Peso-euro rate weakens 17% year-to-date

Many were alarmed by the drop of the peso against the US dollar this year, but many may not have noticed the sharp depreciation of the peso against the euro. Year-to-date, the peso has depreciated by 17 percent against the euro.

The main reason why the peso has weakened substantially against the euro this year is because of the extraordinary strength of euro. The euro is one of the best performing currencies this year.

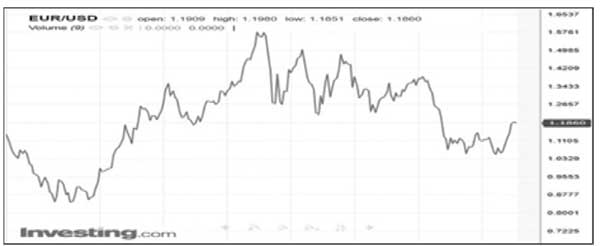

Euro climbs to a 2 ½ year high

The euro is currently up 13 percent against the US dollar year-to-date, climbing to a 2 ½ year high. The euro reached an intraday high of 1.2069 last Tuesday (Aug. 29) before settling at 1.186 on Friday. It is also up by 15 percent from its 14-year low of 1.0341 on Jan. 3.

EUR/USD Monthly Chart (1999 – Present)

Source: Investing.com

Reasons why euro is strong

There are a number of reasons why the euro is surprisingly strong this year. We enumerate them below:

1) Broad-based economic recovery in the Eurozone – Led by Germany which expanded 2.1 percent in 2Q17, the Euro area is growing at its fastest pace since the 2012 EU sovereign debt crisis.

2) Growth continues to surprise to the upside – The euro area economy is poised to achieve above potential growth over the next two years, according to Moody’s. In contrast to the upgrades in EU growth outlook, the US growth outlook has revised downwards.

3) Unemployment at eight-year lows – Unemployment rate in the Euro area is at an eight-year low of 9.1 percent in July 2017. In the case of Germany, the unemployment rate of 4.1 percent is at multi-decade lows.

4) Exports hit record highs – Exports grew eight percent in the first six months of 2017 on the back of vehicle and machinery exports. EU enjoys a trade surplus of EUR 107.7 billion vs. its trading partners.

5) Consumer and business confidence index at record highs – An index of industry and consumer sentiment is at its highest level since 2007.

6) Reduced political risk – The victory of Macron in the French election reduced the threat of a populist takeover in Europe and the potential breakup of the European Union.

7) ECB is looking to taper QE – With EU no longer at risk of deflation, the odds are high that ECB will start normalizing monetary policy as early as October.

History of the euro

The euro currency was launched as an accounting currency in Jan. 1, 1999, following the Maastricht Treaty of 1992. Three years later, on Jan. 1, 2002, it became legal tender and replaced the old national currencies such as the German deutsche mark, French franc, Italian lira, Spanish peso, etc. The euro recorded its lowest level against the dollar when it traded at 0.8252 in October 2000. It reached a peak of 1.599 in July 2008.

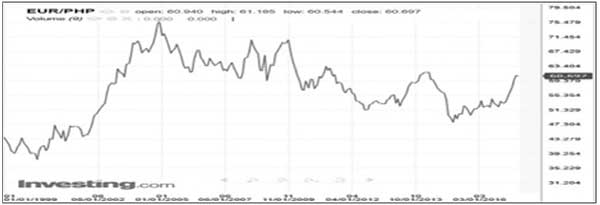

Peso-euro - reversion to the mean

The peso reached its lowest against the euro when the EUR/PHP rate hit 76.73 in December 2004. It then rallied the next 11 years to reach a high of 46.85 against the euro in March 2016. Today, the EUR/PHP has reverted towards the mean, retracing almost half of the move from 76.73 down to 46.85. It closed at 60.69 last week.

EUR/PHP Monthly Chart (1999 – Present)

Source: Investing.com

Weaker peso to benefit exporters, local manufacturers

In last week’s article, we discussed how a weaker peso benefits certain sectors of the economy such as the BPO sector (see Weakening peso – part of economic rebalancing, Aug. 28). We also enumerated the beneficiaries of a weak peso (see Peso weakness – good or bad?, July 17). Two other sectors that stand to gain from the peso’s depreciation are the export and manufacturing sectors.

A weaker peso stimulates exports as our products become more competitive and cheaper for overseas customers. In addition, it makes imports more expensive, thus encouraging import substitution and a revival of local industries. Given our country’s growing trade deficit, the Philippine economy should benefit from a weaker peso as far as the impact on the balance of trade is concerned.

Improving trade balance with EU

Given the strength of the euro and the weakness of the peso, an improvement in the balance of trade is expected. Among those that are expected to benefit are the exporters of agricultural products, processed meat and fish, electrical equipment and optical products. Meanwhile, those that are likely to be negatively affected are the importers of car and furniture products.

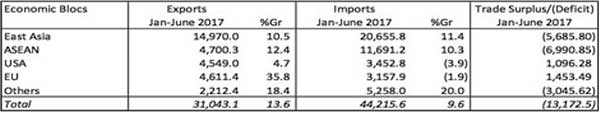

From the table below, we can see a notable improvement in the trade balance between the Philippines and the EU. Exports to EU increased sharply by 35.8 percent from January to June 2017. And despite the likely front loading of EU car purchases ahead of higher excise tax, imports from EU declined by 1.9 percent over the same period. The Philippines enjoys a trade surplus of $ 1.4 billion with the EU, a 728 percent improvement over the $175 million surplus in January to June 2016.

Philippine Trade Statistics (in $millions)

Source: Philippine Statistics Authority, Wealth Securities Research

Not a cause for alarm

Finance Secretary Carlos Dominguez reiterated last week that the weakening peso is not a cause for alarm or panic. He said a weaker peso does not generate the same level of inflation as it used to because the economy has become broader.

“In the past, exchange rate impacted inflation rate almost immediately. But it no longer does. We are a much larger economy and much more diversified. The economy is very different from what it was in the 1990s,” he said.

Secretary Dominguez added that even spikes in petroleum prices does not affect inflation as much. In fact, this is part of what Undersecretary Karl Kendrick Chua presented during Philequity’s Annual Shareholder meeting last Aug. 13. Inflation rate averaged just 2.7 percent from January 2016 to January 2017, while the diesel price increased 75 percent over the same period.

Phl – a net gainer in the peso’s depreciation

According to a sensitivity analysis by the DOF, the Philippines is a net gainer from a peso depreciation, potentially generating a surplus of P7.4 billion for the government for every peso shed against the dollar. Secretary Dominguez maintains the government will let market forces determine the movements of the peso, unless the moves become disorderly.

“I’m not saying that everybody should be happy, but if the majority is benefiting then we should allow the market to take its course. What we are watching very carefully is the rate of change. If it goes from 51 to 53 in one day that’s worrisome,” Sec. Dominguez said.

Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 689-8080 or email [email protected].

- Latest

- Trending