Should commodities be part of one’s portfolio?

In our book “Opportunity of a Lifetime” (see page 185), we wrote about the importance of asset allocation when one is making investment decisions. Simply put, asset allocation is the process of spreading investments across various asset classes such as stocks, bonds, cash, commodities, real estate and alternative assets.

One asset class that has performed well this year is commodities. Traditionally, commodities serve as an excellent diversifier of one’s investment portfolio. Many asset allocators such as the sovereign wealth funds and university endowment funds have allocated a portion of their portfolio to commodities.

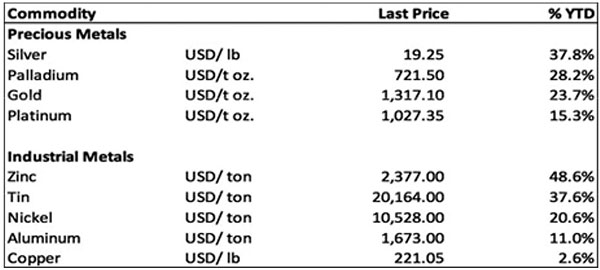

Commodities as an asset class is usually subdivided into sub-sectors such as metals, energy, grains, meats and soft-commodities. In today’s column, we concentrate on precious metals and industrial metals.

Precious metals and industrial metals may have bottomed

Some of the best assets to own so far this year are precious metals and industrial metals. Examples of precious metals are gold, silver, palladium and platinum. Meanwhile, examples of industrial metals are copper, nickel, zinc, aluminum and tin. It is highly likely that metals have registered a bottom this year following a dismal 2015 when it registered its largest yearly loss since 2008.

Source: Bloomberg, Wealth Securities Research

Gold and gold mining stocks

There is growing concern among investors about central banks printing too much “fiat money”. In an era of widespread quantitative easing, zero-based interest rates, massive government debt and out-of-control budget deficits, hyperinflation is becoming a real threat and investors want to hedge against that by owning gold. Many big-time fund managers like George Soros, Stanley Druckenmiller, Bill Gross and Jeffrey Gundlach have announced that they prefer owning gold and gold stocks in this kind of environment.

Since bottoming out last December 2015, gold has risen as much as 32 percent and is up 23.7 percent year-to-date.

Meanwhile, gold mining stocks have more than doubled since hitting bottom in February of this year.

Early stages of a gold bull market?

Normally, in a gold bull market cycle, the bullion moves first, followed by the large miners and then the smaller speculative miners. And while gold is the main driver, silver also tends to outperform gold.

So far this year, silver is up 37.8 percent. Other precious metals such as palladium and platinum are up, 18.2 percent and 15.3 percent year-to-date, respectively. All these point out that we may just be in the early stages of a gold bull market.

Industrial metals bottoming-out

Industrial metals are also to be bottoming out. Zinc and tin are breaking out of their multi-year downtrends while copper, nickel and aluminum are forming rounding bases.

Buying gold and precious metalcommodities thru ETFs

A convenient way to buy gold and commodities is to buy exchange traded funds as proxies for the actual asset. The top gold ETFs traded are the SPDR Gold Shares ETF (GLD) and the iShares Gold Trust ETF (IAU). For silver, it is iShares Silver Trust ETF (SLV). There are also mining ETFs such as the VanEck Vectors Gold Miners ETF (GDX), VanEck Vectors Junior Gold Miners ETF (GDXJ) and the SPDR S&P Metals and Mining ETF (XME).

Local mining firms urged to shape up

In the local stock market, investors can participate in the incipient commodity bull market by buying mining shares. Recently, however, 30 out of 41 mines were suspended when they failed the DENR audit.

The Philippines is the fifth most mineral-rich country in the world for gold, nickel, copper and chromite. With the prices of gold and other metal commodities coming out of a five-year decline, this is something that the country and the local mining industry can take advantage of.

We hope that the mining industry, environmentalists and the regulators can work together and find a WIN-WIN solution.

We will continue our discussion on energy commodities and soft commodities in future articles.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles.

- Latest

- Trending