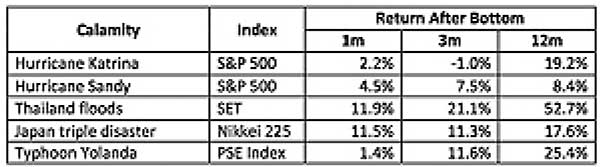

While stock markets do drop because of natural disasters, data shows that markets recover after the initial drop. The table below shows how the various stock markets performed after major natural disasters.

Stock market returns after significant natural disasters

Sources: Bloomberg, Wealth Securities Research

PSEi all-time high!

With the US reaching new all-time highs, the Philippines followed suit. Since hitting its all-time high of 8,137 in 2015, the PSEi has attempted and failed to break this record for more than two years now. This year alone, the index touched the 8,000 level 35 times without staging a decisive breakout. Finally, despite a trading suspension due to flooding, our benchmark index closed at 8,180.85 last Friday, the highest level our index has reached in its entire history. At this new all-time high, our market is now up 19.6 percent YTD.

Unloved bull

While we have been telling our investors to stay the course and ride the bull market, it is unfortunate that many people have missed this bull market. Many analysts and investors remain cynical and doubtful of the resiliency of this bull market because of many reasons. Among these are the supposed elevated valuation of the stock market, rising global interest rates, weakening currency for the US dollar and Philippine peso, geopolitical risks such as North Korea’s missile launches, and political noise such as Trump’s controversial tweets and his risk of impeachment.

However, despite all of these concerns and the bearishness of many investment houses, markets kept moving higher. In previous articles, we wrote about why the global bull market will continue (see Synchronized global growth, June 12 and Every Word You Say, July 24). In fact, through all these calamities and geopolitical events, the bull market in stocks worldwide has continued charging on – a testament to its strength and resiliency.

It’s all about the economy

What this move in stocks has shown us is that investors should focus on the economy and not transitory events, such as hurricanes and floods. Despite the devastation caused by hurricanes, economists are only expecting a mild dent on US economic growth. Therefore, long term investors should not be distracted by temporary events that do not deal permanent damage to the economy, such as hurricanes and political noise. At the end of the day, the effects of calamities and other extraneous events has not been shown to reverse a nation’s economic growth trajectory.

Focus on corporate fundamentals

Before reacting to news of hurricanes, floods and geopolitical events, investors should look at business models of companies first and foremost. If a corporation can continue growing despite natural disasters, then it is corporate fundamentals and earnings that will determine where stock prices will go. If one can focus on corporate fundamentals and filter out the noise, one should do well. Proof of all this is that we now have broken out to new all-time highs.

Investing in the country’s business model and growth prospects

Just as one invests in a company because of its business model and fundamentals, investors should look at the Philippines’ business model and its economy’s growth prospects. Underpinning our future growth is the government’s economic agenda, which includes aggressive infrastructure spending and the comprehensive tax reform package. If the tax reform passage is passed in full and not distracted or derailed by political events, it will bring in much need government revenues for infrastructure spending. This will lift our economy, bring about inclusive growth and usher in the next leg of the bull market. If the economy is well-managed and the right policies are implemented, not only will our country keep growing, but also our stock market will continue to make new all-time highs.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending